Yet again, another GM recall NEW YORK (CNNMoney) General Motors has already recalled more cars and trucks in the U.S. this year than it has sold here in the five years since it filed for bankruptcy.

Yet again, another GM recall NEW YORK (CNNMoney) General Motors has already recalled more cars and trucks in the U.S. this year than it has sold here in the five years since it filed for bankruptcy. Those five years had been good for the "New GM." It recaptured lost market share. It made record profits. And it won praise for the quality of its cars from both critics and buyers.

Then on Feb. 14, GM announced a recall of about 800,000 cars due to an ignition switch problem that could cause the cars to shut off while being driven.

It has been engulfed by the recall crisis ever since.

The company's problems have snowballed. GM (GM, Fortune 500) ultimately recalled 2.6 million cars worldwide for the flawed ignition switch that's been tied to at least 13 deaths. And GM admitted that its employees knew of the problem at least a decade before the recall.

Recalls hit a record: GM has issued more recalls this year than ever before. There have been 29 separate recalls covering 13.8 million U.S. cars and trucks, and at least 15.6 million vehicles worldwide.

The surge is the result of new standards at GM. The automaker is looking back at repair advisories it has issued in the past and issuing recalls when they're warranted. GM says it's also issuing recalls more quickly when reports of new problems emerge.

GM named a new safety chief and also hired 35 additional investigators to follow up on reports of problems.

The company is going to great lengths to show how serious it's taking matters. Last week GM called the owners of 477 trucks, including Silverados, Sierras and Tahoe SUVs to tell them to immediately stop driving the vehicles, which have a steering problem. GM sent flatbeds to pick up the trucks and have them repaire! d.

Scrutiny mounts: So far GM has agreed to pay the maximum fine of $35 million to the National Highway Traffic Safety Administration for the delay in the ignition recall. And it will be subject to closer oversight by the regulator.

The Justice Department is also considering whether to bring criminal charges against the automaker. A similar probe over Toyota's 2009 and 2010 unintended acceleration recalls led to a $1.2 billion fine earlier this year.

GM CEO Mary Barra, who in January became the first woman to lead a major automaker, testified before Congress for two days in April. She faced harsh questions from lawmakers who argued the company is criminally liable.

The company has hired compensation expert Kenneth Feinberg, who worked with victims of 9/11 and the BP oil spill, to determine how to pay victims of the delayed recall.

The automaker is also facing dozens of civil lawsuits.

Profits wiped out: The company estimates it will cost $1.7 billion to repair the cars recalled so far in 2014.

That only covers the cost of actually making repairs, and not any civil or criminal fines it may have to pay to victims or the government.

GM shares are down 18% this year, lagging far behind rivals Toyota (TM) and Ford Motor (F, Fortune 500).

Car buyers don't care: The good news for GM is that car buyers have shown little concern about the recalls. New car sales have been strong in the three months since the ignition recall was announced, and the automaker is still No. 1 in U.S. market share. Even the price of used GM autos have stayed firm throughout the crisis. ![]()

Derek Gordon/Shutterstock

Derek Gordon/Shutterstock

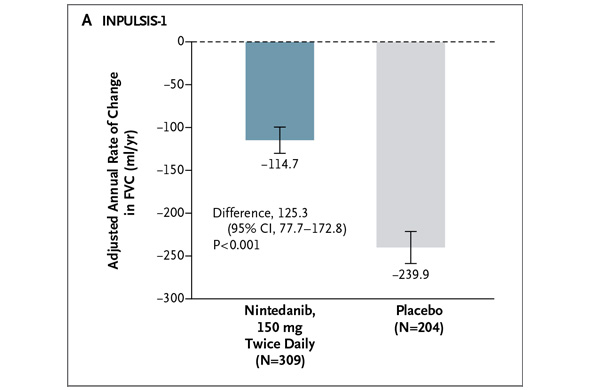

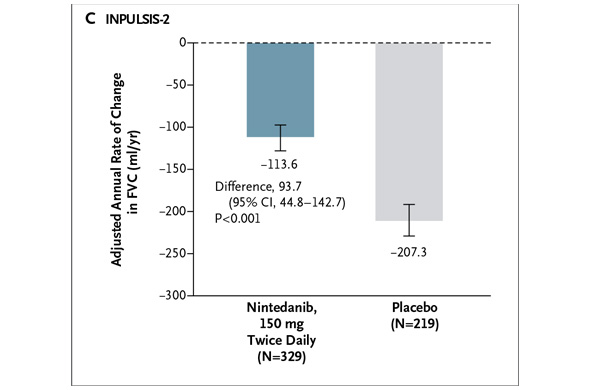

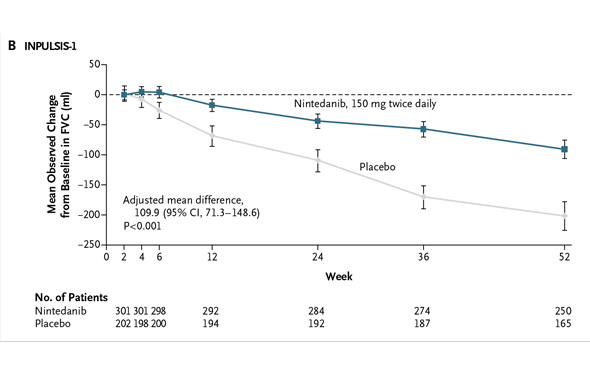

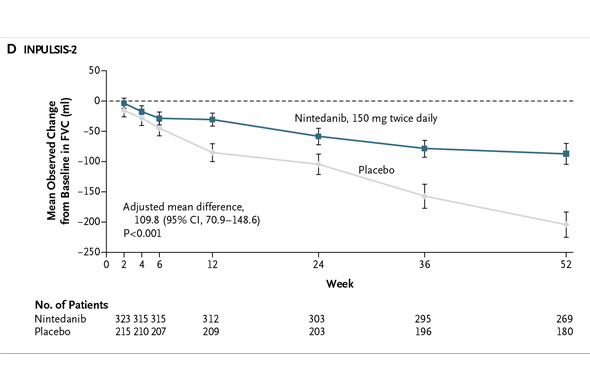

In INPULSIS-2, the annual rate of decline in FVC was -113.6 ml for nintedanib versus -207.3 ml for placebo -- a relative reduction of 45% and statistically significant. Here's what that result looks like graphically (again from the NEJM):

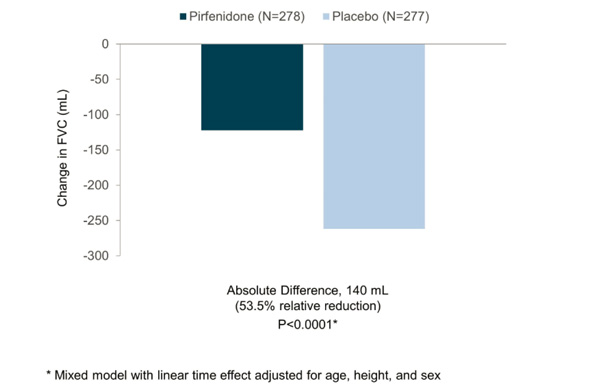

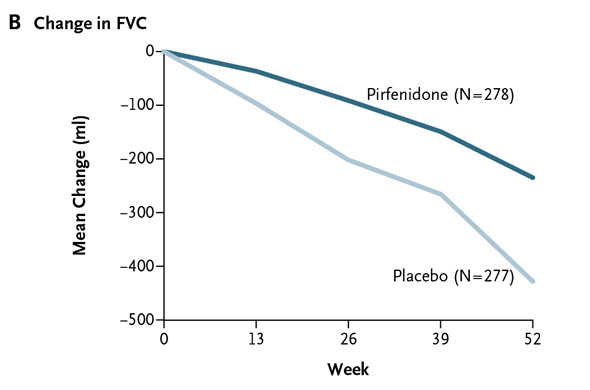

In INPULSIS-2, the annual rate of decline in FVC was -113.6 ml for nintedanib versus -207.3 ml for placebo -- a relative reduction of 45% and statistically significant. Here's what that result looks like graphically (again from the NEJM): In my preview of the IPF data Friday, I mentioned the primary endpoints of the respective phase III studies designed by InterMune and Boehringer were different. InterMune, however, re-analyzed the pirfenidone study using Boehringer's annual rate of FVC decline endpoint. In InterMune's ASCEND phase III study, the annual rate of decline in FVC was -122 ml in the pirfenidone group and -262 ml in the placebo group -- a relative difference of 53% and statistically significant. Here's what this results looks like graphically:

In my preview of the IPF data Friday, I mentioned the primary endpoints of the respective phase III studies designed by InterMune and Boehringer were different. InterMune, however, re-analyzed the pirfenidone study using Boehringer's annual rate of FVC decline endpoint. In InterMune's ASCEND phase III study, the annual rate of decline in FVC was -122 ml in the pirfenidone group and -262 ml in the placebo group -- a relative difference of 53% and statistically significant. Here's what this results looks like graphically: When using Boehringer's primary efficacy endpoint for IPF benefit, InterMune's pirfenidone comes out looking equivalent to nintedanib in one study and superior in the second. [With the caveat that we're comparing across trials.] The primary endpoint of InterMune's ASCEND study measured the proportion of patients in the pirfenidone and placebo arms experiencing a clinically meaningful change (10% or greater) in FVC. The study enrolled 555 IPF patients and achieved its primary endpoint with a high level of statistical significance. At 52 weeks, 16.5% of the IPF patients treated with pirfenidone experienced an FVC decline of 10% or more or death compared to 31.8% in the placebo group. The relative reduction favoring pirfenidone was 48% Boehringer analyzed the nintedanib data from INPULSIS studies to also come up with a categorical description of the drug's efficacy. In INPULSIS-1, 29% of nintedanib-treated patients experienced an FVC decline of 10% or more compared to 43% in the placebo group -- a relative reduction of 33%. In INPULSIS-2, 30% of nintedanib-treated patients experienced an FVC decline of 10% or more compared to 35.5% in the placebo group -- a relative reduction of 15.5%. Using a categorical definition of efficacy in IPF (InterMune's primary endpoint) and comparing across trials, pirfenidone outperformed nintedanib. [Note: InterMune's study enrolled slightly "sicker" IPF patients with a baseline predicted FVC of 67-68% compared to 79-80% in Boehringer's INPULSIS studies.] Let's compare mortality data in the InterMune and Boehringer studies.

When using Boehringer's primary efficacy endpoint for IPF benefit, InterMune's pirfenidone comes out looking equivalent to nintedanib in one study and superior in the second. [With the caveat that we're comparing across trials.] The primary endpoint of InterMune's ASCEND study measured the proportion of patients in the pirfenidone and placebo arms experiencing a clinically meaningful change (10% or greater) in FVC. The study enrolled 555 IPF patients and achieved its primary endpoint with a high level of statistical significance. At 52 weeks, 16.5% of the IPF patients treated with pirfenidone experienced an FVC decline of 10% or more or death compared to 31.8% in the placebo group. The relative reduction favoring pirfenidone was 48% Boehringer analyzed the nintedanib data from INPULSIS studies to also come up with a categorical description of the drug's efficacy. In INPULSIS-1, 29% of nintedanib-treated patients experienced an FVC decline of 10% or more compared to 43% in the placebo group -- a relative reduction of 33%. In INPULSIS-2, 30% of nintedanib-treated patients experienced an FVC decline of 10% or more compared to 35.5% in the placebo group -- a relative reduction of 15.5%. Using a categorical definition of efficacy in IPF (InterMune's primary endpoint) and comparing across trials, pirfenidone outperformed nintedanib. [Note: InterMune's study enrolled slightly "sicker" IPF patients with a baseline predicted FVC of 67-68% compared to 79-80% in Boehringer's INPULSIS studies.] Let's compare mortality data in the InterMune and Boehringer studies.

Bloomberg News

Bloomberg News  Related AA Market Wrap For May 12: Dow And S&P Close At Record Highs Industrial Metals Stock Outlook - May 2014 - Zacks Analyst Interviews Bulls Charge the Street as Traders Cheer FOMC Minutes (Fox Business)

Related AA Market Wrap For May 12: Dow And S&P Close At Record Highs Industrial Metals Stock Outlook - May 2014 - Zacks Analyst Interviews Bulls Charge the Street as Traders Cheer FOMC Minutes (Fox Business)

Popular Posts: The Top 10 S&P 500 Dividend Stocks for May5 Stocks to Buy in MayTwitter Stock Gets Third Upgrade in Three Days … And Still Isn’t a Good Buy Recent Posts: PLUG – Plug Power Stock a Sell Even on Good Earnings Weak Retail Sales Hurt Everything from Home Depot to Nike The Top 10 S&P 500 Dividend Stocks for May View All Posts

Popular Posts: The Top 10 S&P 500 Dividend Stocks for May5 Stocks to Buy in MayTwitter Stock Gets Third Upgrade in Three Days … And Still Isn’t a Good Buy Recent Posts: PLUG – Plug Power Stock a Sell Even on Good Earnings Weak Retail Sales Hurt Everything from Home Depot to Nike The Top 10 S&P 500 Dividend Stocks for May View All Posts  There are always a few stocks that a portion of the market falls head-over-heels in love with, despite investors’ better judgment. Take look at what PLUG stock has done over the last 12 months, and it’s abundantly clear some players are blinded by their ardor.

There are always a few stocks that a portion of the market falls head-over-heels in love with, despite investors’ better judgment. Take look at what PLUG stock has done over the last 12 months, and it’s abundantly clear some players are blinded by their ardor. Just as worrisome is the epic volatility seen in Plug Power stock. Indeed, PLUG stock has traded in a range of 22 cents to $11.72 in the last year alone. Sure, Plug Power stock still is up more than 140% for the year-to-date, but it’s also off 64% since its March 10 high. Have a look at the chart:

Just as worrisome is the epic volatility seen in Plug Power stock. Indeed, PLUG stock has traded in a range of 22 cents to $11.72 in the last year alone. Sure, Plug Power stock still is up more than 140% for the year-to-date, but it’s also off 64% since its March 10 high. Have a look at the chart: