Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of The Advisory Board Company (NASDAQ: ABCO ) were up as much as 12% today, after the consulting firm beat top and bottom-line estimates in its quarterly report.

So what: The Advisory Board said revenue grew 19.1%, to $119.7 million, beating estimates of $117.9 million. Adjusted earnings per share, meanwhile, came in at $0.33, better than the analyst consensus at $0.29. In addition to the strong financial results above, CEO Robert Musselwhite noted a 10% increase in the company's membership base, and a 90% institutional renewal rate. The Advisory Board reaffirmed guidance for the 2013 calendar year, saying it expects revenue of $495-$505 million, and adjusted EPS of $1.18-$1.28.

Now what: The Advisory Board appears to be one of several hidden companies that are poised to benefit from Obamacare, as Musselwhite touted the launch of its ICD-10 Performance Program, "which will help our members navigate the upcoming transition in our nation's system for coding, reporting, and billing medical diagnoses and inpatient procedures." I'd normally say this stock is overpriced, but the health-care connection adds some intrigue. To see what happens to The Advisory Board, add the company to your Watchlist here. ��

Top 10 Electric Utility Stocks To Invest In Right Now: Reliance Industries Ltd (RELIANCE)

Reliance Industries Limited (RIL) is a conglomerate with business in the energy and materials value chain. The Company operates in three segments: petrochemicals, refining and oil & gas. The petrochemicals segment includes production and marketing operations of petrochemical products which include, polyethylene, polypropylene, polyvinyl chloride, poly butadiene rubber, polyester yarn, polyester fibre, purified terephthalic acid, paraxylene, ethylene glycol, olefins, aromatics, linear alkyl benzene, butadiene, acrylonitrile, caustic soda and polyethylene terephthalate. The refining segment includes production and marketing operations of the petroleum products. The oil and gas segment includes exploration, development and production of crude oil and natural gas. Its others segment includes textile, retail business, special economic zone (SEZ) development and telecom / broadband business.

Advisors' Opinion: Top 10 Electric Utility Stocks To Invest In Right Now: Amalgamated Gold and Silver Inc (BCHS)

Amalgamated Gold & Silver Inc., formerly Balmoral FX Systems Inc, incorporated on November 13, 1992, is a development-stage company. The Company is a holding Company researching various opportunities for investment in gold and silver mining operations.

The Company is focused on gold and silver mining interests in the United States and Mexico. The Company has conducted or has attempted to conduct operations in several other industries and is concentrating all operations on the development.

Advisors' Opinion: - [By Peter Graham]

Small cap mining stocks Discovery Minerals Ltd (OTCMKTS: DSCR), Zinco Do Brasil Inc (OTCMKTS: ZNBR) and Amalgamated Gold and Silver Inc (OTCMKTS: BCHS) have been getting some extra attention lately as one stock surged last Friday while the other two are or have been in the past, the subject of paid promotions. It goes without saying though that small cap mining stocks tend to be riskier than your average stock. But do these three small cap mining stocks have what it takes to produce a mother lode for investors? Here is a deeper dig into all three:

10 Best Stocks To Watch Right Now: Auxilio Inc (AUXO)

Auxilio, Inc. (Auxilio), incorporated on August 29, 1995, is engaged in the business of providing fully outsourced print management services to the healthcare industry. The Company is engaged in the business of providing fully-outsourced managed print services to the healthcare industry, working exclusively with hospitals throughout the United States. It provides solutions, a program and savings. It helps hospitals and health systems reduce expenses and create manageable, dependable document image management programs by managing their back-office processes. The process is initiated through a detailed assessment. The assessment is a strategic, operational and financial analysis that is performed at the customer�� premises using a combination of processes and technology for data collection and report generation. The Company�� customers include hospitals and integrated health delivery networks (IDN). Its subsidiaries include Auxilio Solutions, Inc. and e-Perception Technologies, Inc.

The Company helps hospitals and health systems to create image management programs by managing their back-office processes. The process is initiated through a detailed Image Management Assessment (IMA). The IMA is a strategic, operational and financial analysis that is performed at the customer�� premises using a combination of processes and Web-based technology for data collection and report generation. After the assessment and upon engagement, it charged the customer on a per print basis.

The Company competes with Xerox, Canon, Konica Minolta, Ricoh and Sharp.

Advisors' Opinion: - [By CRWE]

Today, AUXO surged (+3.26%) up +0.030 at $.950 with�200 shares in play thus far (ref. google finance Delayed: 9:30AM EDT August 23, 2013).

AUXILIO, Inc. previously reported financial results for its quarter ended June 30, 2013.

For the three months ended June 30, 2013, AUXILIO reported that recurring service revenues increased by $1.4 million from new contracts closed between May 2012 and April 2013; however revenues were $9.8 million, a decrease of 8% when compared to revenues of $10.7 million in the same period of 2012, due to a drop in equipment revenue. Equipment sales were $800,000 as compared to $3.1 million for the same period in 2012. Cost of revenues were $8.2 million for the three months ended June 30, 2013, as compared to $9.3 million for the same period in 2012. This drop was due to the drop in equipment sales offset by additional staffing and service costs from the higher recurring service revenue. Gross profit for the second quarter of 2013 was $1.6 million, or 17% of sales, compared to $1.4 million, or 13% of sales, for the same period of 2012. This improvement is a direct result of the large growth in new facilities that we added in 2012 coupled with the reduction in costs as AUXILIO�� program matures within these new accounts.

Top 10 Electric Utility Stocks To Invest In Right Now: ICG Group Inc (ICGE)

ICG Group, Inc. (ICG), formerly Internet Capital Group, Inc., acquires and builds Internet software and services companies. ICG operates in two business segments: the core reporting segment and the venture reporting segment. The Company�� core reporting segment includes those companies in which its management provides strategic direction and management assistance. Its venture reporting segment includes companies to which it generally devote less capital than it does to its core companies and, therefore, in which it holds relatively smaller ownership stakes than it does in the core companies. As of December 31, 2011, its equity core companies consisted of Channel Intelligence, Inc., Freeborders, Inc. and WhiteFence, Inc. As of December 31, 2011, its venture companies consisted of Acquirgy, Inc., GoIndustry-DoveBid plc and SeaPass Solutions Inc. In April 2012, it acquired MSDSonline Inc. In December 2012, the Company aquired 85% of interest in Procurian Inc. In February 2013, Google Inc acquired Channel Intelligence, Inc. one of the consolidated companies of ICG.

The Company is focused on the software and services markets, particularly on companies in the cloud-based software and services sector. Once the Company acquires an interest in a company, it works to assume an active role in the development and growth of the Company, providing both strategic guidance and operational support. The Company provides strategic guidance to its companies relating to, among other things, market positioning, business model and product development, strategic capital expenditures, mergers and acquisitions and exit opportunities. In addition, it provides operational support to help its companies manage day-to-day business and operational issues and implement the practices in the areas of finance, sales and marketing, business development, human resources and legal services.

GovDelivery Holdings, Inc.

GovDelivery Holdings, Inc. (GovDelivery) is a provider of government-to-citizen com! munication solutions. GovDelivery�� digital subscription management software-as-a-service (SaaS) platform enables government organizations to provide citizens with access to relevant information by delivering new information through e-mail, mobile text alerts, really simple syndication (RSS) and social media channels from United States and United Kingdom government entities at the national, state and local levels.

Investor Force Holdings, Inc.

Investor Force Holdings, Inc. (InvestorForce) is a financial software company specializing in the development of online applications for the financial services industry. InvestorForce provides pension consultants and other financial intermediaries with a Web-based enterprise platform that integrates data management with robust analytic and reporting capabilities in support of their institutional and other clients. InvestorForce�� applications provide investment consultants with the ability to conduct analysis and research into client, manager and market movement and to produce timely, automated client reports.

Procurian Inc.

Procurian Inc. (Procurian) is a specialist in procurement solutions, which partners with transformational business to drive sustainable changes to their cost structures on an accelerated basis. Procurian integrates superior market intelligence with its customers��businesses to optimize spending and deliver savings.

Channel Intelligence, Inc.

Channel Intelligence, Inc. (Channel Intelligence) is a technology and marketing services company that helps retailers, manufacturers and other advertisers make their products and services easier for consumers to find and buy online and in local retail stores. Through its technologies and product database, Channel Intelligence offers online marketing services, such as display advertising, manufacturer-based content and where-to-buy, paid search, shopping engine management, social marketing, Web storefronts, order manage! ment and ! robust performance analytics. With its range of services, Channel Intelligence helps its customers support their consumers through all phases of the sales funnel, from lead generation to consideration to purchase and delivery.

WhiteFence, Inc.

WhiteFence, Inc. (WhiteFence) is a Web services provider used by household consumers to compare and purchase essential home services, such as electricity, natural gas, telephone and cable/satellite television. WhiteFence reaches customers directly through company-owned Websites and through its network of exclusive channel partners that integrate the Web services applications into their own business processes and Websites.

Acquirgy, Inc.

Acquirgy, Inc. (Acquirgy) specializes in direct response marketing services and technology, which provides customers with a range of direct marketing products and services. Acquirgy helps market its products and services on the Internet and through other media channels, such as television, radio, and print advertising.

GoIndustry-DoveBid plc (GoIndustry)

GoIndustry-DoveBid plc (GoIndustry) is an in auction sales and valuations of used industrial machinery and equipment. GoIndustry combines traditional asset sales experience with e-commerce technology and advanced direct marketing to service the needs of multi-national corporations, insolvency practitioners, dealers and asset-based lenders worldwide.

SeaPass Solutions Inc.

SeaPass Solutions Inc. (SeaPass) develops and markets processing solutions that enables insurance carriers, agents and brokers to transmit and receive data in real time by leveraging existing systems to interact automatically. The Company�� technology allows information to be accessed in real time, which increases efficiency across all lines of the insurance business.

Advisors' Opinion: Top 10 Electric Utility Stocks To Invest In Right Now: Lumos Networks Corp (LMOS)

Lumos Networks Corp. is a fiber-based service provider in the Mid-Atlantic region. The Company provides data, broadband, voice and Internet protocol (IP) services over fiber optic network. The Company offers a range of data and voice products supported by approximately 5,800 fiber-route miles in Virginia, West Virginia, and portions of Pennsylvania, Maryland, Ohio and Kentucky. Its products and services include metro Ethernet, IP services, business advantage bundle, managed router service, broadband, voice services and Web hosting. On October 14, 2011, NTELOS Holdings Corp. announced a distribution date of October 31, 2011, for the spin-off of Lumos Networks Corp.

The Company�� broadband services include Business DSL, Dedicated Business Service, Managed Router Services, Business Broadband XL, Business PC Services and Web Hosting. Its IP services include Integrated Access, IP Trunking, IP Centrex and IP Phones. Its voice service include Business Voice, Business Advantage Bundle, nTouch, Intelligent Messaging, Simultaneous Ring, Conference Calling and Long Distance. Its data services include Metro Ethernet and Quality of Service. Lumos Networks Business DSL provides up to six megabits per second downstream and one megabit per second upstream. Its managed router support service equipment includes staging, installation, configuration, and maintenance while support provides around-the-clock monitoring, management and trouble resolution and direct access to networking experts. Its Business Broadband XL offers a selection of high download speeds. Lumos Networks' Integrated Access solution can integrate local voice, long distance, voicemail, and broadband Internet access. Lumos Networks nTouch brings voicemail linking IP Centrex and nTelos Wireless phone.

Advisors' Opinion: - [By Lee Jackson]

Lumos Networks Corp. (NASDAQ: LMOS) is a leading provider of fiber-based bandwidth infrastructure and IP services in key mid-Atlantic markets. It announced last month it had launched its cloud-based hosted call center solution, which provides best-in-class automated call distribution, integrated voice response and call reporting to help organizations manage call volumes more effectively and efficiently. The service operates over Lumos’s carrier-grade, premium optical network, which provides high-speed, resilient access to the call-center cloud service. The consensus price target for the stock is $20.50. Investors are paid a reasonable 2.7% dividend. Lumos closed Thursday at $20.77.

- [By Jake L'Ecuyer]

Top losers in the sector included NQ Mobile (NYSE: NQ), off 5.8 percent, and Lumos Networks (NASDAQ: LMOS), down 2.9 percent.

Top Headline

Citigroup (NYSE: C) reported better-than-expected first-quarter results. Citigroup's quarterly profit surged to $3.94 billion, versus a year-ago profit of $3.81 billion. On a per-share basis, it earned $1.23. Excluding one-time items, its earnings rose to $1.30 versus $1.29. Its revenue declined to $20.12 billion. However, analysts were projecting earnings of $1.14 per share on revenue of $19.37 billion.

- [By Jake L'Ecuyer]

Top losers in the sector included NQ Mobile (NYSE: NQ), off 5.8 percent, and Lumos Networks (NASDAQ: LMOS), down 2.9 percent.

Top Headline

Citigroup (NYSE: C) reported better-than-expected first-quarter results. Citigroup's quarterly profit surged to $3.94 billion, versus a year-ago profit of $3.81 billion. On a per-share basis, it earned $1.23. Excluding one-time items, its earnings rose to $1.30 versus $1.29. Its revenue declined to $20.12 billion. However, analysts were projecting earnings of $1.14 per share on revenue of $19.37 billion.

Top 10 Electric Utility Stocks To Invest In Right Now: Supertex Inc.(SUPX)

Supertex, Inc., together with its subsidiary, Supertex Limited, designs, develops, manufactures, and markets high voltage analog and mixed signal integrated circuits (IC) primarily in Asia, the United States, China, and Europe. The company offers high voltage analog multiplexer switches, pulsers, high-speed MOSFET drivers, and discrete high voltage MOSFETs and arrays for the medical electronics market. It also provides LED driver products, including linear regulators and switching regulators for general lighting in automotive, industrial, and consumer applications; and for backlighting in LCD TVs, monitors, and laptop screens. In addition, the company offers electroluminescent lamps for backlighting hand-held instruments, such as cell phone keypads, watches, monochrome flat screens, and MP3 players; and driver ICs for driving non-impact printers and plotters. Further, it provides high voltage amplifier ICs to drive optical micro-electro-mechanical systems (MEMS) for use in optical switching applications in the telecommunications market; high voltage electronic switch ICs for use in telephones; high voltage ICs for use as ring generators; and protection ICs for line cards. Additionally, the company offers ICs and DMOS devices primarily for various industrial applications. It markets and sells its products through direct sales personnel, independent sales representatives, and distributors primarily to original equipment manufacturers of electronic products. The company was founded in 1975 and is headquartered in Sunnyvale, California.

Advisors' Opinion: Top 10 Electric Utility Stocks To Invest In Right Now: AEterna Zentaris Inc.(AEZS)

Aeterna Zentaris Inc. operates as a late-stage drug development company specialized in oncology and endocrine therapy. Its lead oncology compounds include perifosine, a PI3K/Akt pathway inhibitor that is in Phase 3 registration trial for refractory advanced colorectal cancer and multiple myeloma; and AEZS-108, a doxorubicin-targeted conjugate in Phase II for the treatment of ovarian, endometrial, castration refractory prostate, and refractory bladder cancer. The company?s lead endocrinology compound, AEZS-130, is an oral ghrelin antagonist in Phase III trial as a diagnostic test for adult growth hormone deficiency. Its pipeline also includes earlier-stage compounds, such as AEZS-112 that is in a Phase I trial in advanced solid tumors and lymphoma, as well as AEZS-120, an anti-cancer vaccine in pre-clinical development. The company was founded in 1991 and is headquartered in Quebec City, Canada.

Advisors' Opinion: - [By Eric Volkman]

Aeterna Zentaris (NASDAQ: AEZS ) has made a significant change in its executive suite and boardroom. David Dodd is now the company's chief executive and a member of its board of directors. He succeeds Juergen Engel. The firm did not provide the reasons for the succession.

- [By Sean Williams]

What's coming down the pipeline

As we saw with the current treatment options, the endometrial cancer pipeline isn't filled with a lot of choices, but they are at least more encouraging than the standard care treatments we've seen over the past three decades.

Avastin: Surprise: It's Roche's (NASDAQOTH: RHHBY ) wonder drug yet again! Roche's Avastin is in the process of being tested as a treatment for recurrent endometrial cancer and demonstrated promising results in a mid-stage trial according to the Journal of Clinical Oncology. Avastin, which is an angiogenesis inhibitor (a fancy way of saying it inhibits blood vessel growth), was tested on 52 evaluable patients and delivered a progression-free survival of at least six months for 21 of them. Overall median PFS was 4.2 months, and median overall survival came in at 10.5 months. Don't be surprised if Roche decides to pursue further studies of Avastin in recurrent endometrial cancer with these results.� AEZS-108: Currently in late-stage development by Aeterna Zentaris (NASDAQ: AEZS ) , a holding in my own portfolio, AEZS-108 is an intravenous treatment composed of a synthetic peptide carrier and doxorubicin that targets Luteinizing Hormone Releasing Hormone-receptor expressing tumors. That series of scientific jargon simply means it targets cancer cells with minimal healthy cell death relative to the current standards of treatment. In mid-stage trials, AEZS-108 delivered an overall response rate of 30.8% and a clinical benefit rate of 74.4%. These figures were enough to get AEZS-108 a special protocol assessment (SPA), which should streamline its approval if these results stay consistent in late-stage studies. Your best investment

With very few investable options to choose from, since many of these treatments are off patent as they're decades old, I'm going to split my decision this week between Roche and Aeterna Zentaris for obvious reasons.

- [By Sean Williams]

High-risk, high-reward suggestions

There's an undeniably large dollar amount being pledged to cancer research, but, even if a drug gains approval, that's no guarantee that the biotech or pharmaceutical company behind that drug will be a success. Some of the biggest gains (and losses) come from taking a leap of faith based on clinical data, or the approval of one or two drugs or devices within a pipeline. After that, it's all up to the drug or devices' effectiveness, its pricing, and the success of the marketing teams promoting the drug or device. Here are a few high-risk, high-reward names you should be keeping your eye on.

Exelixis (NASDAQ: EXEL ) : In November Exelixis had its first drug, known as Cometriq, approved by the Food and Drug Administration to treat metastatic medullary thyroid cancer. Although the market for this disease is pretty small -- somewhere between 500 and 700 people in the U.S. -- the near-tripling in progression-free survival, or PFS, in trials would indicate to me a strong likelihood that it could translate to success in other cancer types. In mid-stage prostate cancer trials, for instance, Cometriq was found to be particularly effective in dealing with bone metastases as a second or third-line treatment. We won't get any additional data until next year on Cometriq, but positive data on the prostate cancer front could be enough to double its share price if the PFS, compared to the placebo, is notably strong. ImmunoGen (NASDAQ: IMGN ) : In February, Roche�and ImmunoGen received approval for Kadcyla as a secondary treatment for HER2-positive breast cancer. This is ImmunoGen's first drug approval, and it gives the company a chance to showcase what I feel is one of the future pathways of fighting cancer -- its targeted-antibody payload, or TAP, technology. ImmunoGen's TAP technology works by attaching a toxin -- in this case Roche's Herceptin -- to an antibody, and teaching that antibody to release the to

Top 10 Electric Utility Stocks To Invest In Right Now: Schlumberger N.V.(SLB)

Schlumberger Limited, together with its subsidiaries, supplies technology, integrated project management, and information solutions to the oil and gas exploration and production industries worldwide. The company?s Oilfield Services segment provides exploration and production services; wireline technology that offers open-hole and cased-hole services; supplies engineering support, directional-drilling, measurement-while-drilling, and logging-while-drilling services; and testing services. This segment also offers well services; supplies well completion services and equipment; artificial lift; data and consulting services; geo services; and information solutions, such as consulting, software, information management system, and IT infrastructure services that support oil and gas industry. Its WesternGeco segment provides reservoir imaging, monitoring, and development services; and operates data processing centers and multiclient seismic library. This segment also offers variou s services include 3D and time-lapse (4D) seismic surveys to multi-component surveys for delineating prospects and reservoir management. The company?s M-I SWACO segment supplies drilling fluid systems to improve drilling performance; fluid systems and specialty tools to optimize wellbore productivity; production technology solutions to maximize production rates; and environmental solutions that manages waste volumes generated in drilling and production operations. Its Smith Oilfield segment designs, manufactures, and markets drill bits and borehole enlargement tools; and supplies drilling tools and services, tubular, completion services, and other related downhole solutions. The company?s Distribution segment markets pipes, valves, and fittings, as well as mill, safety, and other maintenance products. This segment also provides warehouse management, vendor integration, and inventory management services. Schlumberger Limited was founded in 1927 and is based in Houston, Texas.

Advisors' Opinion: - [By Lee Jackson]

Schlumberger Ltd. (NYSE: SLB) is another mega cap oil field services stock to buy for 2014. Strong offshore drilling activity combined with a seasonal rebound in Western Canadian activity have driven Schlumberger’s recent growth. Going into 2014, Schlumberger sees five markets providing strong growth: Russia, Sub-Saharan Africa, the Middle East, China and Australia. Shareholders are paid a 1.4% dividend. The Deutsche Bank price target is $124, and the consensus is lower at $110. Schlumberger closed Monday at $89.17.

- [By David Smith]

As June came to an end, the company finalized a joint venture, OneSubsea, with Schlumberger (NYSE: SLB ) . The intriguing partnership -- in which Cameron has a 60% interest, with the remainder Schlumberger's -- will develop products, systems, and services for the subsea oil and gas market.

Top 10 Electric Utility Stocks To Invest In Right Now: Qatar Investment Fund PLC (QIF)

Qatar Investment Fund plc, formerly Epicure Qatar Equity Opportunities plc, is a closed-end investment company established to invest primarily in quoted equities of Qatar and other Gulf Co-operation Council (GCC) countries. Its investment objective is to capture, principally through the medium of the Qatar Exchange by investing in listed companies or companies to be listed. It also invests in listed companies, pre-initial public offer (IPO) companies, in other GCC countries. As of June 30, 2010, the Company had a portfolio of 22 investments in quoted companies in the Gulf, with 17 of them being in Qatar, four investments in United Arab Emirates and one in Kuwait. As at June 30, 2010, the top five holdings of the Company are Qatar National bank, Industries Qatar, Commercial Bank of Qatar, Qatar Islamic Bank and Rayan Bank. The Company�� wholly owned subsidiary is Epicure Qatar Opportunities Holdings Limited. The investment manager of the Company is Epicure Managers Qatar Limited.

Advisors' Opinion: Top 10 Electric Utility Stocks To Invest In Right Now: Fomento Economico Mexicano SAB de CV (FOMC)

Fomento Economico Mexicano SAB de CV (FEMSA) is a Mexico-based holding company engaged in the beverages industry. Through its subsidiary Coca-Cola FEMSA SAB de CV, the Company is active in the production and distribution of a variety of non-alcoholic beverages, bottled water and still beverages such brands as Coca-Cola, Fanta, Sprite, Powerade, Delaware Punch and other trademark beverages of The Coca-Cola Company in Mexico. Through FEMSA Comercio SA de CV, it operates the OXXO convenience-store chain in Latin America. The Company operates in a number of Latinamerican countries and in Philippines.

Advisors' Opinion: - [By CanadianValue]

Former Philadelphia Fed President Edward Boehne elegantly described the approach at a Federal Open Market Committee (FOMC) meeting in late 1989:

��ow, sooner or later, we will have a recession. I don�� think anybody around the table wants a recession or is seeking one, but sooner or later we will have one. If in that recession we took advantage of the anti-inflation (impetus) and we got inflation down from 4 1/2 percent to 3 percent, and then in the next expansion we were able to keep inflation from accelerating, sooner or later there will be another recession out there. And so, if we could bring inflation down from cycle to cycle just as we let it build up from cycle to cycle, that would be considerable progress over what we��e done in other periods in history.��/p>

- [By Canadian Value]

Also interesting is that the duration of rising rate environments is distinctly shorter after 1982. The average duration declines to 14 months from 40 months prior to 1982. A possible explanation could be changes in the monetary mechanism influencing interest rates. In 1982, the Federal Open Market Committee (FOMC) first referenced a targeted federal funds rate.7

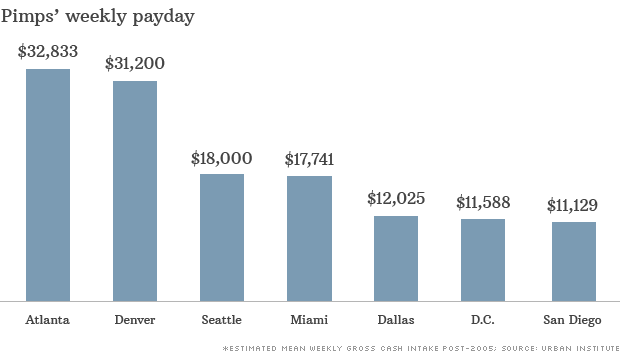

NEW YORK (CNNMoney) Until now, there hasn't been a lot of data to help law enforcement and policymakers better understand the economics of the illegal sex trade and trafficking.

NEW YORK (CNNMoney) Until now, there hasn't been a lot of data to help law enforcement and policymakers better understand the economics of the illegal sex trade and trafficking.  Pimps 'friend' victims on Facebook

Pimps 'friend' victims on Facebook  Getty Images Tax time can be stressful enough without worrying about whether your tax issues will spill over to your credit reports and affect your scores. The good news is that simply filing an extension or finding that you owe the IRS a chunk of money come tax time shouldn't affect your credit reports. It's only when you don't have the money to pay what you owe that it can affect your credit. Following are five ways that your yearly payment to Uncle Sam can affect your credit. Going Into Hock to Pay Taxes Many years ago, in my first year of self-employment, my accountant calculated my estimated taxes but forgot about the "self-employment tax" -- the portion of taxes that cover Medicare and Social Security. As a result, I learned on April 14 (!) that I owed a much bigger tax bill than I expected. At that time there was no option to pay by credit card, and I didn't want to drain my savings entirely to pay it. I ended up taking out a personal loan from my bank at a low interest rate and paid it off fairly quickly. It worked out OK. The loan, however, did appear on my credit reports. It didn't create any problems for me, but if you are going to borrow from another source such as credit cards or a personal loan to pay your taxes, keep in mind that debt can affect your credit scores. How much it will hurt (or help) your scores depends on everything else in your credit reports. Keep it in perspective, though. After all, you may find it's better to owe a credit card issuer than to owe the IRS. Another option is to enter into an installment agreement with the IRS where you pay them monthly until your balance is paid off. In most cases, these payment plans don't appear on your credit. However, if you owe a large amount, you could wind up with a Notice of Federal Tax Lien filed against you, and that will definitely affect your credit. (More on that later.) Quick Refund Woes If you need your refund fast, you may be tempted to take advantage of a "refund anticipation loan." Often marketed as "instant" or "rapid" refunds, these short-term loans basically advance you your refund, usually at a very high cost. Whether or not this will show up on your credit reports depends on the lender's policies. For example, H&R Block (HRB) currently offers a refund anticipation check, and its website says that this is a "bank deposit, not a loan." But it also offers a line of credit called Emerald Advance and that does impact the taxpayer's credit. Their website says, "If you apply and qualify for an Emerald Advance, H&R Block Bank may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your credit report." Also understand that if your refund takes longer than expected to arrive -- or doesn't come through at all -- you may wind up falling behind on this loan and that can end up on your credit reports. Don't think that won't happen to you. Tax-related identity theft is a large and growing problem I'll discuss in a moment. The New York Department of Consumer Affairs warns:

Getty Images Tax time can be stressful enough without worrying about whether your tax issues will spill over to your credit reports and affect your scores. The good news is that simply filing an extension or finding that you owe the IRS a chunk of money come tax time shouldn't affect your credit reports. It's only when you don't have the money to pay what you owe that it can affect your credit. Following are five ways that your yearly payment to Uncle Sam can affect your credit. Going Into Hock to Pay Taxes Many years ago, in my first year of self-employment, my accountant calculated my estimated taxes but forgot about the "self-employment tax" -- the portion of taxes that cover Medicare and Social Security. As a result, I learned on April 14 (!) that I owed a much bigger tax bill than I expected. At that time there was no option to pay by credit card, and I didn't want to drain my savings entirely to pay it. I ended up taking out a personal loan from my bank at a low interest rate and paid it off fairly quickly. It worked out OK. The loan, however, did appear on my credit reports. It didn't create any problems for me, but if you are going to borrow from another source such as credit cards or a personal loan to pay your taxes, keep in mind that debt can affect your credit scores. How much it will hurt (or help) your scores depends on everything else in your credit reports. Keep it in perspective, though. After all, you may find it's better to owe a credit card issuer than to owe the IRS. Another option is to enter into an installment agreement with the IRS where you pay them monthly until your balance is paid off. In most cases, these payment plans don't appear on your credit. However, if you owe a large amount, you could wind up with a Notice of Federal Tax Lien filed against you, and that will definitely affect your credit. (More on that later.) Quick Refund Woes If you need your refund fast, you may be tempted to take advantage of a "refund anticipation loan." Often marketed as "instant" or "rapid" refunds, these short-term loans basically advance you your refund, usually at a very high cost. Whether or not this will show up on your credit reports depends on the lender's policies. For example, H&R Block (HRB) currently offers a refund anticipation check, and its website says that this is a "bank deposit, not a loan." But it also offers a line of credit called Emerald Advance and that does impact the taxpayer's credit. Their website says, "If you apply and qualify for an Emerald Advance, H&R Block Bank may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your credit report." Also understand that if your refund takes longer than expected to arrive -- or doesn't come through at all -- you may wind up falling behind on this loan and that can end up on your credit reports. Don't think that won't happen to you. Tax-related identity theft is a large and growing problem I'll discuss in a moment. The New York Department of Consumer Affairs warns:

Popular Posts: 10 Best “Strong Buy” Stocks — GMK GAME DAL and moreBiggest Movers in Energy Stocks Now – CHK KOG CLD PXDHottest Technology Stocks Now – SYNA INFY GTAT GME Recent Posts: Hottest Financial Stocks Now – AGO SCHW HRG ISBC Hottest Healthcare Stocks Now – EW HZNP PBYI SLXP Hottest Technology Stocks Now – ATHN MDSO FDS SUNE View All Posts 5 Stocks With Poor Earnings Growth — BBRY TCI ZQK RBCN MGPI

Popular Posts: 10 Best “Strong Buy” Stocks — GMK GAME DAL and moreBiggest Movers in Energy Stocks Now – CHK KOG CLD PXDHottest Technology Stocks Now – SYNA INFY GTAT GME Recent Posts: Hottest Financial Stocks Now – AGO SCHW HRG ISBC Hottest Healthcare Stocks Now – EW HZNP PBYI SLXP Hottest Technology Stocks Now – ATHN MDSO FDS SUNE View All Posts 5 Stocks With Poor Earnings Growth — BBRY TCI ZQK RBCN MGPI  Alamy Green Mountain Coffee Roasters (GMCR) has brewed some big gains since announcing on Wednesday afternoon that Coca-Cola (KO) is investing $1.25 billion in the company behind the Keurig platform and striking a 10-year collaborative deal to get Coca-Cola's brands into the upcoming Keurig Cold maker of cold and carbonated beverages. That's going to be special -- and the market loved the news by sending Green Mountain's shares upward Thursday and Friday on the news -- but something even bigger may be brewing at Green Mountain in a few months. The leader in single-serve coffee is getting ready to roll out a new brewing machine in the fall. Keurig 2.0 has all of the functionality of the original platform that continues to lead the industry. Green Mountain announced on Wednesday that it sold a record 5.1 million brewers during the holiday quarter. Its original coffee maker is going strong, but the new system could be even better. Java 2.0 Green Mountain's original Keurig has a problem. The patents protecting the K-Cup portion packs that provide caffeinated blasts of coffee -- one cup at a time -- expired in late 2012. After years of scoring healthy margins on premium coffee refills, Green Mountain faces a future where anyone can put out K-Cups. It may have healthy working relationships with some of the biggest brands in the industry, but that could end at any time. The patent expirations led Green Mountain to introduce Keurig VUE, a new brewer with an entirely new refill system. It hasn't sold well. Since it can't accept the original K-Cup portion packs, it's limited in the variety of flavors and beverages that it can brew. Keurig 2.0 will solve that. It takes K-Cups. However, it will also be the first Keurig machine that also makes entire pots of coffee. Using new K-Carafe pods, the new brewers will be able to brew 28-ounce servings. More importantly for Green Mountain's bottom line, the new K-Carafe refills will be patent protected for a long time. No Ordinary Joe The media's buzzing about Keurig Cold and the possibilities for it now that Coca-Cola is on the bandwagon. The company that cornered the market for single-serve hot beverages will now be taking on SodaStream (SODA) in a battle for cold refreshments. However, this will be a new market for Green Mountain to break into, and as potent a partner as Coca-Cola will be, there will still be a learning curve. It won't be an overnight sensation the way that Keurig 2.0 is. After all, if Coca-Cola is the top dog in soft drinks, can't the same be said about Kuerig premium partner Starbucks (SBUX)? At the end of the day, Green Mountain is all about the coffee. Besides, isn't it odd that Coca-Cola decided to make a 10-figure investment in Green Mountain? It could've just struck a licensing deal to give Keurig Cold a brew. Taking a 10 percent stake in Green Mountain is an investment in the coffee brand. That actually makes more sense than Coca-Cola encouraging consumers to make their own soda at home. After all, Coca-Cola has spent heavily over the years to diversify away from its carbonated stronghold. It has acquired juice and water companies. It has expanded into energy and performance drinks. Coca-Cola is about all beverages, and evolution will eventually lead us to brewed beans. Don't fall for the Keurig Cold hype. The machine to watch this year is Keurig 2.0.

Alamy Green Mountain Coffee Roasters (GMCR) has brewed some big gains since announcing on Wednesday afternoon that Coca-Cola (KO) is investing $1.25 billion in the company behind the Keurig platform and striking a 10-year collaborative deal to get Coca-Cola's brands into the upcoming Keurig Cold maker of cold and carbonated beverages. That's going to be special -- and the market loved the news by sending Green Mountain's shares upward Thursday and Friday on the news -- but something even bigger may be brewing at Green Mountain in a few months. The leader in single-serve coffee is getting ready to roll out a new brewing machine in the fall. Keurig 2.0 has all of the functionality of the original platform that continues to lead the industry. Green Mountain announced on Wednesday that it sold a record 5.1 million brewers during the holiday quarter. Its original coffee maker is going strong, but the new system could be even better. Java 2.0 Green Mountain's original Keurig has a problem. The patents protecting the K-Cup portion packs that provide caffeinated blasts of coffee -- one cup at a time -- expired in late 2012. After years of scoring healthy margins on premium coffee refills, Green Mountain faces a future where anyone can put out K-Cups. It may have healthy working relationships with some of the biggest brands in the industry, but that could end at any time. The patent expirations led Green Mountain to introduce Keurig VUE, a new brewer with an entirely new refill system. It hasn't sold well. Since it can't accept the original K-Cup portion packs, it's limited in the variety of flavors and beverages that it can brew. Keurig 2.0 will solve that. It takes K-Cups. However, it will also be the first Keurig machine that also makes entire pots of coffee. Using new K-Carafe pods, the new brewers will be able to brew 28-ounce servings. More importantly for Green Mountain's bottom line, the new K-Carafe refills will be patent protected for a long time. No Ordinary Joe The media's buzzing about Keurig Cold and the possibilities for it now that Coca-Cola is on the bandwagon. The company that cornered the market for single-serve hot beverages will now be taking on SodaStream (SODA) in a battle for cold refreshments. However, this will be a new market for Green Mountain to break into, and as potent a partner as Coca-Cola will be, there will still be a learning curve. It won't be an overnight sensation the way that Keurig 2.0 is. After all, if Coca-Cola is the top dog in soft drinks, can't the same be said about Kuerig premium partner Starbucks (SBUX)? At the end of the day, Green Mountain is all about the coffee. Besides, isn't it odd that Coca-Cola decided to make a 10-figure investment in Green Mountain? It could've just struck a licensing deal to give Keurig Cold a brew. Taking a 10 percent stake in Green Mountain is an investment in the coffee brand. That actually makes more sense than Coca-Cola encouraging consumers to make their own soda at home. After all, Coca-Cola has spent heavily over the years to diversify away from its carbonated stronghold. It has acquired juice and water companies. It has expanded into energy and performance drinks. Coca-Cola is about all beverages, and evolution will eventually lead us to brewed beans. Don't fall for the Keurig Cold hype. The machine to watch this year is Keurig 2.0.

Tiny cars flunk crash test

Tiny cars flunk crash test

38.15 (1y: -23%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SODA', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1358834400000,49.75],[1358920800000,50.41],[1359007200000,51.75],[1359093600000,53.23],[1359352800000,50.96],[1359439200000,50.67],[1359525600000,50.53],[1359612000000,48.09],[1359698400000,49.65],[1359957600000,48.21],[1360044000000,48.34],[1360130400000,50.98],[1360216800000,50.14],[1360303200000,50.69],[1360562400000,49.95],[1360648800000,49.52],[1360735200000,49.85],[1360821600000,51.49],[1360908000000,51.1],[1361253600000,52.44],[1361340000000,49.1],[1361426400000,47.6],[1361512800000,47.34],[1361772000000,45.9],[1361858400000,46.37],[1361944800000,48.5],[1362031200000,47.59],[1362117600000,48.69],[1362376800000,48.03],[1362463200000,49.13],[1362549600000,48.87],[1362636000000,49.25],[1362722400000,49.73],[1362978000000,49.83],[1363064400000,50.08],[1363150800000,49.76],[1363237200000,49.38],[1363323600000,48.16],[1363582800000,47.8],[1363669200000,47.69],[1363755600000,48.16],[1363842000000,49.01],[1363928400000,49.51],[1364187600000,49.13],[1364274000000,49.182],[1364360400000,49.45],[1364446800000,49.64],[1364792400000,50.86],[1364878800000,50.6],[1364965200000,48.51],[1365051600000,48.38],[1365138000000,48.96],[1365397200000,49.56],[1365483600000,50.38],[1365570000000,52.41],[1365656400000,54.06],[1365742800000,53.03],[1366002000000,50.95],[1366088400000,52.7],[1366174800000,52.062],[1366261200000,50.43],[1366347600000,50.72],[1366606800000,50.18],[1366693200000,51.59],[1366779600000,52.55],[1366866000000,53.75],[1366952400000,53.4],[1367211600000,53.59],[1367298000000,53.84],[1367384400000,52.48],[1367470800000,52.82],[1367557200000,54],[1367816400000,54.98],[1367902800000,53.11],[1367989200000,51.96],[1368075600000,55.49],[1368162000000,58.79],[1368421200000,57.29],[1368507600000,64.08],[1368594000000,63.05],[1368680400000,63.46],[1368766800000,64.63],[1369026000000,65.01],[1369112400000,64.83],[1369198800000,62.36],[1369285200000,61.8],[1369371600000,61.97],[1369717200000,63.05],[1369803600000,63.74],[1369890000000,63.6],[1369976400000,63.8],[1370235600000,69.06],[1370322000000,70.35],[! 1370408400000,69.35],[1370494800000,71.24],[1370581200000,72.52],[1370840400000,76.11],[1370926800000,73.78],[1371013200000,70.64],[1371099600000,71.98],[1371186000000,72.82],[1371445200000,71.02],[1371531600000,70.55],[1371618000000,68.57],[1371704400000,70.28],[1371790800000,71.01],[1372050000000,67.17],[1372136400000,69.31],[1372222800000,71.3],[1372309200000,72.35],[1372395600000,72.65],[1372654800000,70.38],[1372741200000,67.41],[1372827600000,67.18],[1373000400000,67.63],[1373259600000,65.36],[1373346000000,61.95],[1373432400000,62.79],[1373518800000,62.52],[1373605200000,59.51],[1373864400000,60.39],[1373950800000,57.68],[1374037200000,58.69],[1374123600000,58.22],[1374210000000,58.27],[1374469200000,60.04],[1374555600000,59.3],[1374642000000,58.94],[1374728400000,57.42],[1374814800000,57.45],[1375074000000,58.4],[1375160400000,58.32],[1375246800000,65.08],[1375333200000,65.55],[1375419600000,65.63],[1375678800000,65.19],[1375765200000,65.09],[1375851600000,62.65],[1375938000000,62.47],[1376024400000,64.44],[1376283600000,65.42],[1376370000000,64.73],[1376456400000,64.12],[1376542800000,63.55],[1376629200000,62.4],[1376888400000,61.66],[1376974800000,63.96],[1377061200000,63.61],[1377147600000,63.88],[1377234000000,65.06],[1377493200000,67.39],[1377579600000,63.34],[1377666000000,63.54],[1377752400000,63.59],[1377838800000,62.49],[1378184400000,63.55],[1378270800000,62.27],[1378357200000,62.49],[1378443600000,61.

38.15 (1y: -23%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SODA', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1358834400000,49.75],[1358920800000,50.41],[1359007200000,51.75],[1359093600000,53.23],[1359352800000,50.96],[1359439200000,50.67],[1359525600000,50.53],[1359612000000,48.09],[1359698400000,49.65],[1359957600000,48.21],[1360044000000,48.34],[1360130400000,50.98],[1360216800000,50.14],[1360303200000,50.69],[1360562400000,49.95],[1360648800000,49.52],[1360735200000,49.85],[1360821600000,51.49],[1360908000000,51.1],[1361253600000,52.44],[1361340000000,49.1],[1361426400000,47.6],[1361512800000,47.34],[1361772000000,45.9],[1361858400000,46.37],[1361944800000,48.5],[1362031200000,47.59],[1362117600000,48.69],[1362376800000,48.03],[1362463200000,49.13],[1362549600000,48.87],[1362636000000,49.25],[1362722400000,49.73],[1362978000000,49.83],[1363064400000,50.08],[1363150800000,49.76],[1363237200000,49.38],[1363323600000,48.16],[1363582800000,47.8],[1363669200000,47.69],[1363755600000,48.16],[1363842000000,49.01],[1363928400000,49.51],[1364187600000,49.13],[1364274000000,49.182],[1364360400000,49.45],[1364446800000,49.64],[1364792400000,50.86],[1364878800000,50.6],[1364965200000,48.51],[1365051600000,48.38],[1365138000000,48.96],[1365397200000,49.56],[1365483600000,50.38],[1365570000000,52.41],[1365656400000,54.06],[1365742800000,53.03],[1366002000000,50.95],[1366088400000,52.7],[1366174800000,52.062],[1366261200000,50.43],[1366347600000,50.72],[1366606800000,50.18],[1366693200000,51.59],[1366779600000,52.55],[1366866000000,53.75],[1366952400000,53.4],[1367211600000,53.59],[1367298000000,53.84],[1367384400000,52.48],[1367470800000,52.82],[1367557200000,54],[1367816400000,54.98],[1367902800000,53.11],[1367989200000,51.96],[1368075600000,55.49],[1368162000000,58.79],[1368421200000,57.29],[1368507600000,64.08],[1368594000000,63.05],[1368680400000,63.46],[1368766800000,64.63],[1369026000000,65.01],[1369112400000,64.83],[1369198800000,62.36],[1369285200000,61.8],[1369371600000,61.97],[1369717200000,63.05],[1369803600000,63.74],[1369890000000,63.6],[1369976400000,63.8],[1370235600000,69.06],[1370322000000,70.35],[! 1370408400000,69.35],[1370494800000,71.24],[1370581200000,72.52],[1370840400000,76.11],[1370926800000,73.78],[1371013200000,70.64],[1371099600000,71.98],[1371186000000,72.82],[1371445200000,71.02],[1371531600000,70.55],[1371618000000,68.57],[1371704400000,70.28],[1371790800000,71.01],[1372050000000,67.17],[1372136400000,69.31],[1372222800000,71.3],[1372309200000,72.35],[1372395600000,72.65],[1372654800000,70.38],[1372741200000,67.41],[1372827600000,67.18],[1373000400000,67.63],[1373259600000,65.36],[1373346000000,61.95],[1373432400000,62.79],[1373518800000,62.52],[1373605200000,59.51],[1373864400000,60.39],[1373950800000,57.68],[1374037200000,58.69],[1374123600000,58.22],[1374210000000,58.27],[1374469200000,60.04],[1374555600000,59.3],[1374642000000,58.94],[1374728400000,57.42],[1374814800000,57.45],[1375074000000,58.4],[1375160400000,58.32],[1375246800000,65.08],[1375333200000,65.55],[1375419600000,65.63],[1375678800000,65.19],[1375765200000,65.09],[1375851600000,62.65],[1375938000000,62.47],[1376024400000,64.44],[1376283600000,65.42],[1376370000000,64.73],[1376456400000,64.12],[1376542800000,63.55],[1376629200000,62.4],[1376888400000,61.66],[1376974800000,63.96],[1377061200000,63.61],[1377147600000,63.88],[1377234000000,65.06],[1377493200000,67.39],[1377579600000,63.34],[1377666000000,63.54],[1377752400000,63.59],[1377838800000,62.49],[1378184400000,63.55],[1378270800000,62.27],[1378357200000,62.49],[1378443600000,61.