Most Asian stocks fell as corporate earnings showed mixed results and the Bank of Japan added nothing new to its stimulus pledge. The regional benchmark index remains headed toward its biggest monthly advance since at least December.

Shiseido Co., Asia�� biggest cosmetics maker, slumped 8.3 percent in Tokyo after reducing its dividend. Advantest dropped 7.9 percent after the maker of chip testers posted an unexpected loss on falling computer demand. BYD Co., the Chinese automaker partially owned by Warren Buffett�� Berkshire Hathaway Inc., jumped 12 percent in Hong Kong after saying first-half earnings will surge.

The MSCI Asia Pacific Index fell 0.1 percent to 139.79 at 7:11 p.m. in Tokyo, erasing a gain of 0.4 percent. About two stocks dropped for each that rose. The measure is heading for a 2.6 percent advance this week, while having gained 3.1 percent this month.

��rofit results look OK,��said Shane Oliver, Sydney-based head of investment strategy at AMP Capital Investors Ltd., which has $126 billion under management. ��nvestors are giving Japan the benefit of the doubt. If it�� a good profit or economic figure, investors say it�� good. And if it�� a bad one, they say it doesn�� matter because the BOJ is doing stimulus.��

Best Bank Companies To Buy For 2014: Lloyds Banking Group PLC (LYG)

Lloyds Banking Group plc, incorporated on October 21, 1985, is a holding company. The Company is a financial services group providing a range of banking and financial services, primarily in the United Kingdom, to personal and corporate customers. The Company operates in four segments: Retail, Commercial Banking, Wealth, Asset Finance and International and Insurance. Retail provides banking, mortgages and other financial services to personal customers in the United Kingdom. Commercial Banking provides banking and related services to business clients, from small businesses to large corporate. Wealth, Asset Finance and International provides private banking and asset management and asset finance in the United Kingdom and overseas and operates the Company�� international retail businesses. Insurance provides long term savings, protection and investment products in the United Kingdom and Europe and provides general insurance to personal customers in the United Kingdom.

Retail

The Retail division operates the retail bank in the United Kingdom and is a provider of current accounts, savings, personal loans, credit cards and mortgages. This includes a range of current accounts including packaged accounts and basic banking accounts. It is also the provider of personal loans in the United Kingdom, as well as being the United Kingdom�� credit card issuer. Retail is the private sector savings provider in the United Kingdom. It is also a general insurance and bancassurance distributor, offering a range of long-term savings, investment and general insurance products.

Commercial Banking

The Commercial Banking division supports the Company�� business clients from small businesses to corporate. Commercial Banking provides support to corporate clients through the provision of core banking products, such as lending, deposits and transaction banking services whilst also offering clients expertise in capital markets (private placements, bonds and syndicated loans), ! financial markets (foreign exchange, interest rate management, money market and credit) and private equity.

Wealth, Asset Finance and International

Wealth, Asset Finance and International consists of the Company�� the United Kingdom and international wealth businesses, the Company�� the United Kingdom and international asset finance and online deposit businesses along with its international retail businesses. The Wealth business consists of private banking and asset management. Wealth�� private banking operations cater to the range of wealth clients from affluent to Ultra High Net Worth within the United Kingdom, Channel Islands and Isle of Man, and internationally. Asset Finance consists of a number of leasing and speciality lending businesses in the United Kingdom, including Lex Autolease and Black Horse Motor and Personal Finance along with its leasing and specialty lending businesses in Australia and its European online deposit business. The international business comprises its non-core banking business outside the United Kingdom, with the exception of corporate business written through the Commercial Banking division. This primarily consists of Ireland, Retail Europe and Asia.

Insurance

The Insurance division provides long-term savings, protection and investment products and general insurance products to customers in the United Kingdom and Europe. The United Kingdom Life, Pensions and Investments business provides long-term savings, protection and investment products distributed through the bancassurance, intermediary and direct channels of the Lloyds TSB, Halifax, Bank of Scotland and Scottish Widows brands. The European Life, Pensions and Investments business distributes products primarily in the German market under the Heidelberger Leben and Clerical Medical brands. The General Insurance business is a distributor of home insurance in the United Kingdom, with products sold through the branch network, direct channels and strategic corporate! partners! . It operates primarily under the Lloyds TSB, Halifax and Bank of Scotland brands.

Advisors' Opinion: - [By Jeff Reeves]

Swiss financials Credit Suisse (CS) and UBS as well as U.K. banks like Lloyd's (LYG) have delivered returns significantly better than the S&P 500 this year. Optimism regarding consumer and business lending has lifted shares, and the trend looks to continue in 2014. If you're a believer in the EU recovery, financial stocks are a great way to be at the center of an economic turnaround.

Best Bank Companies To Buy For 2014: Mitsubishi UFJ Financial Group Inc (MTU)

Mitsubishi UFJ Financial Group, Inc. (MUFJ), incorporated on April 2, 2001, is a holding company for The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU), Mitsubishi UFJ Trust and Banking Corporation (MUTB), Mitsubishi UFJ Securities Holdings Co., Ltd. (MUSHD), Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.( MUMSS), Mitsubishi UFJ NICOS Co., Ltd. (Mitsubishi UFJ NICOS) and other companies engaged in a range of financial businesses. Its services include commercial banking, trust banking, securities, credit cards, consumer finance, asset management, leasing and fields of financial services. In May 2010, the Company and Morgan Stanley formed two joint ventures in Japan by integrating our respective Japanese securities companies engaged in investment banking and securities businesses. The Company converted the wholesale and retail securities businesses conducted in Japan by the former MUS into one of the joint venture entities, which is named MUMSS. Morgan Stanley contributed the investment banking operations conducted in Japan by its formerly wholly owned subsidiary, Morgan Stanley Japan Securities Co., Ltd. (MSJS) into MUMSS and converted the sales and trading and capital markets businesses conducted in Japan by MSJS into a second joint venture entity called Morgan Stanley MUFG Securities, Co., Ltd.

Integrated Retail Banking Business Group

The Integrated Retail Banking Business Group covers all domestic retail businesses, including commercial banking, trust banking and securities businesses, and enables the Company to offer a range of banking products and services, including financial consulting services, to retail customers in Japan. This business group integrates the retail business of BTMU, MUTB and MUMSS, as well as retail product development, promotion and marketing in a single management structure. Many of its retail services are offered through its network of MUFG Plazas providing individual customers with access to its financial product offerings of integrated commercial b! anking, trust banking and securities services.

The Company offers a range of bank deposit products, including a non-interest-bearing deposit account that is redeemable on demand and intended for payment and settlement functions, and is insured without a maximum amount limitation. It also offers a variety of asset management and asset administration services to individuals, including savings instruments, such as current accounts, ordinary deposits, time deposits, deposits at notice and other deposit facilities. MUFJ also offers trust products, such as loan trusts and money trusts, and other investment products, such as investment trusts, performance-based money trusts and foreign currency deposits.

The Company creates portfolios by combining savings instruments and investment products. It also provide a range of asset management and asset administration products, as well as customized trust products for high-net-worth individuals, as well as advisory services relating to the purchase and disposal of real estate and effective land utilization, and testamentary trusts. The Company provides a varied line up of investment trust products allowing its customers to choose products according to their investment needs through BTMU, MUTB and MUMSS, as well as kabu.com Securities, which specializes in online financial services. In the fiscal year ended March 31, 2010, BTMU offered a total of five investment trusts. As of the end of March 2010, BTMU offered its clients a total of 73 investment trusts.

The Company offers securities, including publicly offered stocks, foreign and domestic investment trusts, Japanese government bonds, foreign bonds and various other products. The Company offers housing loans, card loans and other loans to individuals. With respect to housing loans, in addition to housing loans incorporating health insurance for seven major illnesses, BTMU began offering in June 2009 preferential interest rates under its Environmentally Friendly Support program ! to custom! ers who purchase environment-conscious houses (like houses with solar electric systems), which meet specific criteria in response to increasing public interest in environmental issues. In September 2009, BTMU launched housing loans with home mortgage insurance, which BTMU jointly developed with the Japan Housing Finance Agency, a governmental agency under the Japanese government�� economic stimulus measures, under which the agency indemnifies BTMU for losses from housing loans.

The Company offers products and services through a range of channels, including branches, automated teller machines (ATMs) (including convenience store ATMs shared by multiple banks), Mitsubishi-Tokyo UFJ Direct (telephone, Internet and mobile phone banking), the Video Counter and postal mail. It offers integrated financial services combining its banking, trust banking and securities services at MUFG Plazas. These Plazas provide retail customers with integrated and flexible suite of services at one-stop outlets. As of March 31 2010, the Company provided those services through 47 MUFG Plazas. The Company offers MUTB�� trust related products and advisory services through its trust agency system not only for MUTB customers but also for BTMU and MUMSS customers. As of March 31, 2010, BTMU engaged in eight businesses as the trust banking agent for MUTB: testamentary trusts, inheritance management, asset succession planning, inheritance management agency operations, business management financial consulting, lifetime gift trusts, share disposal trusts, and marketable securities administration trusts.

Integrated Corporate Banking Business Group

The Integrated Corporate Banking Business Group covers all domestic and overseas corporate businesses, including commercial banking, investment banking, trust banking and securities businesses, as well as UnionBanCal Corporation (UNBC). UNBC is a wholly owned subsidiary of BTMU and a US bank holding company with Union Bank being its primary subsidiary. T! he Compan! y provides various financial solutions, such as loans and fund management, remittance and foreign exchange services. It also helps its customers develop business strategies, such as inheritance-related business transfers and stock listings.

It offers advanced financial solutions to companies through corporate and investment banking services. Product specialists globally provide derivatives, securitization, syndicated loans, structured finance and other services. It also provides investment banking services, such as merger and acquisition (M&A) advisory, bond and equity underwriting. It provides online banking services that allow customers to make domestic and overseas remittances electronically. It also provides a global cash pooling/netting service, and the Treasury Station, a fund management system for a multi-company group. The Company�� global Corporate and Investment Banking business (Global CIB), primarily serves companies, financial institutions, and sovereign and multinational organizations with a set of solutions for their financing needs.

Integrated Trust Assets Business Group

The Integrated Trust Assets Business Group covers asset management and administration services for products, such as pension trusts and security trusts by integrating the trust banking expertise of MUTB and the international strengths of BTMU. The business group provides a range of services to corporate and pension funds, including stable and secure pension fund management and administration, advice on pension schemes, and payment of benefits to scheme members. Its Integrated Trust Assets Business Group combines MUTB�� trust assets business, comprising trust assets management services, asset administration and custodial services, and the businesses of Mitsubishi UFJ Global Custody S.A., Mitsubishi UFJ Asset Management Co., Ltd. and KOKUSAI Asset Management Co., Ltd.

Advisors' Opinion: - [By Jim Jubak]

I think you can use shares of Japanese exporters-such as Toyota Motors (TM)-or Japanese financials-such as Mitsubishi UFJ Financial Group (MTU)-as trading vehicles for this move. I mention both because they trade as very liquid ADRs in New York. If you trade in Tokyo, you should look at exporters more leveraged to the yen than Toyota-such as Hino Motors (JP:7205 in Tokyo) or Mazda Motor (JP:7261)-or real estate development companies with more yen sensitivity than more diversified financials-such as Sumitomo Realty and Development (JP:8830). Toyota and Mitsubishi UFJ are both members of my Jubak's Picks portfolio.

- [By Dan Carroll]

Mitsubishi UFJ (NYSE: MTU ) also plunged in the Japanese financial sector's sell-off, with the firm's stock dropping 12.3% over the week. This firm faced more of a threat from Thursday's action, however: Japan's benchmark bond yield climbed to its highest level in more than a year, and Mitsubishi is the largest lender by assets in the country and holds more than 48 million yen in government bonds. Bond yields are still coming off of record lows, so Mitsubishi's hardly in a dangerous place. The firm's attempts to expand recently may also help boost revenue at a company that posted declining net income in its most recent quarter.

Top Penny Companies To Own For 2014: Citigroup Inc.(C)

Citigroup, Inc., a global financial services company, provides consumers, corporations, governments, and institutions with a range of financial products and services. The company operates through two segments, Citicorp and Citi Holdings. The Citicorp segment operates as a global bank for businesses and consumers with two primary businesses, Regional Consumer Banking and Institutional Clients Group. The Regional Consumer Banking business provides traditional banking services, including retail banking, and branded cards in North America, Asia, Latin America, Europe, the Middle East, and Africa. The Institutional Clients Group business provides securities and banking services comprising investment banking and advisory services, lending, debt and equity sales and trading, institutional brokerage, foreign exchange, structured products, cash instruments and related derivatives, and private banking; and transaction services consisting of treasury and trade solutions, and securiti es and fund services. The Citi Holdings segment operates Brokerage and Asset Management, Local Consumer Lending, and Special Asset Pool businesses. The Brokerage and Asset Management Business, through its 49% stake in Morgan Stanley Smith Barney joint venture and Nikko Cordial Securities, offers retail brokerage and asset management services. The Local Consumer Lending business provides residential mortgage loans, retail partner card loans, personal loans, commercial real estate, and other consumer loans, as well as western European cards and retail banking services. The Special Asset Pool business is a portfolio of securities, loans, and other assets. Citigroup Inc. has approximately 200 million customer accounts and operates in approximately 160 countries. The company was founded in 1812 and is based in New York, New York.

Advisors' Opinion: Best Bank Companies To Buy For 2014: Comerica Inc (CMA)

Comerica Incorporated (Comerica) is a financial services company. Comercia operates in four segments: the Business Bank, the Retail Bank, Wealth Management and the Finance Division. As of December 31, 2011, Comerica owned two active banking and 49 non-banking subsidiaries. The Company's Business Bank meets the needs of middle market businesses, multinational corporations and governmental entities by offering products and services, including commercial loans and lines of credit, deposits, cash management, capital market products, international trade finance, letters of credit, foreign exchange management services and loan syndication services. On July 28, 2011, Comerica acquired Sterling Bancshares, Inc. (Sterling), a bank holding company.

The Company's Retail Bank includes small business banking and personal financial services, consisting of consumer lending, consumer deposit gathering and mortgage loan origination. In addition to a range of financial services provided to small business customers, this business segment offers a range of consumer products, including deposit accounts, installment loans, credit cards, student loans, home equity lines of credit and residential mortgage loans.

Wealth Management offers products and services consisting of fiduciary services, private banking, retirement services, investment management and advisory services, investment banking and brokerage services. This business segment also offers the sale of annuity products, as well as life, disability and long-term care insurance products. The Finance segment includes Comerica�� securities portfolio and asset and liability management activities. This segment is engaged in managing Comerica�� funding, liquidity and capital needs, performing interest sensitivity analysis and executing strategies to manage Comerica�� exposure to liquidity, interest rate risk and foreign exchange risk.

The Other category includes discontinued operations, the income and expense impact of equity an! d cash, tax benefits not assigned to specific business segments and miscellaneous other expenses of a corporate nature. In addition, Comerica delivers financial services in its four markets: Midwest, Western, Texas and Florida. The Midwest market consists of Michigan, Ohio and Illinois. The Western market consists of the states of California, Arizona, Nevada, Colorado and Washington. California operations represent the the Western market. The Texas and Florida markets consist of the states of Texas and Florida, respectively. Other Markets include businesses with a national perspective, Comerica�� investment management and trust alliance businesses, as well as activities in all other markets, in which Comerica has operations, except for the International market. The International market represents the activities of Comerica�� international finance division, which provides banking services to foreign-owned, North American-based companies and to international operations of North American-based companies.

Advisors' Opinion: - [By Rich Duprey]

Financial-services specialist�Comerica (NYSE: CMA ) announced yesterday its third-quarter dividend of $0.17�per share, the same rate it's paid for the past two quarters after raising the payout 13% from $0.15 per share.

- [By Shauna O'Brien]

Goldman Sachs announced on Tuesday that it has lifted its rating on Comerica Incorporated (CMA) to “Neutral.”

The firm has upgraded CMA from “Sell” to “Neutral,” and has raised the company’s price target from $38 to $42. This price target suggests a 2% upside from the stock’s current price of $40.83.

An analyst from the firm noted: “The market has shown willingness to price the shares at a premium based on CMA�� absolute rate upside, which we do not expect to change much over time.”

“That said, near-term expectations could be at risk given the ~4% decline in loans in 3Q, which if it continues could weigh on its longer-term earnings profile,” the analyst added.

Looking ahead, the firm has lowered its FY2013 earnings estimates from $2.85 to $2.81 per share. FY2014 estimates have been reduced from $2.95 to $2.90 per share and FY2015 estimates of $3.30 per share were maintained.

Comerica shares were mostly flat during pre-market trading Tuesday. The stock is up 35% YTD.

- [By The Part-time Investor]

The following stocks met the criteria in January of 2008 and were put into the initial portfolio:

Abbot Labs (ABT)Advanced data processing (ADP)Associated Banc-Corp (ASBC)Bank of America (BAC)BB&T Corp. (BBT)Bemis Company (BMS)Anheuser Busch (BUD)The Chubb Corporation (CB)Clorox (CLX)Comerica Inc. (CMA)Diebold Inc. (DBD)Emerson Electronics (EMR)First Dollar Corp. (FDO)First Third BanCorp. (FITB)Gannett Co, Inc. (GCI)General Electric (GE)Hershey (HSY)Illinois Tools Works (ITW)Johnson and Johnson (JNJ)Leggett and Platt (LEG)Eli Lilly (LLY)La-Z-Boy (LZB)McDonald's (MCD)Marsh and Ilsley (MI)M&T Bancorp (MTB)PepsiCo (PEP)Pfizer (PFE)Procter & Gamble (PG)Pentair Ltd. (PNR)Regions Financial Corp. (RF)Rohm and Haas (ROH)RPM International (RPM)Sherwin Williams (SHW)Sysco Corp. (SYY)UDR Inc. (UDR)Historical quotes were taken from Yahoo Finance. $10,000 was put into each position, to the nearest whole share, so a total of $349,262.89 was invested. From 1/15/08 through 5/16/13 all dividends were reinvested back into the stock that paid them. If a dividend cut was announced, that stock was sold on the ex-div date of the new, lower dividend.

Best Bank Companies To Buy For 2014: Western Alliance Bancorporation (WAL)

Western Alliance Bancorporation (WAL) is a bank holding company. The Company provides full-service banking and lending to locally owned businesses, professional firms, real estate developers and investors, local non-profit organizations, high net worth individuals and other consumers through its three wholly owned subsidiary banks (the Banks): Bank of Nevada (BON), operating in Southern Nevada; Western Alliance Bank (WAB), operating in Arizona and Northern Nevada, and Torrey Pines Bank (TPB), operating in California. In addition, the Company�� non-bank subsidiaries, Shine Investment Advisory Services, Inc. (Shine) and Western Alliance Equipment Finance (WAEF), offer an array of financial products and services to small to mid-sized businesses and their proprietors, including financial planning, custody and investments, and equipment leasing nationwide. It operates in four segments: Bank of Nevada, Western Alliance Bank, Torrey Pines Bank and Other.

The Company provides a range of banking services, as well as investment advisory services, through its consolidated subsidiaries. As of December 31, 2011, WAL owned an 80% interest in Shine. As of December 31, 2011, the Company owned a 24.9% interest in Miller/Russell & Associates, Inc. (MRA), an investment advisor. MRA provides investment advisory services to individuals, foundations, retirement plans and corporations.

Lending Activities

Through the Company�� banking segments, the Company provides a variety of financial services to customers, including commercial real estate loans, construction and land development loans, commercial loans, and consumer loans. Loans to businesses consisted 89.2% of the total loan portfolio at December 31, 2011. Loans to finance the purchase or refinancing of commercial real estate (CRE) and loans to finance inventory and working capital that are additionally secured by CRE make up the majority of its loan portfolio. These CRE loans are secured by apartment buildings, professional of! fices, industrial facilities, retail centers and other commercial properties. As of December 31, 2011, 49% of its CRE loans were owner-occupied. Owner-occupied commercial real estate loans are loans secured by owner-occupied nonfarm nonresidential properties for which the primary source of repayment (more than 50%) is the cash flow from the ongoing operations and activities conducted by the borrower who owns the property. Non-owner-occupied commercial real estate loans are commercial real estate loans for which the primary source of repayment is nonaffiliated rental income associated with the collateral property.

Construction and land development loans include multi-family apartment projects, industrial/warehouse properties, office buildings, retail centers and medical facilities. Commercial and industrial loans include working capital lines of credit, inventory and accounts receivable lines, mortgage warehouse lines, equipment loans and leases, and other commercial loans. Commercial loans are primarily originated to small and medium-sized businesses in a variety of industries. Consumer loans are generally offered at a higher rate and shorter term than residential mortgages. Its consumer loans include home equity loans and lines of credit, home improvement loans, credit card loans, and personal lines of credit. As of December 31, 2011, its loan portfolio totaled $4.68 billion, or approximately 68.4% of its total assets.

Investment Activities

All of the Company�� investment securities are classified as available-for-sale (AFS) or held-to-maturity (HTM). As of December 31, 2011, the Company had an investment securities portfolio of $1.48 billion, representing approximately 21.7% of its total assets. As of December 31, 2011, its investment securities portfolio consisted of the United States Government sponsored agency securities, Municipal obligations, Adjustable-rate preferred stock, Mutual funds, Corporate bonds, Direct the United States obligation and government-! sponsored! enterprise (GSE) residential mortgage-backed securities, private label residential mortgage-backed securities, Community Reinvestment Act (CRA) investments, Trust preferred securities, Private label commercial mortgage-backed securities, and Collateralized debt obligations.

Sources of Funds

The Company offers a variety of deposit products, including checking accounts, savings accounts, money market accounts and other types of deposit accounts, including fixed-rate, fixed maturity retail certificates of deposit. As of December 31, 2011, the deposit portfolio consisted of 27.5% non-interest bearing deposits and 72.5% interest-bearing deposits. Non-interest bearing deposits consist of non-interest bearing checking account balances. In addition to its deposit base, it has access to other sources of funding, including Federal Home Loan Bank (FHLB) and Federal Reserve Bank (FRB) advances, repurchase agreements and unsecured lines of credit with other financial institutions.

Financial Products and Services

In addition to traditional commercial banking activities, the Company offers other financial services to customers, including Internet banking, wire transfers, electronic bill payment, lock box services, courier, and cash management services. Through Shine, a full-service financial advisory firm, the Company offers financial planning and investment management.

Advisors' Opinion: - [By Investment Biker]

Investment Summary: This article is on Western Alliance Bancorporation (WAL), a growth-oriented commercial lender in the Southwest. The banks looks set to improve profitability supported by economic recovery in Last Vegas, industry-leading revenue performance and operating leverage supported by expense control. The credit profile of the bank looks excellent with limited exposure to residential mortgage and well poised to grow its loan portfolio by 20% annually over the next 3 years. It is also well set on a path to credit recovery with improving fundamentals that justifies premium valuation going forward.

Best Bank Companies To Buy For 2014: Commonwealth Bank of Australia (CBA.AX)

Commonwealth Bank of Australia (the Bank) is engaged in the provision of a range of banking and financial products and services to retail, small business, corporate and institutional clients. The Bank is a provider of integrated financial services, including retail, business and institutional banking, superannuation, life insurance, general insurance, funds management, broking services and finance company activities. Its operating segments include Retail Banking Services, Business and Private Banking, Institutional Banking and Markets, Wealth Management, New Zealand, Bankwest and Other. Its retail banking services include home loans, consumer finance, retail deposits and distribution. Its business and private banking include corporate financial services, regional and agribusiness banking, local business banking, private bank and equities and margin lending. The Bank and its subsidiaries ceased to be a substantial holder in Ten Network Holdings Limited, as of September 12, 2012.

Best Bank Companies To Buy For 2014: Itau Unibanco Holding SA (ITUB)

Itau Unibanco Holding S.A., incorporated on September 9, 1943, is a bank in Brazil. The Company has four operational segments: Commercial Banking, Itau BBA, Consumer Credit and Corporate and Treasury. Commercial banking, including insurance, pension plan and capitalization products, credit cards, asset management and a variety of credit products and services for individuals, small and middle-market companies). Itau BBA includes corporate and investment banking. Consumer credit includes financial products and services to its non-accountholders. Corporate and treasury includes the results related to the trading activities in its portfolio, trading related to managing currency, interest rate and other market risk factors, gap management and arbitrage opportunities in domestic and foreign markets. It also includes the results associated with financial income from the investment of its excess capital.

On October 24, 2010, Itau Unibanco completed the integration of customer service locations throughout Brazil. In total, 998 branches and 245 customer site branches (CSB) of Unibanco were redesigned and integrated as Itau Unibanco customer service locations, thus creating a network of approximately 4,700 units in the country under the Itau brand. The Company is a financial holding company controlled by Itau Unibanco Participacoes S.A. (IUPAR). As of December 31, 2010, it had a network of 3,747 service branches throughout Brazil. As of December 31, 2010, it operated 913 CSBs throughout Brazil. As of December 31, 2010, it operated 28,844 automated teller machines (ATMs) throughout Brazil.

Commercial banking

The commercial banking segment offers a range of banking services to a diversified base of individuals and companies. Services offered by the commercial banking segment include insurance, pension plan and capitalization products, credit cards, asset management, credit products and customized products and solutions. The commercial banking segment comprises the specialized! areas and products, such as retail banking (individuals); public sector banking; personnalite (banking for high-income individuals); private banking (banking and financial consulting for wealthy individuals); very small business banking; small business banking; middle-market banking; credit cards; real estate financing; asset management; corporate social responsibility fund; securities services for third parties; brokerage, and insurance, private retirement and capitalization products.

The Company�� credit products include personal loans, overdraft protection, payroll loans, vehicles, credit cards, mortgage and agricultural loans, working capital, trade note discount and export. Its investments products include pension plans, mutual funds, time deposits, demand deposit accounts, savings accounts and capitalization plans. Its services include insurance (life, home, credit/cash cards, vehicles, loan protection, among others), exchange, brokerage and others. Its core business is retail banking, which serves individuals with a monthly income below R$7,000. In October 2010, it completed the conversion of branches under the Unibanco brand to the Itau brand and as of December 31, 2010, it had over 15.2 million customers and 4,660 branches and CSBs. Its public sector business operates in all areas of the public sector, including the federal, state and municipal governments (in the executive, legislative and judicial branches). As of December 31, 2010, it had approximately 2,300 public sector customers. Itau Personnalite�� focus is delivering financial advisory services by its managers, who understand the specific needs of its higher-income customers; a portfolio of exclusive products and services; special benefits based on the type and length of relationship with the customer, including discounts on various products and services. Itau Personnalite�� customer base reached more than 600,000 individuals as of December 31, 2010. Itau Personnalite customers also have access to Itau Unibanco netwo! rk of bra! nches and ATMs throughout the country, as well as Internet banking and phone.

Itau Private Bank is a Brazilian bank in the global private banking industry, providing wealth management services to approximately 17,951 Latin American clients as of December 31, 2010. The Company serves its customers��needs for offshore wealth management solutions in major jurisdictions through independent institutions in the United States through Banco Itau Europa International and Itau Europa Securities , in Luxembourg through Banco Itau Europa Luxembourg S.A. , in Switzerland through Banco Itau Suisse , in the Bahamas through BIE Bank & Trust Bahamas and in Cayman through Unicorp Bank & Trust Cayman. As of December 31, 2010, it had over 565 very small business banking offices located throughout Brazil and approximately 2,500 managers working for over 1,235,000 small business customers. Loans to very small businesses totaled R$5,981 million as of December 31, 2010. As of December 31, 2010, it had 374 small business banking offices located nationwide in Brazil and nearly 2,500 managers who worked for over 525,000 companies. Loans to small businesses totaled R$28,744 million as of December 31, 2010.

As of December 31, 2010, it had approximately 115,000 middle-market corporate customers that represented a range of Brazilian companies located in over 83 cities in Brazil. The Company offers a range of financial products and services to middle-market customers, including deposit accounts, investment options, insurance, private retirement plans and credit products. Credit products include investment capital loans, working capital loans, inventory financing, trade financing, foreign currency services, equipment leasing services, letters of credit and guarantees. The Company also carries out financial transactions on behalf of middle-market customers, including interbank transactions, open market transactions and futures, swaps, hedging and arbitrage transactions. It also offers its middle-market custom! ers colle! ction services and electronic payment services. The Company is able to provide these services for virtually any kind of payment, including Internet office banking. It charges collection fees and fees for making payments, such as payroll, on behalf of its customers.

The Company is engaged in the Brazilian credit card market. Its subsidiaries, Banco Itaucard S.A. (Banco Itaucard) and Hipercard Banco Multiplo S.A. (Hipercard), offers a range of products to 26 million customers as of December 31, 2010, including both accountholders and non-accountholders. As of December 31, 2010, it had approximately R$16,271 million in outstanding real estate loans. As of December 31, 2010, it had total net assets under management of R$291,748 million on behalf of approximately 2.1 million customers. The Company also provides portfolio management services for pension funds, corporations, private bank customers and foreign investors. As of December 31, 2010, it had R$184,496 million of assets under management for pension funds, corporations and private bank customers. As of December 31, 2010, the Company offered and managed about 1,791 mutual funds, which are mostly fixed-income and money market funds. For individual customers, it offered 154 funds to its retail customers and approximately 287 funds to its Itau Personnalite customers. Private banking customers may invest in over 600 funds, including those offered by other institutions. Itau BBA�� capital markets group also provides tailor-made mutual funds to institutional, corporate and private banking customers.

The Company provides securities services in the Brazilian capital markets. Its services also include acting as transfer agent, providing services relating to debentures and promissory notes, custody and control services for mutual funds, pension funds and portfolios, providing trustee services and non-resident investor services, and acting as custodian for depositary receipt programs. The Company also provides brokerage services to inte! rnational! customers through its broker-dealer operations in New York, through its London branch, and through its broker-dealers in Hong Kong and Dubai. Its main lines of insurance are life and casualty (excluding Vida Gerador de Benefucio Livre), extended warranties and property. Its policies are sold through its banking operations, independent local brokers, multinational brokers and other channels. As of December 31, 2010, it had 9.9 million in capitalization products outstanding, representing R$2,620 million in liabilities with assets that function as guarantees of R$2,646 million. The Company distributes these products through its retail network, Itau Personnalite and Itau Uniclass branches, electronic channels and ATMs. These products are sold by its subsidiary, Cia. Itau de Capitalizacao S.A.

Itau BBA

Itau BBA is responsible for its corporate and investment banking activities. As of December 31, 2010, Itau BBA offered a portfolio of products and services to approximately 2,400 companies and conglomerates in Brazil. Itau BBA�� activities range from typical operations of a commercial bank to capital markets operations and advisory services for mergers and acquisitions. As of December 31, 2010, its corporate loan portfolio was R$ 76,584 million. In investment banking, the fixed income department was responsible for the issuance of debentures and promissory notes that totaled R$18,888 million and securitization transactions that amounted to R$4,677 million in Brazil in 2010. In addition, Itau BBA advised 35 merger and acquisition transactions with an aggregate deal volume of R$16,973 million in 2010.

Itau BBA is also active in Banco Nacional de Desenvolvimento Economico e Social (BNDES) on-lending to finance large-scale projects, aiming at strengthening domestic infrastructure. In consolidated terms, total loans granted by Itau BBA under BNDES on-lending represented more than R$9,010 million in 2010. Itau BBA focuses on the products and initiatives in the international ! business ! unit, such as structuring long-term, bilateral and syndicated financing, and spot foreign exchange. In addition, in 2010 Itau BBA continued to offer a large number of lines of credit for foreign trade.

Consumer Credit

As of December 31, 2010, its portfolio of vehicle financing, leasing and consortium lending consisted of approximately 3.8 million contracts, of which approximately 71.1% were non-accountholder customers. The personal loan portfolio relating to vehicle financing and leasing reached R$60,254 million in 2010. The Company leased and financed vehicles through 13,706 dealers as of December 31, 2010. Sales are made through computer terminals installed in the dealerships that are connected to its computer network. Redecard S.A. (Redecard) is a multibrand credit card provider in Brazil, also responsible for the capturing, transmission, processing and settlement of credit, debit and benefit card transactions. As of December 31, 2010, the Company held approximately 50% interest in Redecard�� capital stock.

The Company competes with Bradesco, Banco do Brasil S.A. (Banco do Brasil), Banco Santander, Caixa Economica Federal (CEF), BNDES, HSBC, Banco Citibank S.A, Banco de Investimentos Credit Suisse (Brasil) S.A., Banco JP Morgan S.A., Banco Morgan Stanley S.A., Banco Merrill Lynch de Investimentos S.A., Banco BTG Pactual S.A., Banco Panamericano S.A, Citibank S.A., Banco GE Capital S.A. and Banco Ibi S.A.

Advisors' Opinion: - [By Hilary Kramer]

Itau Unibanco (ITUB): A lot of investors have never heard of Itau because it’s headquartered in Brazil, but it’s one of the world’s largest financial institutions. With 5,000 branches, 100,000 employees and nearly $500 billion in assets (yes, half a trillion!), ITUB is not just the largest Latin American bank, it is one of the biggest in the world. With proven dominance in Brazil (and Latin America), Itau Unibanco is a go-to financial pick, and it currently yields an attractive 3.5%. I recently recommended that my Inner Circle readers sell ITUB on a nice bounce due to the risk of near-term weakness on economic data out of China, but I�� already looking for an opportunity to get back in.

Best Bank Companies To Buy For 2014: Popular Inc.(BPOP)

Popular, Inc., through its subsidiaries, provides a range of retail and commercial banking products and services primarily to corporate clients, small and middle size businesses, and retail clients in Puerto Rico and Mainland United States. It offers deposit products; commercial, consumer, and mortgage loans, as well as lease finance; and finance and advisory services. The company also offers trust and asset management, brokerage and investment banking, and insurance and reinsurance services. As of December 31, 2010, it owned and occupied approximately 94 branch premises and other facilities in Puerto Rico; and 119 offices, including 20 owned and 99 leased in New York, Illinois, New Jersey, California, Florida, and Texas. Popular, Inc. was founded in 1917 and is headquartered in San Juan, Puerto Rico.

Advisors' Opinion: - [By Jake L'Ecuyer]

Popular (NASDAQ: BPOP) shares tumbled 5.54 percent to $27.48 after Morgan Stanley downgraded the stock from Equal-weight to Underweight.

Pacific Coast Oil Trust (NYSE: ROYT) down, falling 7.13 percent to $16.70 after the company priced a public offering by Pacific Coast Energy Company LP and other selling unitholders of 13,500,000 trust units at a price of $17.10 per unit.

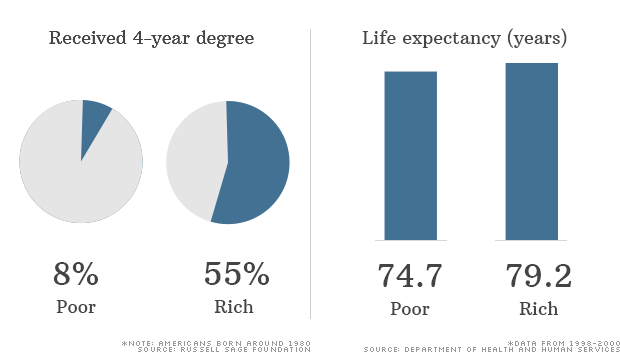

NEW YORK (CNNMoney) It's not just income inequality. It's lifespan inequality. And education inequality. And declining economic growth.

NEW YORK (CNNMoney) It's not just income inequality. It's lifespan inequality. And education inequality. And declining economic growth.  Who's to blame for income inequality?

Who's to blame for income inequality?