DELAFIELD, Wis. (Stockpickr) -- Trading stocks that trigger major breakouts can lead to massive profits. Once a stock trends to a new high or takes out a prior overhead resistance point, then it's free to find new buyers and momentum players who can ultimately push the stock significantly higher.

One example of a successful breakout trade I flagged recently was banking player Doral Financial (DRL), which I featured in July 18's "5 Stocks Ready for Breakouts" at around $5.21 per share. I mentioned in that piece that shares of Doral Financial recently pulled back sharply from its high of $9.93 to its intraday low of $5.04 a share. Shares of DRL were just starting to find some buying interest around $5 a share, and that action was setting up DRL for a possible breakout if the stock could manage to take out some key near-term overhead resistance levels at $5.52 to $6.16 a share.

Guess what happened? Shares Doral Financial dipped lower again on July 22 to $4.61 a share, but then on July 23 this stock skyrocketed higher with heavy upside volume flows and triggered that breakout. Volume on that day registered 7.14 million shares, which is well above its three-month average action of 1.51 million shares. Shares of DRL tagged an intraday high on July 23 of $7.10 a share, which represents a monster gain of close to 40% from the price DRL was trading at the day I flagged it. As you can see, when breakouts trigger with high-volume stocks can make very explosive moves in short time frames.

Read More:5 Toxic Stocks You Should Sell This Summer

Breakout candidates are something that I tweet about on a daily basis. I frequently tweet out high-probability setups, breakout plays and stocks that are acting technically bullish. These are the stocks that often go on to make monster moves to the upside. What's great about breakout trading is that you focus on trend, price and volume. You don't have to concern yourself with anything else. The charts do all the talking.

Trading breakouts is not a new game on Wall Street. This strategy has been mastered by legendary traders such as William O'Neal, Stan Weinstein and Nicolas Darvas. These pros know that once a stock starts to break out above past resistance levels and hold above those breakout prices, then it can easily trend significantly higher.

With that in mind, here's a look at five stocks that are setting up to break out and trade higher from current levels.

Read More: Read More: 5 Stocks Under $10 Set to Soar

2U

One application software player that's starting to trend within range of triggering a near-term breakout trade is 2U (TWOU), which provides cloud-based software-as-a-service (SaaS) solutions for nonprofit colleges and universities to deliver education to qualified students. This stock hasn't done much so far in 2014, with shares up modestly by 2.7%.

If you take a look at the chart for 2U, you'll notice that this stock recently formed a major bottoming chart pattern over the last two months, since each time it pulled back to around $13 a share it found buying interest and support. Shares of TWOU have now started to spike sharply higher here right above those support levels and it's now quickly moving within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in TWOU if it manages to break out above some near-term overhead resistance levels at Friday's intraday high of $14.43 to $14.78 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 193,944 shares. If that breakout gets underway soon, then TWOU will set up to re-test or possibly take out its next major overhead resistance levels at $16 to $17.33 a share, or even its all-time high of $17.58 a share. Any high-volume move above $17.58 will then give TWOU a chance to make a run at $20 a share.

Traders can look to buy TWOU off weakness to anticipate that breakout and simply use a stop that sits right below near-term support at $13.50 a share or near major support at around $13 a share. One can also buy TWOU off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Read More: 3 Huge Stocks on Traders' Radars

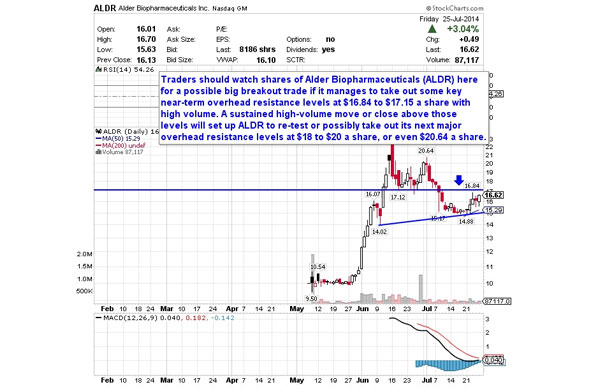

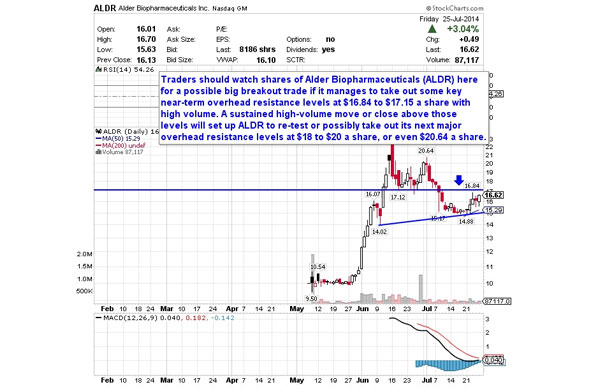

Alder Biopharmaceuticals

A health care player that's quickly moving within range of triggering a near-term breakout trade is Alder Biopharmaceuticals (ALDR), which a clinical-stage biopharmaceutical company, discovers, develops, and commercializes various therapeutic antibodies in the U.S. and Australia. This stock is off to a monster start so far in 2014, with shares up sharply by 65%.

If you take a look at the chart for Alder Biopharmaceuticals, you'll notice that this stock spiked higher on Friday right above its 50-day moving average of $15.29 a share. That spike is occurring right above its 50-day and right above some more key near-term support at around $15 a share. Shares of ALDR are now starting to trend within range of triggering a near-term breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in ALDR if it manages to break out above some key near-term overhead resistance levels at $16.84 to $17.15 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 189,895 shares. If that breakout triggers soon, then ALDR will set up to re-test or possibly take out its next major overhead resistance levels at $18 to $20 a share, or even $20.64 a share. Any high-volume move above $20.64 will then give ALDR a chance to re-test or possibly take out its all-time high of $22.94 a share.

Traders can look to buy ALDR off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $15.29 a share or below more key near-term support at $14.88 a share. One could also buy ALDR off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Read More: 3 Biotech Stocks Under $10 to Trade for Breakouts

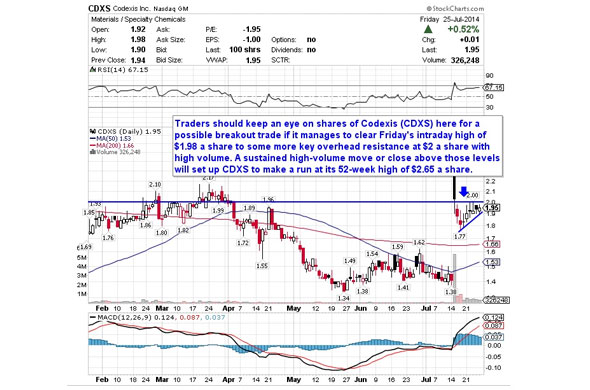

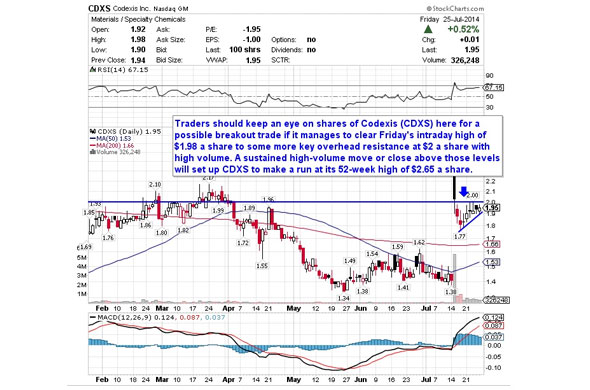

Codexis

Another biotechnology player that's starting to move within range of triggering a big breakout trade is Codexis (CDXS), which develops biocatalysts for the pharmaceutical and fine chemicals markets in the U.S., Europe and Asia. This stock is off to a strong start in 2014, with shares up sharply by 39%.

If you take a glance at the chart for Codexis, you'll notice that this stock recently gapped sharply higher from around $1.38 to $2.65 a share with monster upside volume. Following that move, shares of CDXS sold off to $1.77 a share and filed a good portion of that previous gap. Shares of CDXS are now starting to uptrend again off that $1.77 low and it's quickly moving within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in CDXS if it manages to break out above Friday's intraday high of $1.98 a share to some more key overhead resistance at $2 a share with high volume. Watch for a sustained move or close above those levels with volume that hits near or above its three-month average action 175,248 shares. If that breakout materializes soon, then CDXS will set up to make a run at its 52-week high of $2.65 a share.

Traders can look to buy CDXS off weakness to anticipate that breakout and simply use a stop that sits just below its recent low of $1.77 a share. One can also buy CDXS off strength once it starts to take out those breakout levels share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Read More: 5 Toxic Stocks to Sell This Summer

Receptos

Another clinical-stage biopharmaceutical player that's starting to trend within range of triggering a big breakout trade is Receptos (RCPT), which focuses on the discovery, development and commercialization of various therapeutics for immune disorders. This stock is off to a strong start in 2014, with shares up sharply by 34%.

If you take a glance at the chart for Receptos, you'll notice that this stock recently started to bounce higher right off both its 50-day and 200-day moving averages. That bounce is starting to push shares of RCPT within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in RCPT if it manages to break out above some near-term overhead resistance levels at $39.77 to $40.81 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average volume of 442,795 shares. If that breakout begins soon, then RCPT will set up to re-test or possibly take out its next major overhead resistance level at $45.29 a share. Any high-volume move above $45.29 will then give RCPT a chance to make a run at $50 a share.

Traders can look to buy RCPT off weakness to anticipate that breakout and simply use a stop that sits right around its 200-day moving average of $35.13 a share. One can also buy RCPT off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Read More: 5 Large-Cap Stocks to Trade for Earnings Season Gains

IntelliPharmaCeutics International

My final breakout trading prospect is pharmaceutical player IntelliPharmaCeutics (IPCI), which researches, develops, and manufactures novel and generic controlled and targeted release oral solid dosage drugs in Canada. This stock has been hit by the bears so far in 2014, with shares down sharply by 23%.

If you look at the chart for IntelliPharmaCeutics, you'll see that this stock recently plunged sharply lower from its high of $4.19 to its recent low of $2.55 a share with heavy downside volume flows. During that move, shares of IPCI were consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of IPCI have now started to bounce off that $2.55 low and it's quickly moving within range of triggering a major breakout trade.

Traders should now look for long-biased trades in IPCI if it manages to break out above some near-term overhead resistance levels at $2.86 to $3 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 169,524 shares. If that breakout gets underway soon, then IPCI will set up to re-test or possibly take out its next major overhead resistance levels at $3.40 to its 50-day moving average of $3.50 a share.

Traders can look to buy IPCI off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $2.65 to $2.55 a share. One can also buy IPCI off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a conformable percentage from your entry point.

To see more breakout candidates, check out the Breakout Stocks of the Week portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Stocks Insiders Love Right Now

>>Hedge Funds Hate These 5 Stocks -- Should You?

>>4 Big Stocks Getting Big Attention

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

FCC chairman Tom Wheeler's got some harsh words for Verizon. NEW YORK (CNNMoney) Verizon's biggest users may soon find that their data plans aren't so "unlimited" after all. And federal regulators aren't happy about it.

FCC chairman Tom Wheeler's got some harsh words for Verizon. NEW YORK (CNNMoney) Verizon's biggest users may soon find that their data plans aren't so "unlimited" after all. And federal regulators aren't happy about it.

WEST BRIDGEWATER, Mass. -- It's been called a David vs. Goliath story, a "Tale of Two Arthurs" and even the "ultimate Greek tragedy," but the characters in this drama aren't Biblical or literary figures. They're grocery store owners. A workers' revolt at the Market Basket supermarket chain has led to empty store shelves, angry customers and support for a boycott from more than 100 state legislators and mayors. Industry analysts say worker revolts at non-union companies are rare, but what's happening at Market Basket is particularly unusual because the workers aren't asking for higher pay or better benefits. They are demanding the reinstatement of beloved former CEO Arthur T. Demoulas, who workers credit with keeping prices low, treating employees well and guiding the company's success. The New England grocery store chain is embroiled in a family feud featuring two cousins who have been at odds for decades. While earlier squabbles between Arthur T. Demoulas and Arthur S. Demoulas were fought in courtrooms, this dispute has spilled into Market Basket stores. For the past week, warehouse workers have refused to make deliveries to Market Basket's stores, leaving fruit, vegetable, seafood and meat shelves empty. Workers have held huge protest rallies and organized boycott petitions through social media, attracting thousands of supporters. Customers are defecting to other grocery stores. In some cases, customers have taped receipts from competitors to Market Basket windows. "We are going to go somewhere else from now on," said Soraya DeBarros, as she walked through a depleted produce department at the Market Basket in West Bridgewater this week. "I'm sad about it because of course I want to keep the low prices, but I want to support the workers." Despite threats by new management to fire any workers who fail to perform their duties, some 300 warehouse workers and 68 drivers have refused to make deliveries. So far, eight supervisors have been fired. Massachusetts Attorney General Martha Coakley, who is running for governor, and New Hampshire Gov. Maggie Hassan have publicly supported the employees. "If you had told me that workers at a grocery store would walk out to save the job of a CEO, I would say that's incredible. There is usually such a gulf between the worker and the CEO," said Gary Chaison, a professor of industrial relations at Clark University in Worcester. Long-Running Feud Market Basket stores have long been a fixture in Massachusetts. The late Arthur Demoulas -- grandfather of Arthur S. and Arthur T. and a Greek immigrant -- opened the first store in Lowell nearly a century ago. Gradually, Market Basket became a regional powerhouse, with 25,000 employees and 71 stores in Massachusetts, New Hampshire and Maine. The feud dates back to the 1970s, but the most recent round of infighting began last year when Arthur S. Demoulas gained control of the board of directors. Last month, the board fired Arthur T., sparking the current uprising. Workers are fiercely loyal to Arthur T. "You know the movie, 'It's a Wonderful Life.' He's George Bailey," said Tom Trainor, a district supervisor who worked for the company for 41 years before being fired last weekend over the protests. "He's just a tremendous human being that puts people above profits. He can walk through a store, and if he's met you once, he knows our name, he knows your wife, your husband, your kids, where they are going to school." Employees said they believe the fight between the family members loyal to Arthur T. and Arthur S. is largely over money and the direction of the company. They say Arthur S. and his supporters have pressed for a greater return to shareholders. Arthur T. and his supporters have focused on keeping prices low. Outsiders Brought In Many employees are distrustful of Arthur S. and two co-chief executives who were brought in from outside the company: Felicia Thornton, a former executive of the grocery chain Albertsons, and Jim Gooch, former president and chief executive at RadioShack (RSH). "I'm worried about my job," said Valerie Burke, a worker in the West Bridgewater store. "It's a great company to work for now, but we are worried it won't stay that way," she said as she picketed outside the store Tuesday. Arthur S. hasn't spoken publicly, while Gooch and Thornton have communicated only through prepared statements. They assured workers in a statement that they aren't planning drastic changes in the way the company is operated, and urged employees to return to work. Arthur T. on Wednesday offered to buy the company for an undisclosed amount. Gooch and Thornton declined to comment. Workers have planned another rally Friday in Tewksbury, while the company's board of directors is scheduled to hold a meeting the same day in Boston. Steve Paulenka, who started in 1974 as a bag boy and rose to facilities and operations manager before being fired last weekend, said he sees no end to protests unless Arthur T. is reinstated. "A big part of me doesn't like what's going on -- it's like breaking your favorite toy on purpose," he said. "But we'll get through this."

WEST BRIDGEWATER, Mass. -- It's been called a David vs. Goliath story, a "Tale of Two Arthurs" and even the "ultimate Greek tragedy," but the characters in this drama aren't Biblical or literary figures. They're grocery store owners. A workers' revolt at the Market Basket supermarket chain has led to empty store shelves, angry customers and support for a boycott from more than 100 state legislators and mayors. Industry analysts say worker revolts at non-union companies are rare, but what's happening at Market Basket is particularly unusual because the workers aren't asking for higher pay or better benefits. They are demanding the reinstatement of beloved former CEO Arthur T. Demoulas, who workers credit with keeping prices low, treating employees well and guiding the company's success. The New England grocery store chain is embroiled in a family feud featuring two cousins who have been at odds for decades. While earlier squabbles between Arthur T. Demoulas and Arthur S. Demoulas were fought in courtrooms, this dispute has spilled into Market Basket stores. For the past week, warehouse workers have refused to make deliveries to Market Basket's stores, leaving fruit, vegetable, seafood and meat shelves empty. Workers have held huge protest rallies and organized boycott petitions through social media, attracting thousands of supporters. Customers are defecting to other grocery stores. In some cases, customers have taped receipts from competitors to Market Basket windows. "We are going to go somewhere else from now on," said Soraya DeBarros, as she walked through a depleted produce department at the Market Basket in West Bridgewater this week. "I'm sad about it because of course I want to keep the low prices, but I want to support the workers." Despite threats by new management to fire any workers who fail to perform their duties, some 300 warehouse workers and 68 drivers have refused to make deliveries. So far, eight supervisors have been fired. Massachusetts Attorney General Martha Coakley, who is running for governor, and New Hampshire Gov. Maggie Hassan have publicly supported the employees. "If you had told me that workers at a grocery store would walk out to save the job of a CEO, I would say that's incredible. There is usually such a gulf between the worker and the CEO," said Gary Chaison, a professor of industrial relations at Clark University in Worcester. Long-Running Feud Market Basket stores have long been a fixture in Massachusetts. The late Arthur Demoulas -- grandfather of Arthur S. and Arthur T. and a Greek immigrant -- opened the first store in Lowell nearly a century ago. Gradually, Market Basket became a regional powerhouse, with 25,000 employees and 71 stores in Massachusetts, New Hampshire and Maine. The feud dates back to the 1970s, but the most recent round of infighting began last year when Arthur S. Demoulas gained control of the board of directors. Last month, the board fired Arthur T., sparking the current uprising. Workers are fiercely loyal to Arthur T. "You know the movie, 'It's a Wonderful Life.' He's George Bailey," said Tom Trainor, a district supervisor who worked for the company for 41 years before being fired last weekend over the protests. "He's just a tremendous human being that puts people above profits. He can walk through a store, and if he's met you once, he knows our name, he knows your wife, your husband, your kids, where they are going to school." Employees said they believe the fight between the family members loyal to Arthur T. and Arthur S. is largely over money and the direction of the company. They say Arthur S. and his supporters have pressed for a greater return to shareholders. Arthur T. and his supporters have focused on keeping prices low. Outsiders Brought In Many employees are distrustful of Arthur S. and two co-chief executives who were brought in from outside the company: Felicia Thornton, a former executive of the grocery chain Albertsons, and Jim Gooch, former president and chief executive at RadioShack (RSH). "I'm worried about my job," said Valerie Burke, a worker in the West Bridgewater store. "It's a great company to work for now, but we are worried it won't stay that way," she said as she picketed outside the store Tuesday. Arthur S. hasn't spoken publicly, while Gooch and Thornton have communicated only through prepared statements. They assured workers in a statement that they aren't planning drastic changes in the way the company is operated, and urged employees to return to work. Arthur T. on Wednesday offered to buy the company for an undisclosed amount. Gooch and Thornton declined to comment. Workers have planned another rally Friday in Tewksbury, while the company's board of directors is scheduled to hold a meeting the same day in Boston. Steve Paulenka, who started in 1974 as a bag boy and rose to facilities and operations manager before being fired last weekend, said he sees no end to protests unless Arthur T. is reinstated. "A big part of me doesn't like what's going on -- it's like breaking your favorite toy on purpose," he said. "But we'll get through this."