Sonoco Products (SON) is a diversified manufacturer that is mostly involved in the consumer packaging industry and other related fields. The company is also a dividend champion, with 31 consecutive years of dividend growth. Like many dividend stocks, Sonoco Products' stock has been an outperformer, with a YTD gain of over 17%. Sonoco Products currently offers a $0.31 per share quarterly dividend and yields about 3.60%.

(click to enlarge)

Overview

Sonoco Products is a provider of consumer packaging, industrial products, protective packaging, and packaging supply chain services. When a customer wants custom packages for their products, Sonoco Products is usually the company they go to. The majority (77%) of Sonoco Products' FY 2012 sales came from North America, while only a small fraction (16%) were from Europe.

(click to enlarge)

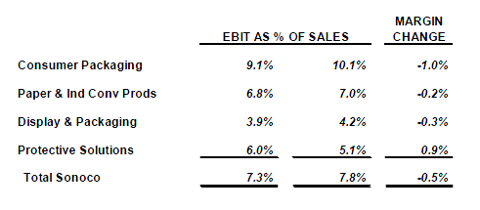

Sonoco Products is divided into four separate business units: consumer packaging, display and packaging, paper and industrial converted products, and protective solutions. The largest in terms of both sales and EBIT is the consumer packaging segment, followed closely by the paper related segment. Sonoco Products' protective packaging segment saw strong growth in 2012 due to the November 2011 Tegrant Corp acquisition.

(click to enlarge)

Operating Metrics

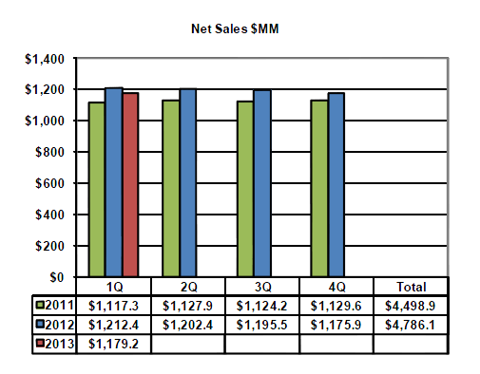

Since 2011, Sonoco Products has seen relatively stable revenue growth. During Q1 2013, Sonoco Products reported revenues of $1.18B, down 3% from the $1.21B in 2012. The vast majority of this decline came from lower volumes in its consumer packaging segment, which declined $33M, or 7%,! to $463M. The paper related segment also saw revenues decline $10M, or 2%, to $454M, due to declining volumes in Europe. A bright spot for Sonoco Products in Q1 2013 was its display and packaging segment, which saw revenues increase $5M, or 4%, to $120M. This was due to lower margin volume growth from an international contract. Also seeing small growth was the protective solutions segment, which saw revenues grow $4M, or 3%, to $142M. This was mostly due to increase volumes.

(click to enlarge)

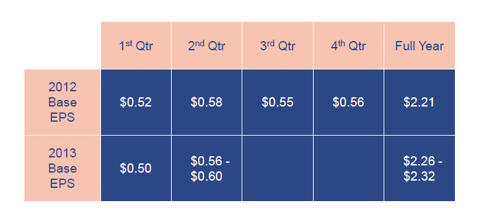

Sonoco Products net income actually increase $5M to $48.1M, or $0.47 per share, for Q1 2013, compared with $43.1M, or $0.42 per share last year. However when adjusting for certain items such as impairments, restructuring charges and currency adjustments, base earnings were actually $51.7M, or $0.50 per share, down from $53.8M, or $0.52 per share. For Q2 2013, Sonoco Products has guided for EPS to range from $0.56 to $0.60 per share, Using the midpoint of $0.58 per share, this points towards Sonoco Products EPS being flat from last year.

(click to enlarge)

When looking at Sonoco Products' margins, we can see that the company may be getting squeezed. Except for the protective solutions segment, every segment for Sonoco Products saw margins decline year over year. The worst drop by far was in the consumer packaging segment, which saw margins decline a full percent to 9.1%. Overall, Sonoco Products saw its margins decline 0.5% to only 7.3%.

(click to enlarge)

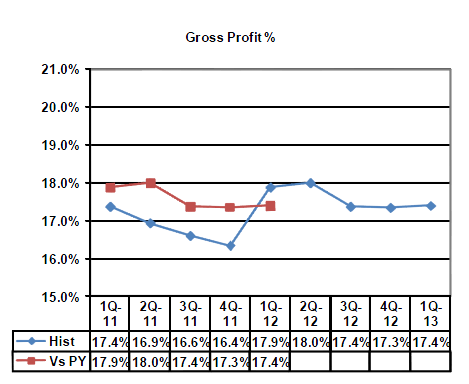

However, when looking at Sonoco Products' gross profits, the decline does not seem that bad. Gross profits were 17.4% in Q1 2013, down from 1! 7.9% last! year. This quarter was actually the first year over year decline in gross profits in five quarters.

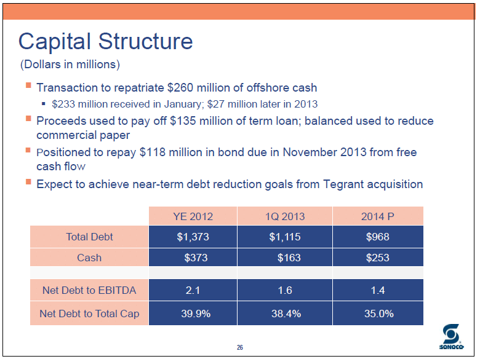

Lowering Debt

Sonoco Products has been aiming to lower its overall debt for a couple years. In the quarter, the company managed to lower its total debt by $258M to $1.12B, from $1.37B in Q4 2012. Sonoco Products achieved this by repatriating $260M of its overseas cash. Sonoco Products net debt to EBITDA is now a modest 1.6Xm down from 2.1X last quarter. By 2014, Sonoco Products plans to reduce its debt to about $968M using its FCF.

(click to enlarge)

Price Increases, Improved Productivity and New Contracts Drive EPS Growth

When looking at Sonoco Products' guidance, we can see that the company projects a fairly strong rest of the year. Assuming the above mentioned Q2 2013 EPS of $0.58, Sonoco Products' Q3 and Q4 2013 combined EPS should range from $1.16 to $1.22, which would be an increase from the combined Q3 and Q4 2012 EPS of $1.11. Using the midpoint of $1.19 for this range, Sonoco Products would see EPS growth of about 7% for the later half of 2013.

During the Q1 2013 conference call, Sonoco Products' CEO Jack Sanders mentioned several reasons why the company projects stronger growth in EPS.

The first factor is improve pricing. Sonoco Products has increased price for several of its products, which should result in improved margins.

The first is pricing. As many of you know, we implemented a $25 a ton domestic price increase for encoded recycled paperboard and a 4% increase in tubes and cores. We are very encouraged as the increases are supported in the m! arket. Wh! ile we are not a large producer, we will benefit from the announced $50 a ton increase in container board and corrugated medium. Finally, we have implemented price increases beginning this quarter in both composite cans and plastics. These increases are to recover a material and other inflationary costs.

The second reason for improved EPS will come from improved productivity. Sonoco Products was plagued by unplanned downtime due to maintenance in Q1. This work should improve uptime for the remainder of the year. In addition, Sonoco Products is planning cost cuts in various segments.

The second factor that will drive our improvement is better operating performance. Clearly, productivity in the first quarter was not to our historic average. Late last year, we changed the management team in paper North America, and their focus on preventive maintenance is much greater than we've had in the past. As we were conducting both planned and unplanned maintenance during the quarter, we expanded the scope of the work to ensure we fix the problem and paved the way for better uptime for the balance of the year. As we enter April, the mills are running better, and we are projecting improved run rates and productivity. Demand remains solid. In plastics, we are bringing up a third production wheel that will eliminate the bottleneck that impacted volume in Q1 and will pave the way to produce new won volume. In addition, we're implementing further cost reductions in many of our businesses.

Lastly, Sonoco Products scored a large contract from battery maker Energizer. Sonoco Products will be the primary packaging, retail display assembly and fulfillment of a segment of battery products for Energizer brands.

The third factor that makes me optimistic is recent won volume. Yesterday, we announced the Energizer, but we also have several additional wins I believe will help us reach our commercial objectives in 2013.

Are Volumes for Composite Cans Picking Up?

Along with the above mentioned Ener! gizer dea! l, there are other signs of Sonoco Products seeing volumes pick up. Volumes for composite cans, which is a large chunk of its paper related segment, have been on the rise. Sonoco Products has added a new line for this product in Malaysia. In addition, the company added a second line in China. The company also shifted some of its capacity in composite cans from Germany to Poland, which should lower labor costs. Composite can volumes in Q1 were actually down 1%, largely due to declines in the US. In addition, revenues were down 4%, hurt by a shift towards smaller cans, such as refrigerated dough, and away from larger cans for powdered coffee and infant formula. However, as mentioned above, Sonoco Products pushed through a price increase for this product.

Also, food inflation has moderated in the US. This may lead to an increase in volumes for food based packages. In addition, food volumes in US are usually higher during summer months. When you couple improved volumes with the above mentioned price increase, it appears that Sonoco Products' paper related segment may post improved results in Q2 2013.

Are Plastic Clamshells in Decline?

A large business for Sonoco Products is in producing plastic clamshells. These are part of its protective packaging segment. Much of Sonoco Products' material for this segment is sourced through its Alloyd business. However, volumes were down 9% for Alloyd. This lead to speculation during the Q1 2013 conference call about possible structural changes in protective packaging industry away from clamshells. The company noted that this decline in volumes was mostly due to customers delaying several product launches. However, as anyone who has been frustrated in opening a plastic clamshell can attest, clamshells are rather user unfriendly. Investors should be on the lookout to see if there is indeed a secular shift away from these packages.

Conclusion

Sonoco Products seems to be a solid stock for risk-averse investors. The company has a long history of ! growing i! ts dividend and has mundane, but safe, business model.

I would however wait for a pullback before starting a position. The stock is currently trading for a 18 PE ratio, which is fairly high for a slow grower like Sonoco Products. Using the above mentioned 6% EPS growth rate, this leads to a PEG ratio of around 3.0X, which is again somewhat inflated. Q2 2013 earnings are also just around the corner, which should lead to more clarity in regards to the anticipated Q3 and Q4 EPS growth.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment