Asian stocks outside Japan fell for a fifth week, the longest streak of losses in two years, amid concern central banks are losing an appetite for more stimulus. Japanese stocks rebounded the final day of the week as Nomura Holdings Inc. and Fidelity Worldwide advised buying shares.

Newcrest Mining Ltd. fell a third week amid after the Australia�� biggest gold producer said it will write down the value of its assets by as much as $5.7 billion. Nomura Holdings Inc., Japan�� largest brokerage, climbed 1.3 percent with the Topix index little changed after a fourth week of swings. Chinese shares in Hong Kong capped a record losing streak.

The MSCI Asia Pacific excluding Japan Index dropped 1.3 percent this week to 440.07, extending this year�� loss to 6.6 percent. A gauge that includes Japanese shares added 0.3 percent for the week. The Hang Seng China Enterprises Index fell for a record 12 straight days through June 14 amid concern that growth is slowing in the world�� No. 2 economy.

Hot Gold Stocks For 2014: Goldman Sachs Group Inc.(The)

The Goldman Sachs Group, Inc., together with its subsidiaries, provides investment banking, securities, and investment management services to corporations, financial institutions, governments, and high-net-worth individuals worldwide. Its Investment Banking segment offers financial advisory, including advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense, risk management, restructurings, and spin-offs; and underwriting securities, loans and other financial instruments, and derivative transactions. The company?s Institutional Client Services segment provides client execution activities, such as fixed income, currency, and commodities client execution related to making markets in interest rate products, credit products, mortgages, currencies, and commodities; and equities related to making markets in equity products, as well as commissions and fees from executing and clearing institutional client transactions on stock, options, and fu tures exchanges. This segment also engages in the securities services business providing financing, securities lending, and other prime brokerage services to institutional clients, including hedge funds, mutual funds, pension funds, and foundations. Its Investing and Lending segment invests in debt securities, loans, public and private equity securities, real estate, consolidated investment entities, and power generation facilities. This segment also involves in the origination of loans to provide financing to clients. The company?s Investment Management segment provides investment management services and investment products to institutional and individual clients. This segment also offers wealth advisory services, including portfolio management and financial counseling, and brokerage and other transaction services to high-net-worth individuals and families. In addition, it provides global investment research services. The company was founded in 1869 and is headquartered in New York, New York.

Hot Gold Stocks For 2014: Australian Dollar(AU)

AngloGold Ashanti Limited primarily engages in the exploration and production of gold. It also produces silver, uranium oxide, and sulfuric acid. The company conducts gold-mining operations in South Africa; continental Africa, including Ghana, Guinea, Mali, Namibia, and Tanzania; Australia; and the Americas, which include Argentina, Brazil, and the United States. It also has mining or exploration operations in the Democratic Republic of the Congo, Guinea, and Colombia. As of December 31, 2010, the company had proved and probable gold reserves of 71.2 million ounces. The company has a strategic alliance with Thani Dubai Mining Limited to explore, develop, and operate mines across the Middle East and parts of North Africa. AngloGold Ashanti Limited, formerly known as Vaal Reefs Exploration and Mining Company Limited, was founded in 1944 and is headquartered in Johannesburg, South Africa.

Advisors' Opinion: - [By Profit Confidential]

Graham Ehm, Executive Vice President of South African-based AngloGold Ashanti Limited (NYSE: AU), one of the biggest gold producers in the global economy, stated the company is looking to save $500 million over the next 18 months, as capital expenditures will only be going towards their highest-quality assets. (Source: Mining Weekly, August 5, 2013.)

- [By Rich Duprey]

Considering the work stoppages and violent clashes that have become the norm at South African precious-metals mines, perhaps the miners were wondering exactly what they were getting for their money. An expose by South Africa's Daily Maverick has uncovered a system where miners such as AngloGold Ashanti (NYSE: AU ) and BHP Billiton (NYSE: BHP ) surreptitiously paid for the salaries of the heads of the local mining unions to keep the mine workers in line, and it's only because the miners sought to end the "uncomfortable arrangement" with the unions that the matter came to light.

- [By Dan Caplinger]

One way Yamana has kept its competitive cost advantage is through extensive sales of base-metal byproducts like copper and zinc, as both it and fellow low-cost rival Goldcorp (NYSE: GG ) benefit from utilizing those secondary metals to offset the cost of their gold production. Peers Gold Fields (NYSE: GFI ) and AngloGold Ashanti (NYSE: AU ) , on the other hand, face much higher costs in part because of their exposure to South Africa and its unstable labor market.

Best Oil Companies To Own In Right Now: CME Group Inc.(CME)

CME Group Inc. operates the CME, CBOT, NYMEX, and COMEX regulatory exchanges worldwide. The company provides a range of products available across various asset classes, including futures and options on interest rates, equity indexes, energy, agricultural commodities, metals, foreign exchange, weather, and real estate. It offers various products that provide a means of hedging, speculation, and asset allocation relating to the risks associated with interest rate sensitive instruments, equity ownership, changes in the value of foreign currency, credit risk, and changes in the prices of commodities. CME Group owns and operates clearing house, CME Clearing, which provides clearing and settlement services for exchange-traded contracts and counter derivatives transactions; and also engages in real estate operations. Its primary trade execution facilities consist of its CME Globex electronic trading platform and open outcry trading floors, as well as privately negotiated transact ions that are cleared and settled through its clearing house. In addition, the company offers market data services comprising live quotes, delayed quotes, market reports, and historical data services, as well as involves in index services business. CME Group?s customer base includes professional traders, financial institutions, institutional and individual investors, corporations, manufacturers, producers, and governments. It has strategic partnerships with BM&FBOVESPA S.A., Bursa Malaysia Derivatives, Singapore Exchange Limited, Green Exchange, Dubai Mercantile Exchange, Johannesburg Stock Exchange, and Bolsa Mexicana de Valores, S.A.B. de C.V., as well as joint venture agreement with Dow Jones & Company. The company was formerly known as Chicago Mercantile Exchange Holdings Inc. and changed its name to CME Group Inc. in July 2007. CME Group was founded in 1898 and is headquartered in Chicago, Illinois.

Advisors' Opinion: - [By Jeff Reeves]

Options traders and commodity junkies should recognize CME Group (CME) as the Chicago Mercantile Exchange, a financial entity that operates a host of futures exchanges as well as providing its own exchange-traded products and derivatives.

- [By Dan Caplinger]

Among exchanges, the action is beyond the stock market. With the rise in trading of futures, options, and other derivative investments, NYSE Euronext's ownership of the NYSE Liffe exchange in London was a key element of ICE's interest. CME Group (NASDAQ: CME ) and CBOE Holdings (NASDAQ: CBOE ) have worked hard to preserve their respective strength in futures and options, and rising market turbulence has made many of their products look a lot more enticing. Given that derivatives can help hedge market risk and reduce overall exposure, all of the exchange companies have an opportunity to bolster their presence in the derivatives market with innovative products that meet the new needs investors have in a more turbulent financial environment.

Hot Gold Stocks For 2014: Agnico-Eagle Mines Limited(AEM)

Agnico-Eagle Mines Limited, through its subsidiaries, engages in the exploration, development, and production of mineral properties in Canada, Finland, and Mexico. The company primarily explores for gold, as well as silver, copper, zinc, and lead. Its flagship property includes the LaRonde mine located in the southern portion of the Abitibi volcanic belt, Canada. The company was founded in 1953 and is based in Toronto, Canada.

Advisors' Opinion: - [By Sally Jones]

The once-troubled Agnico Eagle Mines Ltd. (AEM) is hitting a new record for gold production in the third quarter at 315,828 ounces, according to the Financial Post, and the company�� executives are buying. Here�� a third quarter company update and a look at billionaire stakeholders of AEM, a stock that spiked 23.66% over the past five days.

- [By Patricio Kehoe] e, has cash costs of $912 per ounce, and Agnico Eagle�� costs do not even reach the $700 per ounce mark. Hence, it comes as little surprise that revenue has been decreasing steadily, since gold prices are hovering around the $1300 mark at best. As the company is hemorrhaging money, investment gurus the like of John Burbank and Seth Klarman have decided to sell their entire stake in the firm. I agree with this bearish stance, and recommend investors stay away from Kinross Gold.

Any Long Term Investment?

If you were to follow Jean-Marie Eveillard�� purchases, one would be inclined to see good growth prospects for Agnico Eagle, and thus believe in this stock�� potential. And, you wouldn�� be wrong, as the firm has been growing at a steady pace, with no end in sight to its expansion possibilities. However, with a 171% price premium, investors might be better off waiting until a more favorable entry-point is available. Nevertheless, as a long-term investment, I feel highly optimistic and would thus even consider paying the additional cost.

Disclosure: Patricio Kehoe holds no position in any stocks mentioned.

Also check out: Jean-Marie Eveillard Undervalued Stocks Jean-Marie Eveillard Top Growth Companies Jean-Marie Eveillard High Yield stocks, and Stocks that Jean-Marie Eveillard keeps buying John Burbank Undervalued Stocks John Burbank Top Growth Companies John Burbank High Yield stocks, and Stocks that John Burbank keeps buying

The Strategy of Ben Graham ��Warren Buffett�� Mentor From 1923 to 1957 Warren Buffett�� mentor, Ben Graham, followed a strategy of investing in net-nets. He said: ��t always seemed, and still seems ridiculously simple to say that if one can acquire a diversified group of common stocks at a price less than the...net current assets alone��he results should be quite satisfactory. They were so in our experience, for more than 30 years.��br> Today net-nets are rare. They are collected under Gu

Hot Gold Stocks For 2014: Thompson Creek Metals Company Inc.(TC)

Thompson Creek Metals Company Inc., through its subsidiaries, engages in mining, milling, processing, and marketing molybdenum products in the United States and Canada. The company?s principal properties include the Thompson Creek Mine and mill in Idaho; a metallurgical roasting facility in Langeloth, Pennsylvania; and a joint venture interest in the Endako Mine, mill, and roasting facility in British Columbia. It also holds interests in development projects comprising the Davidson molybdenum property and the Berg copper-molybdenum-silver property located in northern British Columbia; the Howard?s Pass property, a lead and zinc project situated in the Yukon territory-northwest territories border; and the Maze Lake property, a gold project located in the Kivalliq district of Nunavut. The company produces molybdenum products, primarily molybdic oxide and ferromolybdenum, as well as soluble technical oxide, pure molybdenum tri-oxide, and high purity molybdenum disulfide. As o f December 31, 2010, its consolidated recoverable proven and probable ore reserves totaled 462.2 million pounds of contained molybdenum in the Thompson Creek Mine and the Endako Mine. The company was formerly known as Blue Pearl Mining Ltd. and changed its name to Thompson Creek Metals Company Inc. in May 2007. Thompson Creek Metals Company Inc. is based in Denver, Colorado.

Advisors' Opinion: - [By Selena Maranjian]

The biggest new holdings are Chesapeake Energy�puts, and shares of Discovery Communications. Other new holdings of interest include Halcon Resources (NYSE: HK ) , and Thompson Creek Metals (NYSE: TC ) . Oil and gas company Halcon, operating in the promising Bakken region, as well as Texas's productive Eagle Ford shale region, among others, is expected to grow by 30% annually over the coming years. It recently reported 2012 net daily production 128% higher than year-ago levels, and proven reserves up 417%. Halcon was recently one of my colleague Joel South's top two energy holdings, and analysts at Stifel recently upped its rating�from Hold to Buy.

Hot Gold Stocks For 2014: Northgate Minerals Corporation(NXG)

Northgate Minerals Corporation, together with its subsidiaries, engages in exploring, developing, processing, and mining gold and copper deposits in Canada and Australia. Its principal producing assets include 100% interests in the Fosterville and Stawell Gold mines in Victoria, Australia; and the Kemess South mine located in north-central British Columbia, Canada. The company was formerly known as Northgate Exploration Limited and changed its name to Northgate Minerals Corporation in May 2004. Northgate Minerals Corporation was founded in 1919 and is headquartered in Toronto, Canada.

Hot Gold Stocks For 2014: NEW GOLD INC.(NGD)

New Gold Inc. engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties. The company primarily explore for gold, silver, and copper deposits. Its operating properties include the Mesquite gold mine in the United States; the Cerro San Pedro gold-silver mine in Mexico; and the Peak gold-copper mine in Australia. The company also has development projects, including the New Afton gold, silver, and copper project in Canada; and a 30% interest in the El Morro copper-gold project in Chile. The company was formerly known as DRC Resources Corporation and changed its name to New Gold Inc. in June 2005. New Gold Inc. was founded in 1980 and is headquartered in Vancouver, Canada.

Advisors' Opinion: - [By Ben Levisohn]

Even bad news has failed to dent the rise in gold stocks today. NewGold (NGD), for instance, has gained 1.8% to $7.49 despite the fact that the wall of one of its mines collapsed. The Wall Street Journal has the details:

- [By Ben Levisohn]

One group of stocks not feeling the optimism today: Gold miners. With fewer concerns that a U.S. attack on Syria will be disruptive and more evidence that tapering will begin this month, the price of the precious metal has dropped 1.6% to $1,388.90 an ounce–and gold stocks are falling with it. New Gold (NGD), for one, has dropped 3% to $6.55, while Barrick Gold (ABX) has fallen 1.3% to $19.25.

- [By Ben Levisohn]

Bridges favorite stocks include Goldcorp, Newmont, Eldorado Gold (EGO) and New Gold (NGD).

Note, however, that these recommendations are all qualified in one way or another. Investors should keep that in mind before going all in on the gold miners.

Hot Gold Stocks For 2014: Claude Resources Inc.(CGR)

Claude Resources Inc. engages in the acquisition, exploration, and development of precious metal properties, as well as production and marketing of minerals in Canada. It primarily explores for gold in northern Saskatchewan and northwestern Ontario. The company holds interests in the Seabee gold mine located at Laonil Lake, northern Saskatchewan; and the Madsen property that consists of 6 contiguous claim blocks totaling approximately 10,000 acres, located in the Red Lake Mining District of northwestern Ontario. It also holds interest in the Amisk Gold project, which covers an area of 13,800 hectares in the province of Saskatchewan. The company was founded in 1980 and is based in Saskatoon, Canada.

Alamy Politics aside, Hillary Clinton was right: For most of human history, it usually took a village (or a tribe) of people to raise a child. Humans are social creatures: Though moms and -- to a lesser extent -- dads shouldered the major tasks of child-rearing, the support of the community played a huge role. Meals were cooked, kids were looked after, and social groups helped ensure the safe upbringing of the young. Today, that same societal structure isn't anywhere near as prevalent. In its place are long waiting lists and sky-high costs associated with putting a child in day care. How expensive has this gotten? If you lived in Washington, D.C., in 2011, putting your infant in a child care center would have cost $388 per week -- or more than $20,000 for a full year. Of course, I'm cherry-picking one of the most expensive locales, but it highlights a nationwide trend. In fact, in every region of the country except for the West, a family with two children in child care spent more for their kids to be looked after than they did on all housing costs combined. If you're expecting, or already have children, here are some key trends to keep in mind when deciding what to do when it comes to looking after your kids. Location, Location, Location This is the mantra of just about every real estate agent, but the same could be said of child care providers. For instance, full-time child care for an infant in Mississippi averaged $4,600 per year in 2011, but was $15,000 in Massachusetts. But the difference in absolute dollars doesn't mean much when you consider that the average salary in Massachusetts is higher than what it is in Mississippi. Instead, here's a look at the five least and most expensive states to have an infant in center-based care, as a percentage of median family income.

Alamy Politics aside, Hillary Clinton was right: For most of human history, it usually took a village (or a tribe) of people to raise a child. Humans are social creatures: Though moms and -- to a lesser extent -- dads shouldered the major tasks of child-rearing, the support of the community played a huge role. Meals were cooked, kids were looked after, and social groups helped ensure the safe upbringing of the young. Today, that same societal structure isn't anywhere near as prevalent. In its place are long waiting lists and sky-high costs associated with putting a child in day care. How expensive has this gotten? If you lived in Washington, D.C., in 2011, putting your infant in a child care center would have cost $388 per week -- or more than $20,000 for a full year. Of course, I'm cherry-picking one of the most expensive locales, but it highlights a nationwide trend. In fact, in every region of the country except for the West, a family with two children in child care spent more for their kids to be looked after than they did on all housing costs combined. If you're expecting, or already have children, here are some key trends to keep in mind when deciding what to do when it comes to looking after your kids. Location, Location, Location This is the mantra of just about every real estate agent, but the same could be said of child care providers. For instance, full-time child care for an infant in Mississippi averaged $4,600 per year in 2011, but was $15,000 in Massachusetts. But the difference in absolute dollars doesn't mean much when you consider that the average salary in Massachusetts is higher than what it is in Mississippi. Instead, here's a look at the five least and most expensive states to have an infant in center-based care, as a percentage of median family income.  Even within states, however, there are big differences. And no variable seems to be more important than -- you guessed it -- location. But this time, instead of talking about different states, we're referring to the difference between living in an urban or suburban community (defined as near a city center of at least 50,000) and a rural one. The most extreme example would be in Oregon, where the cost to put your infant in a child care center in an urban area is more than as expensive as it is in a rural area. But Oregon isn't alone: How Much More Expensive Is Urban Care vs. Rural Care?

Even within states, however, there are big differences. And no variable seems to be more important than -- you guessed it -- location. But this time, instead of talking about different states, we're referring to the difference between living in an urban or suburban community (defined as near a city center of at least 50,000) and a rural one. The most extreme example would be in Oregon, where the cost to put your infant in a child care center in an urban area is more than as expensive as it is in a rural area. But Oregon isn't alone: How Much More Expensive Is Urban Care vs. Rural Care?  Is It a Better Option to Quit Your Job and Stay at Home? When confronted with such costs -- and endless waiting lists -- many parents are faced with the difficult decision of whether to continue working or to take a few years off to care for their children themselves. Of course, finances alone aren't the only consideration; for many people, their work is an intrinsically rewarding experience that goes beyond just earning a paycheck. But because one's approach to their work varies from individual to individual, let's just focus on the dollars and cents of such a decision. One very important matter to be aware of is a federal tax credit available to families who have to pay for child care. The credit is good for up to 35 percent of your child care bill with a limit of $3,000 for one child and $6,000 for two or more children. Let's take the most average state from our data set -- Iowa -- and see when it makes more financial sense to stay at home.

Is It a Better Option to Quit Your Job and Stay at Home? When confronted with such costs -- and endless waiting lists -- many parents are faced with the difficult decision of whether to continue working or to take a few years off to care for their children themselves. Of course, finances alone aren't the only consideration; for many people, their work is an intrinsically rewarding experience that goes beyond just earning a paycheck. But because one's approach to their work varies from individual to individual, let's just focus on the dollars and cents of such a decision. One very important matter to be aware of is a federal tax credit available to families who have to pay for child care. The credit is good for up to 35 percent of your child care bill with a limit of $3,000 for one child and $6,000 for two or more children. Let's take the most average state from our data set -- Iowa -- and see when it makes more financial sense to stay at home.

Considering China’s restrictions on foreign investment in the country’s capital markets, it is little surprise that few people appreciate the sheer size of those markets. The only way outsiders can make anything close to a direct investment in Chinese equities or bonds is through Hong Kong-traded instruments or the few Chinese American Depository Receipts listed on US exchanges.

Considering China’s restrictions on foreign investment in the country’s capital markets, it is little surprise that few people appreciate the sheer size of those markets. The only way outsiders can make anything close to a direct investment in Chinese equities or bonds is through Hong Kong-traded instruments or the few Chinese American Depository Receipts listed on US exchanges. Reading the Table OV/UN Valued: Stocks with a red number are undervalued by this percentage. Those with a black number are overvalued by that percentage according to ValuEngine. VE Rating: A "1-engine" rating is a strong sell, a "2-engine" rating is a sell, a "3-engine" rating is a hold, a "4-engine" rating is a buy and a "5-engine" rating is a strong buy. Last 12-Month Return (%): Stocks with a red number declined by that percentage over the last 12 months. Stocks with a black number increased by that percentage. Forecast 1-Year Return: Stocks with a red number are projected to decline by that percentage over the next 12 months. Stocks with a black number in the table are projected to move higher by that percentage over the next 12 months.

Reading the Table OV/UN Valued: Stocks with a red number are undervalued by this percentage. Those with a black number are overvalued by that percentage according to ValuEngine. VE Rating: A "1-engine" rating is a strong sell, a "2-engine" rating is a sell, a "3-engine" rating is a hold, a "4-engine" rating is a buy and a "5-engine" rating is a strong buy. Last 12-Month Return (%): Stocks with a red number declined by that percentage over the last 12 months. Stocks with a black number increased by that percentage. Forecast 1-Year Return: Stocks with a red number are projected to decline by that percentage over the next 12 months. Stocks with a black number in the table are projected to move higher by that percentage over the next 12 months.

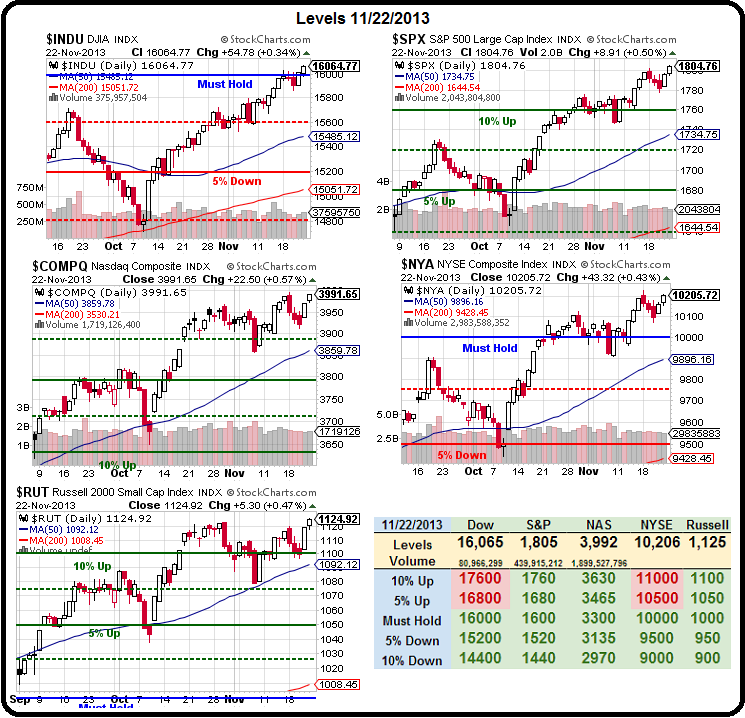

It's that time yet again.

It's that time yet again.