Despite being in a precarious situation, DryShips (DRYS) is still regarded as a leading player in the shipping sector. DryShips released its fourth-quarter earnings just recently, and the results were mixed as the company managed to beat the revenue estimate but missed out on the bottom line estimate.

What's even more worrying for investors is that the company's debt-to-capitalization ratio jumped from 0.52 to 0.58, which signifies that the company's debt is becoming unmanageable. In addition to that, DryShips also reported a year-over-year increment in expenses of 6.3%. The rising debt-to-capitalization ratio and increasing expenditure shows that the company might struggle to stay afloat and may even dilute its shares once more. On the bright side, DryShips' Oil Tanker segment's revenue increased by an impressive 190.5% from last year to $32.4 million.

Rising Debt and Not Generating Enough Money

DryShips has nearly doubled in 2013 due to optimism that the company is well positioned to capitalize on the recent revival in shipping rates. However, I don't think that the hike in shipping rates will help DryShips generate enough money to offset its gigantic debt, and it is one of the primary reasons why I will suggest investors to stay away from the stock.

As per Yahoo Finance, DryShips' debt currently stands at $4.55 billion. And given that the company only has $227 million in cash, this scenario is very daunting. While maturities of many of these debts have been extended to 2015, DryShips is still in a very precarious situation.

Moving on to the shipping segment, DryShips reported $13.4 million in EBITDA for this sector. However, the company has spent more than $33 million in debt payments. So, it is evident that DryShips is not generating enough money to keep up with its debt payments, and will need to triple its earnings just to remain on par with the debt payments. Therefore, it will be irrational to assume that the recent revival in shipping rates will turn around the company's fortunes.

Ocean Rig Myth

Many analysts and investors are of the opinion that DryShips' financial situation will improve because of drilling operations which it provides through its partially owned subsidiary, Ocean Rig. Quarterly revenues from drilling contracts jumped 15% from last year to $328 million, and even though DryShips owns a 59% stake in Ocean Rig, it has no control over the capital and resources of Ocean Rig. So, investors shouldn't believe that Ocean Rig's order backlog worth $5.8 billion will benefit DryShips in any way.

Dilution and Poor Management

To deal with these stringent financial conditions, DryShips' management decided to issue nearly 6 million shares for $20 million in the previous quarter. This isn't the first time the company has resorted to diluting shares to tackle the financial pressure and this just goes on to show that DryShips might never return a good yield in the long run because of poor management. The company's management has continued the dilution process to stay afloat, rather than sacrificing underperforming assets. Another example of poor management is when DryShips paid a buyer $21.4 million to take two unfinished ships off its hands.

Conclusion

There might be some who would be expecting DryShips to get better in the future. The stock has run up close to 100% this year on the back of investors' optimism, but facts and figures are against it. A huge debt load, poor cash position, and poor management decisions are some good reasons why investors should book their profits and consider selling DryShips.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments

Sdnarra - 1 hour ago

It is not just this one. Many of the shipping companies habitually dilute their shareholders. I was a shareholder in NAT(Nordic american tankers) for some time and felt totally mistreated by the management. They issued dilutive shares repeatedly while shares were well below book value, continued to pay a dividend while they were cash flow negative, continuously misread the market they were in, and continued to pay themselved handsomely for their utter mismanagement. Having lost well over a third of my capital in a 2 1/2 yr period when the markets were rising and realising the interests of management were completely misalligned with mine, and deciding time is more potentially injurious to my capital, I exited in sheer disgust at them. Even a solid pristine balance sheet can't stand up to idiotic self serving management.

Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

DRYS STOCK PRICE CHART

3.25 (1y: +84%) $(function(){var seriesOptions=[],yAxisOptions=[],name='DRYS',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372309200000,1.77],[1372395600000,1.87],[1372654800000,1.89],[1372741200000,1.78],[1372827600000,1.81],[1373000400000,1.8],[1373259600000,1.82],[1373346000000,1.84],[1373432400000,1.85],[1373518800000,1.84],[1373605200000,1.91],[1373864400000,1.93],[1373950800000,1.92],[1374037200000,1.93],[1374123600000,2.03],[1374210000000,1.995],[1374469200000,2.09],[1374555600000,2.09],[1374642000000,2.04],[1374728400000,2.08],[1374814800000,2.04],[1375074000000,1.965],[1375160400000,1.92],[1375246800000,1.92],[1375333200000,1.96],[1375419600000,2.03],[1375678800000,2.05],[1375765200000,1.94],[1375851600000,1.96],[1375938000000,2.02],[1376024400000,2.04],[1376283600000,2],[1376370000000,1.95],[1376456400000,2.09],[1376542800000,2.12],[1376629200000,2.04],[1376888400000,1.92],[1376974800000,2.01],[1377061200000,2.05],[1377147600000,2.17],[1377234000000,2.25],[1377493200000,2.41],[1377579600000,2.44],[1377666000000,2.45],[1377752400000,2.37],[1377838800000,2.33],[1378184400000,2.33],[1378270800000,2.49],[1378357200000,2.765],[1378443600000,2.88],[1378702800000,3.085],[1378789200000,2.965],[1378875600000,3.03],[1378962000000,2.91],[1379048400000,2.9],[1379307600000,2.97],[1379394000000,3.09],[1379480400000,3.29],[1379566800000,3.608],[1379653200000,3.495],[1379912400000,3.46],[1379998800000,3.6],[1380085200000,3.93],[1380171600000,3.86],[1380258000000,3.64],[1380517200000,3.54],[1380603600000,3.73],[1380690000000,3.74],[1380776400000,3.71],[1380862800000,3.78],[1381122000000,3.57],[1381208400000,3.395],[1381294800000,3.31],[1381381200000,3.49],[1381467600000,3.42],[1381726800000,3.39],[1381813200000,3.38],[1381899600000,3.461],[1381986000000,3.49],[1382072400000,3.425],[1382331600000,3.08],[1382418000000,3.09],[1382504400000,2.915],[1382590800000,2.84],[1382677200000,2.87],[1382936400000,2.719],[1383022800000,2.83],[1383109200000,2.72],[1383195600000,2.76],[1383282000000,3.07],[138354480000! 0,3.23],[1383631200000,3.18],[1383717600000,3.029],[1383804000000,2.87],[1383890400000,3.06],[1384149600000,3.16],[1384236000000,3.09],[1384322400000,3.19],[1384408800000,3.1],[1384495200000,3.13],[1384754400000,3.04],[1384840800000,2.94],[1384927200000,2.97],[1385013600000,3.1],[1385100000000,3.05],[1385359200000,3.06],[1385445600000,3.091],[1385532000000,3.29],[1385704800000,3.44],[1385964000000,3.33],[1386050400000,3.35],[1386136800000,3.4],[1386223200000,3.6],[1386309600000,3.5],[1386568800000,3.43],[1386655200000,3.42],[1386741600000,3.46],[1386828000000,3.49],[1386914400000,3.66],[1387173600000,3.6],[1387260000000,3.58],[1387346400000,3.59],[1387432800000,3.73],[1387519200000,3.69],[1387778400000,3.93],[1387864800000,4.17],[1388037600000,4.7],[1388124000000,4.68],[1388383200000,4.38],[1388469600000,4.7],[1388642400000,4.31],[1388728800000,4.27],[1388988000000,4.04],[1389074400000,4.105],[1389160800000,4.08],[1389247200000,3.92],[1389333600000,3.86],[1389592800000,3.62],[1389679200000,3.68],[1389765600000,4],[1389852000000,3.99],[1389938400000,3.82],[1390284000000,3.81],[1390370400000,3.81],[1390456800000,3.77],[1390543200000,3.38],[1390802400000,3.4],[1390888800000,3.47],[1390975200000,3.36],[1391061600000,3.37],[1391148000000,3.4],[1391407200000,3.251],[1391493600000,3.32],[1391580000000,3.23],[1391666400000,3.41],[1391752800000,3.64],[1392012000000,3.63],[1392098400000,3.8],[1392184800000,3.74],[1392271200000,3.73],[1392357600000,3.7],[1392703200000,3.71],[1392789600000,3.48],[1392876000000,3.53],[1392962400000,3.51],[1393221600000,3.6],[1393308000000,3.545],[1393394400000,3.51],[1393480800000,3.66],[1393567200000,3.68],[1393826400000,3.68],[1393912800000,3.88],[1393999200000,4.14],[1394085600000,4.02],[1394172000000,3.95],[1394427600000,3.78],[1394514000000,3.68],[1394600400000,3.57],[1394686800000,3.52],[1394773200000,3.4],[1395032400000,3.42],[1395118800000,3.59],[1395205200000,3.58],[1395291600000,3.495],[1395378000000,3.48],[1395637200000,3.31],[1395723600000,3.35],[1395810000000,3.22],[139! 589640000! 0,3.14],[1395982800000,3.25],[1396242000000,3.23],[1396328400000,3.28],[1396414800000,3.28],[1396501200000,3.21],[1396587600000,3.26],[1396846800000,3.19],[1396933200000,3.25],[1397019600000,3.34],[1397106000000,3.19],[1397192400000,3.1],[1397451600000,3.13],[1397538000000,3.1],[1397624400000,3.13],[1397710800000,3.16],[1398056400000,3.25],[1398142800000,3.32],[1398229200000,3.25],[1398315600000,3.22],[1398402000000,3.11],[1398661200000,2.94],[1398747600000,2.9],[1398834000000,2.92],[1398920400000,3.04],[1399006800000,3.07],[1399266000000,3.09],[1399352400000,3.07],[1399438800000,3],[1399525200000,2.95],[1399611600000,2.98],[1399870800000,3.1],[1399957200000,3.08],[1400043600000,3.04],[1400130000000,3.03],[1400216400000,3.03],[1400475600000,3.02],[1400562000000,2.99],[1400648400000,3.03],[1400734800000,3.06],[1400821200000,3.08],[1401166800000,3

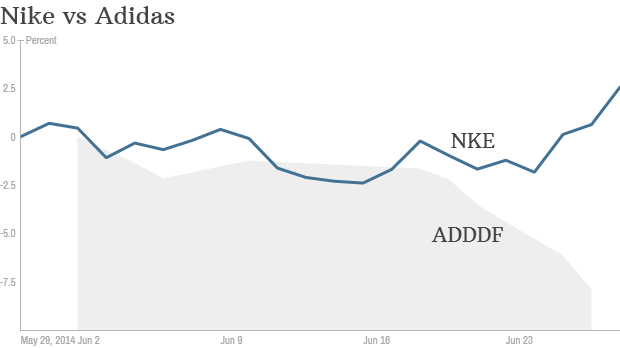

Nike 1, Adidas 0 NEW YORK (CNNMoney) The World Cup is not just a battle for soccer supremacy. It's also a showdown between two global brands: Nike and Adidas.

Nike 1, Adidas 0 NEW YORK (CNNMoney) The World Cup is not just a battle for soccer supremacy. It's also a showdown between two global brands: Nike and Adidas.  World Cup retail is Christmas in June

World Cup retail is Christmas in June

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  3.25 (1y: +84%) $(function(){var seriesOptions=[],yAxisOptions=[],name='DRYS',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372309200000,1.77],[1372395600000,1.87],[1372654800000,1.89],[1372741200000,1.78],[1372827600000,1.81],[1373000400000,1.8],[1373259600000,1.82],[1373346000000,1.84],[1373432400000,1.85],[1373518800000,1.84],[1373605200000,1.91],[1373864400000,1.93],[1373950800000,1.92],[1374037200000,1.93],[1374123600000,2.03],[1374210000000,1.995],[1374469200000,2.09],[1374555600000,2.09],[1374642000000,2.04],[1374728400000,2.08],[1374814800000,2.04],[1375074000000,1.965],[1375160400000,1.92],[1375246800000,1.92],[1375333200000,1.96],[1375419600000,2.03],[1375678800000,2.05],[1375765200000,1.94],[1375851600000,1.96],[1375938000000,2.02],[1376024400000,2.04],[1376283600000,2],[1376370000000,1.95],[1376456400000,2.09],[1376542800000,2.12],[1376629200000,2.04],[1376888400000,1.92],[1376974800000,2.01],[1377061200000,2.05],[1377147600000,2.17],[1377234000000,2.25],[1377493200000,2.41],[1377579600000,2.44],[1377666000000,2.45],[1377752400000,2.37],[1377838800000,2.33],[1378184400000,2.33],[1378270800000,2.49],[1378357200000,2.765],[1378443600000,2.88],[1378702800000,3.085],[1378789200000,2.965],[1378875600000,3.03],[1378962000000,2.91],[1379048400000,2.9],[1379307600000,2.97],[1379394000000,3.09],[1379480400000,3.29],[1379566800000,3.608],[1379653200000,3.495],[1379912400000,3.46],[1379998800000,3.6],[1380085200000,3.93],[1380171600000,3.86],[1380258000000,3.64],[1380517200000,3.54],[1380603600000,3.73],[1380690000000,3.74],[1380776400000,3.71],[1380862800000,3.78],[1381122000000,3.57],[1381208400000,3.395],[1381294800000,3.31],[1381381200000,3.49],[1381467600000,3.42],[1381726800000,3.39],[1381813200000,3.38],[1381899600000,3.461],[1381986000000,3.49],[1382072400000,3.425],[1382331600000,3.08],[1382418000000,3.09],[1382504400000,2.915],[1382590800000,2.84],[1382677200000,2.87],[1382936400000,2.719],[1383022800000,2.83],[1383109200000,2.72],[1383195600000,2.76],[1383282000000,3.07],[138354480000! 0,3.23],[1383631200000,3.18],[1383717600000,3.029],[1383804000000,2.87],[1383890400000,3.06],[1384149600000,3.16],[1384236000000,3.09],[1384322400000,3.19],[1384408800000,3.1],[1384495200000,3.13],[1384754400000,3.04],[1384840800000,2.94],[1384927200000,2.97],[1385013600000,3.1],[1385100000000,3.05],[1385359200000,3.06],[1385445600000,3.091],[1385532000000,3.29],[1385704800000,3.44],[1385964000000,3.33],[1386050400000,3.35],[1386136800000,3.4],[1386223200000,3.6],[1386309600000,3.5],[1386568800000,3.43],[1386655200000,3.42],[1386741600000,3.46],[1386828000000,3.49],[1386914400000,3.66],[1387173600000,3.6],[1387260000000,3.58],[1387346400000,3.59],[1387432800000,3.73],[1387519200000,3.69],[1387778400000,3.93],[1387864800000,4.17],[1388037600000,4.7],[1388124000000,4.68],[1388383200000,4.38],[1388469600000,4.7],[1388642400000,4.31],[1388728800000,4.27],[1388988000000,4.04],[1389074400000,4.105],[1389160800000,4.08],[1389247200000,3.92],[1389333600000,3.86],[1389592800000,3.62],[1389679200000,3.68],[1389765600000,4],[1389852000000,3.99],[1389938400000,3.82],[1390284000000,3.81],[1390370400000,3.81],[1390456800000,3.77],[1390543200000,3.38],[1390802400000,3.4],[1390888800000,3.47],[1390975200000,3.36],[1391061600000,3.37],[1391148000000,3.4],[1391407200000,3.251],[1391493600000,3.32],[1391580000000,3.23],[1391666400000,3.41],[1391752800000,3.64],[1392012000000,3.63],[1392098400000,3.8],[1392184800000,3.74],[1392271200000,3.73],[1392357600000,3.7],[1392703200000,3.71],[1392789600000,3.48],[1392876000000,3.53],[1392962400000,3.51],[1393221600000,3.6],[1393308000000,3.545],[1393394400000,3.51],[1393480800000,3.66],[1393567200000,3.68],[1393826400000,3.68],[1393912800000,3.88],[1393999200000,4.14],[1394085600000,4.02],[1394172000000,3.95],[1394427600000,3.78],[1394514000000,3.68],[1394600400000,3.57],[1394686800000,3.52],[1394773200000,3.4],[1395032400000,3.42],[1395118800000,3.59],[1395205200000,3.58],[1395291600000,3.495],[1395378000000,3.48],[1395637200000,3.31],[1395723600000,3.35],[1395810000000,3.22],[139! 589640000! 0,3.14],[1395982800000,3.25],[1396242000000,3.23],[1396328400000,3.28],[1396414800000,3.28],[1396501200000,3.21],[1396587600000,3.26],[1396846800000,3.19],[1396933200000,3.25],[1397019600000,3.34],[1397106000000,3.19],[1397192400000,3.1],[1397451600000,3.13],[1397538000000,3.1],[1397624400000,3.13],[1397710800000,3.16],[1398056400000,3.25],[1398142800000,3.32],[1398229200000,3.25],[1398315600000,3.22],[1398402000000,3.11],[1398661200000,2.94],[1398747600000,2.9],[1398834000000,2.92],[1398920400000,3.04],[1399006800000,3.07],[1399266000000,3.09],[1399352400000,3.07],[1399438800000,3],[1399525200000,2.95],[1399611600000,2.98],[1399870800000,3.1],[1399957200000,3.08],[1400043600000,3.04],[1400130000000,3.03],[1400216400000,3.03],[1400475600000,3.02],[1400562000000,2.99],[1400648400000,3.03],[1400734800000,3.06],[1400821200000,3.08],[1401166800000,3

3.25 (1y: +84%) $(function(){var seriesOptions=[],yAxisOptions=[],name='DRYS',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372309200000,1.77],[1372395600000,1.87],[1372654800000,1.89],[1372741200000,1.78],[1372827600000,1.81],[1373000400000,1.8],[1373259600000,1.82],[1373346000000,1.84],[1373432400000,1.85],[1373518800000,1.84],[1373605200000,1.91],[1373864400000,1.93],[1373950800000,1.92],[1374037200000,1.93],[1374123600000,2.03],[1374210000000,1.995],[1374469200000,2.09],[1374555600000,2.09],[1374642000000,2.04],[1374728400000,2.08],[1374814800000,2.04],[1375074000000,1.965],[1375160400000,1.92],[1375246800000,1.92],[1375333200000,1.96],[1375419600000,2.03],[1375678800000,2.05],[1375765200000,1.94],[1375851600000,1.96],[1375938000000,2.02],[1376024400000,2.04],[1376283600000,2],[1376370000000,1.95],[1376456400000,2.09],[1376542800000,2.12],[1376629200000,2.04],[1376888400000,1.92],[1376974800000,2.01],[1377061200000,2.05],[1377147600000,2.17],[1377234000000,2.25],[1377493200000,2.41],[1377579600000,2.44],[1377666000000,2.45],[1377752400000,2.37],[1377838800000,2.33],[1378184400000,2.33],[1378270800000,2.49],[1378357200000,2.765],[1378443600000,2.88],[1378702800000,3.085],[1378789200000,2.965],[1378875600000,3.03],[1378962000000,2.91],[1379048400000,2.9],[1379307600000,2.97],[1379394000000,3.09],[1379480400000,3.29],[1379566800000,3.608],[1379653200000,3.495],[1379912400000,3.46],[1379998800000,3.6],[1380085200000,3.93],[1380171600000,3.86],[1380258000000,3.64],[1380517200000,3.54],[1380603600000,3.73],[1380690000000,3.74],[1380776400000,3.71],[1380862800000,3.78],[1381122000000,3.57],[1381208400000,3.395],[1381294800000,3.31],[1381381200000,3.49],[1381467600000,3.42],[1381726800000,3.39],[1381813200000,3.38],[1381899600000,3.461],[1381986000000,3.49],[1382072400000,3.425],[1382331600000,3.08],[1382418000000,3.09],[1382504400000,2.915],[1382590800000,2.84],[1382677200000,2.87],[1382936400000,2.719],[1383022800000,2.83],[1383109200000,2.72],[1383195600000,2.76],[1383282000000,3.07],[138354480000! 0,3.23],[1383631200000,3.18],[1383717600000,3.029],[1383804000000,2.87],[1383890400000,3.06],[1384149600000,3.16],[1384236000000,3.09],[1384322400000,3.19],[1384408800000,3.1],[1384495200000,3.13],[1384754400000,3.04],[1384840800000,2.94],[1384927200000,2.97],[1385013600000,3.1],[1385100000000,3.05],[1385359200000,3.06],[1385445600000,3.091],[1385532000000,3.29],[1385704800000,3.44],[1385964000000,3.33],[1386050400000,3.35],[1386136800000,3.4],[1386223200000,3.6],[1386309600000,3.5],[1386568800000,3.43],[1386655200000,3.42],[1386741600000,3.46],[1386828000000,3.49],[1386914400000,3.66],[1387173600000,3.6],[1387260000000,3.58],[1387346400000,3.59],[1387432800000,3.73],[1387519200000,3.69],[1387778400000,3.93],[1387864800000,4.17],[1388037600000,4.7],[1388124000000,4.68],[1388383200000,4.38],[1388469600000,4.7],[1388642400000,4.31],[1388728800000,4.27],[1388988000000,4.04],[1389074400000,4.105],[1389160800000,4.08],[1389247200000,3.92],[1389333600000,3.86],[1389592800000,3.62],[1389679200000,3.68],[1389765600000,4],[1389852000000,3.99],[1389938400000,3.82],[1390284000000,3.81],[1390370400000,3.81],[1390456800000,3.77],[1390543200000,3.38],[1390802400000,3.4],[1390888800000,3.47],[1390975200000,3.36],[1391061600000,3.37],[1391148000000,3.4],[1391407200000,3.251],[1391493600000,3.32],[1391580000000,3.23],[1391666400000,3.41],[1391752800000,3.64],[1392012000000,3.63],[1392098400000,3.8],[1392184800000,3.74],[1392271200000,3.73],[1392357600000,3.7],[1392703200000,3.71],[1392789600000,3.48],[1392876000000,3.53],[1392962400000,3.51],[1393221600000,3.6],[1393308000000,3.545],[1393394400000,3.51],[1393480800000,3.66],[1393567200000,3.68],[1393826400000,3.68],[1393912800000,3.88],[1393999200000,4.14],[1394085600000,4.02],[1394172000000,3.95],[1394427600000,3.78],[1394514000000,3.68],[1394600400000,3.57],[1394686800000,3.52],[1394773200000,3.4],[1395032400000,3.42],[1395118800000,3.59],[1395205200000,3.58],[1395291600000,3.495],[1395378000000,3.48],[1395637200000,3.31],[1395723600000,3.35],[1395810000000,3.22],[139! 589640000! 0,3.14],[1395982800000,3.25],[1396242000000,3.23],[1396328400000,3.28],[1396414800000,3.28],[1396501200000,3.21],[1396587600000,3.26],[1396846800000,3.19],[1396933200000,3.25],[1397019600000,3.34],[1397106000000,3.19],[1397192400000,3.1],[1397451600000,3.13],[1397538000000,3.1],[1397624400000,3.13],[1397710800000,3.16],[1398056400000,3.25],[1398142800000,3.32],[1398229200000,3.25],[1398315600000,3.22],[1398402000000,3.11],[1398661200000,2.94],[1398747600000,2.9],[1398834000000,2.92],[1398920400000,3.04],[1399006800000,3.07],[1399266000000,3.09],[1399352400000,3.07],[1399438800000,3],[1399525200000,2.95],[1399611600000,2.98],[1399870800000,3.1],[1399957200000,3.08],[1400043600000,3.04],[1400130000000,3.03],[1400216400000,3.03],[1400475600000,3.02],[1400562000000,2.99],[1400648400000,3.03],[1400734800000,3.06],[1400821200000,3.08],[1401166800000,3

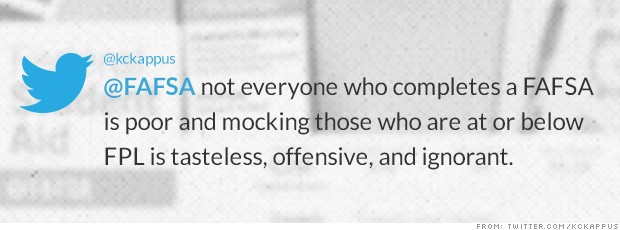

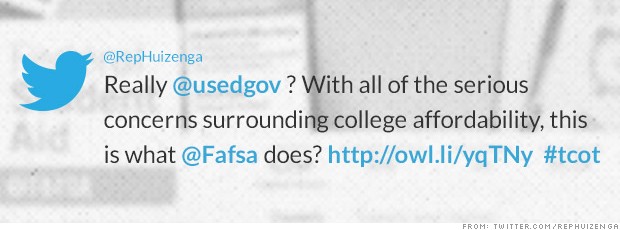

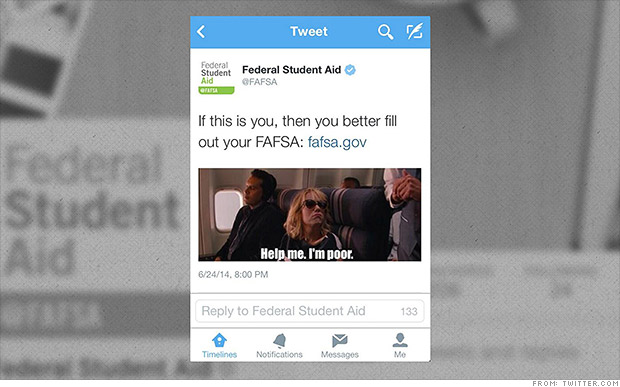

NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.

NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.