What are the main problems that advisors try to solve in a client’s portfolio?

To justify your own fees, performance that consistently outpaces the broader market indexes would be nice. However, you’re not willing to take on undue risk or volatility. Moreover, as an advisor you’re always focused on the cost of those investments, and an investment with high turnover goes against the long-term investing goal that most advisors have on behalf of their clients, not to mention the tax consequences of higher-frequency trading.

So perhaps you’re thinking that certain alternative investments would fit the bill. The problem with many alts, however, is that your clients may need to be part of the high-net-worth cohort. Burned by the 2008-2009 hyper-correlation and crash-and-burn of many private vehicles, you demand liquidity and transparency. Oh, you also can’t stomach the costs of 2-and-20 managers.

Enter Ben Warwick of QES Investments and a pairing of two investing vehicles — in ETF and mutual fund formats — that appears to go a long way toward meeting client needs for performance and diversification while assuaging advisors’ concerns about alternatives’ costs, transparency and liquidity.

Last month, an ETF was launched based on a QES private equity strategy on the London Stock Exchange, Source Nomura Modeled PERI ETF (PERI:LN). This past week, Hatteras Partners launched a mutual fund, Hatteras Private Equity Intelligence Fund (HPEIX). Both are built to deliver the benefits of private equity investing without the drawbacks of direct investing in listed or unlisted PE.

As CIO for the multi-office family office Sovereign Wealth Management, Warwick — a ThinkAdvisor and Investment Advisor contributor — and his team sought to use alternatives in performing asset allocation for larger portfolios. However, he found that there were “some negatives to what we were using,” the primary drawback being the “the delivery mechanism of the limited partnership.” Looking to deliver to his clients “access to risk premia that they wouldn’t have been able to access,” QES started by using futures, especially managed futures in portfolios as a strategic tilt away from the typical 60/40 portfolios.

Warwick realized that QES wanted to “build products that solve problems for advisors.” First up: the Aspen Managed Futures mutual fund (MFBTX), a low-cost index-based managed futures ’40 Act fund using both trend and countertrend strategies. He says the “low cost and the sensible structure of the index gave us some success with that product,” which has attracted $160 million in assets in just two years.

Around that time, however, “we started to see if we could make available the returns of private equity, specifically buyout funds.”

Why private equity? Simple, Warwick says. “Because the returns are better,” delivering 3% to 5% better returns than an unmanaged S&P 500 strategy. However, PE also requires that a HNW investor “tie up your money for a decade” more often than not.

So QES started conducting attribution analysis on PE returns to determine the source of those extra returns. While some observers would expect the returns come from “levered equity," Warwick said, "that doesn’t explain why private equity investments show a bigger upside with lower drawdowns.”

It turns out that individual managers’ alpha isn’t the primary driver, either, though he admits “there’s some of that.” Instead, what QES’ research found was that the “surprising driver” of PE returns is timing — “when you get in and when you get out” — and sector selection.

“Private equity managers are like hedge fund managers,” argues Warwick, in that they exhibit “herd behavior; if you see one or two deals in utilities,” for example, “you’ll see all these private equity managers going into utilities."

Since there’s a “momentum effect in capturing the money flows of PE, if you could capture that momentum effect and mirror the leverage, which changes with credit spreads, you could get close” to the returns of private equity funds. So QES needed to find the data on private equity funds to determine that momentum and timing.

Enter Preqin, which Warwick calls the “Morningstar of PE,” which has a “huge database” containing “30,000 transactions and 600 buyout funds.” Its data allowed QES to build portfolios that mimic the private equity buyout space.

Warwick says its PE index “went live a year ago, published on Bloomberg,” and true to QES’ research, “is providing good returns with less volatility.” The ETF, based on the Nomura QES Modeled Private Equity Returns Index, launched last month while the Hatteras mutual fund, HPEIX, launched last week.

How do the funds help advisors? “Lots of advisors” want to follow the endowment model, Warwick says, and allocate 30% to private equity, “but clients can’t afford that, so these funds allow you to cover the PE allocation.”

Moreover, the benefits of buying an index-based PE fund include ameliorating the “significant timing risk” of buying just one “vintage year” of PE. “If you buy into our funds, you get every vintage year in one trade; we look at the asset allocation of every vintage year in the database.”

Why not buy listed private equity, then? “Contrast our approach — trying to give returns from actual buyout funds — to listed PE, which buys the service providers of funds.” Listed PE, he says, is “very illiquid; ours (the ETF and mutual fund) are more liquid than the funds they’re wrapped into.”

The downside to PE index approach? “The big risk with our strategy is that we’re tied to how buyout funds do: if they don’t do well, then we won’t do well.”

However, Warwick says that “historically their downside participation in equity pullbacks is much more muted than the S&P 500,” partly because “we’ll always be a combination of long equity and cash.”

Why the cash? It’s all about the private equity need for ‘dry powder’ in the portfolio, i.e., the cash necessary to fund future buyouts. If the QES funds are mimicking the private equity funds, they’ll also mimic the amount of dry powder being held by PE funds. “Last year,” says Warwick, the average level of cash in the portfolio was 35%, but the portfolio yielded “S&P returns with 30% less volatility.”

What’s the role of the funds? “Some people are looking to use our fund as a smart beta, others put it in the alternatives bucket; pension plans see these as return drivers,” while “private banks see it as portfolio diversifiers.”

The cost? “The index has a 1% fee embedded in it,” plus trading costs.

The mutual fund’s final expense ratios are still to be determined by Hatteras, but it will provide, says Warwick, “far cheaper access to private equity.” Warwick himself says he’s a “significant investor in both the managed futures fund” and the private equity funds. “I’m a big believer in eating my own cooking,” he says.

---

Ben Warwick is a frequent contributor to Investment Advisor and writes the monthly Searching for Alpha index newsletter for ThinkAdvisor.com.

Ben also presented during a Nov. 12 ThinkAdvisor webinar on how to manage risk in a portfolio now.

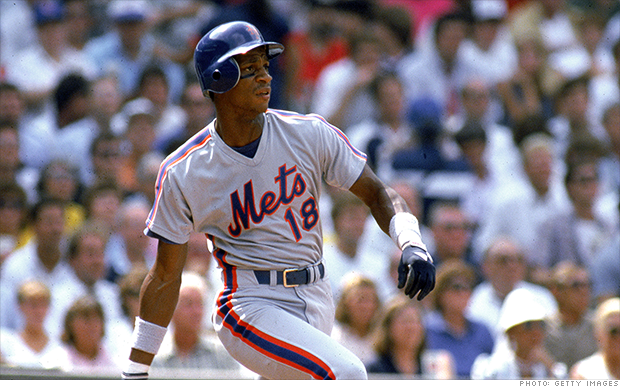

Strawberry took home four World Series titles over his 17-year Major League Baseball career. NEW YORK (CNNMoney) You can own a piece of baseball history, but it's nothing that can be put on a shelf.

Strawberry took home four World Series titles over his 17-year Major League Baseball career. NEW YORK (CNNMoney) You can own a piece of baseball history, but it's nothing that can be put on a shelf.