The following video is from Thursday's Investor Beat,� in which host Chris Hill, and analysts Jason Moser and Isaac Pino dissect the hardest-hitting investing stories of the day.

Shares of Microsoft rose nearly 3% on news that the tech giant is planning a major reorganization. Microsoft will be organized around key functions rather than specific products, and the goal is a better sharing of information, better devices, and better services. In our lead story on Investor Beat, Motley Fool analysts Jason Moser and Isaac Pino discuss how Microsoft seems to be modeling its changes on Ford Motor's most recent reorganization, and whether investors will benefit.

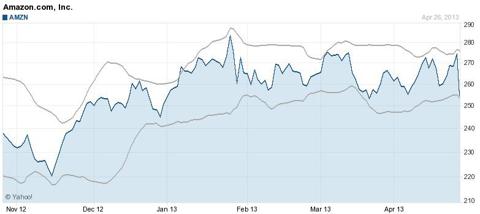

Also, our analysts discuss Yum! Brands' deepening troubles, Amazon's uptick riding a trend of rising e-commerce, Costco's 6% increase in same-store sales, and Wal-Mart abandoning its plans for three new stores in Washington, D.C. Those stories, plus two stocks our analysts are going to be keeping a close eye on in the week ahead.

5 Best Tech Stocks To Invest In Right Now: StemCells Inc (STEM.W)

StemCells, Inc. (StemCells), incorporated in August 1988, is engaged in the research, development, and commercialization of stem cell therapeutics and related tools and technologies for academia and industry. The Company is focused on developing and commercializing stem and progenitor cells as the basis for therapeutics and therapies, and cells and related tools and technologies to enable stem cell-based research and drug discovery and development. The Company�� primary research and development efforts are focused on identifying and developing stem and progenitor cells as potential therapeutic agents. The Company has two therapeutic product development programs, including its CNS Program, which is developing applications for HuCNS-SC cells, its human neural stem cell product candidate, and its Liver Program, which is characterizing the Company�� human liver cells as a therapeutic product.

CNS Program

The Company in its CNS Program, is in clinical development with its HuCNS-SC cells for a range of disorders of the central nervous system. The CNS includes the brain, spinal cord and eye. In February 2012, the Company had completed a Phase I clinical trial in Pelizeaus-Merzbacher Disease (PMD), a fatal myelination disorder in the brain.

The Company�� CNS Program is focused on developing clinical applications, in which transplanting HuCNS-SC cells protect or restore organ function of the patient before such function is irreversibly damaged or lost due to disease progression. The Company�� initial target indications are PMD, and more generally, diseases in which deficient myelination plays a central role, such as cerebral palsy or multiple sclerosis; spinal cord injury, disorders in which retinal degeneration plays a central role, such as age-related macular degeneration or retinitis pigmentosa. The Company�� product candidate, HuCNS-SC cells, is a purified and expanded composition of normal hum an neural stem cells. Its HuCNS-SC cells can be directly tr! a! nsplanted.

Liver Program

Liver stem or progenitor cells offer an alternative treatment for liver diseases. A liver cellular therapy or cell-based therapeutic provide or support liver function in patients with liver disease. The Company held a portfolio of issued and allowed patents in the liver field, which cover the isolation and use of both hLEC cells and the isolated subset, as well as the composition of the cells themselves.

The Company�� range of cell culture products, which are sold under the SC Proven brand, includes iSTEM, GS1-R, GS2-M, RHB-A, RHB-Basal, NDiff N2, and NDiff N2B27. Its iSTEM is a serum-free, feeder-free medium that maintains mouse embryonic stem cells in their pluripotent ground state by using selective small molecule inhibitors to block the pathways, which induce differentiation. RHB-A is a defined, serum-free culture medium for the selective culture of human and mouse neural stem cells and their maintenanc e and expansion as adherent cell populations. RHB-Basal is a defined, serum-free basal medium. When supplemented with specific growth factors, this media is formulated for the propagation and differentiation of adherent neural stem cells. RHB-Basal can also be tailored to specific-cell type requirements by the addition of customer preferred supplements.

The Company�� NDiff N2 is a defined serum-free scell culture supplement for the derivation, maintenance, expansion and/or differentiation of human and mouse embryonic stem (ES) cells and tissue-derived neural stem cells supplement. Its NDiff N2-AF is a serum-free and animal component-free version of NDiff N2. Its NDiff N2B27 is a defined, serum-free medium for the differentiation of mouse embryonic stem cells to neural cell types. NDiff N27-AF is a serum-free and animal component-free version of NDiff N27. Its GS1-R is a serum-free media formulation shown to enable the derivation and long-term maintenance of tr ue, germline competent rat embryonic stem cells without! the ! ad! dition ! of cytokines or growth factors. Its GS2-M is a defined, serum- and feeder-free medium for the derivation and long-term maintenance of true, germline competent mouse iPS cells.

The Company also markets a number of antibody reagents for use in cell detection, isolation and characterization. These reagents are also under the SC Proven brand and it includes STEM24, STEM101, STEM121 and STEM123. Its STEM24 is a human antibody that recognizes human CD24, also known as heat stable antigen (HSA), a glycoprotein expressed on the surface of many human cell types, including immature human hematopoietic cells, peripheral blood lymphocytes, erythrocytes and many human carcinomas. Its CD24 is also a marker of human neural differentiation. Its STEM101 is a human-specific mouse antibody that recognizes the Ku80 protein found in human nuclei. Its STEM121 is a human-specific mouse antibody that recognizes a cytoplasmic protein of human cells. Its STEM123 is a human-specific mouse antibody that recognizes human glial fibrillary acidic protein (GFAP).

The Company�� Other products marketed under SC Proven include total cell genomic DNA (gDNA), RNA and protein lysate reagents purified from homogenous stem cell populations for intra-comparative studies, such as Epigenetic fingerprinting, Southern, Western and Northern blots, PCR, RT-PCR and microarrays. This range of purified stem cell line lysates includes mouse embryonic stem (ES) cells propagated in SC Proven 2i inhibitor-based GS2-M media and mouse ES cell-derived and fetal tissue-derived neural stem (NS) cells propagated in SC Proven RHB-A media.

5 Best Tech Stocks To Invest In Right Now: Tangoe Inc (TNGO)

Tangoe, Inc. (Tangoe), incorporated on February 9, 2000, is a global provider of communications lifecycle management (CLM), software and services to a range of enterprises, including large and medium-sized businesses and other organizations. CLM encompasses the entire lifecycle of an enterprise's communications assets and services, including planning and sourcing, procurement and provisioning, inventory and usage management, mobile device management (MDM), invoice processing, expense allocation and accounting, and asset decommissioning and disposal. Its on-demand Communications Management Platform is a suite of software designed to manage and optimize the complex processes and expenses associated with this lifecycle for both fixed and mobile communications assets and services. On February 21, 2012, it acquired ttMobiles Limited (ttMobiles), On January 10, 2012, Tangoe acquired Anomalous Networks Inc. On December 19, 2011, it acquired ProfitLine, Inc. (ProfitLine).On March 16, 2011, the Company acquired the telecommunications expense management division of Telwares, Inc. and its subsidiary Vercuity Solutions, Inc. (Telwares). On January 25, 2011, it acquired HCL Expense Management Services Inc. (HCL). On August 8, 2012, the Company acquired the Telecommunications Expense Management Business of Symphony Teleca (TEM Business).

The Company�� solution is implemented worldwide, providing service coverage in over 180 countries and territories in over 125 currencies with support for approximately 1,700 different communications carriers and 1,900 different billing formats. Its user interface is translated into 16 different languages and its solution supports compliance with the requirements of 63 regulatory committees around the world. Its on-demand software organizes disparate billing, ordering, asset and usage data into a format, allowing its customers to access, query and analyze their communications expense and asset profile information. Improved control of the billing process helps enterpri! ses ensure they pay their bills on time, avoiding late payments and associated service interruptions. Its software also provides customers proactive and predictive mobile usage alerts allowing them to avoid mobile bill overages. Its solution allows its customers to manage the financial, legal and reputational risks associated with unauthorized or unintended use of their communications assets and services.

Communications Management Platform

The Company�� customers can engage the Company through its client service group to manage their communications assets and services using a combination of CMP and its client services. The services it offers include help desk, asset procurement and provisioning and carrier dispute resolution. Its Communications Data Management technology processes and normalizes service-provider billing and order-related information for its customers. CMP also integrates with its customers' critical third-party enterprise systems, including enterprise resource planning, accounts payable, general ledger and human resources systems, which enables automated, real-time access to and synchronization with employee, accounting, user access authentication and security policy information.

The Company sells CMP in three standard bundles: Asset Management, Expense Management and Usage Management. The Asset Management bundle of CMP provides asset procurement, provisioning, tracking and disposal capabilities for fixed and mobile communications assets and services. The Asset Management bundle tracks and audits all add, move, change or disconnect service transaction orders and manages all customer assets and services by location, business unit and employee. Its MDM software allows its customers to manage and maintain their mobile inventory with wireless, real-time monitoring and remote update functions. Key capabilities of the Asset Management bundle of CMP include catalog management, procure, provision, track, maintain and dispose.

Catalog Manage! ment incl! ude Customer-configurable catalog of over 51,500 services, devices, features and plans with dynamic access and presentation based on corporate policy and user profile. Procure include capture, validation, approval, submission and tracking of fixed and mobile service and equipment orders. Provision is engaged in establishment of mobile device enterprise connectivity with installation of corporate applications, usage and security policies utilizing wireless provisioning capabilities. Track includes tracking of fixed and mobile assets, including information regarding characteristics, configurations, ownership and operational and connectivity status. Maintain include centralized management of mobile devices enabled through on-device software providing security and usage policy enforcement as well as automated mobile policy and mobile application deployments and updates. Dispose include collection, data cleansing and disposal of mobile devices.

The Expense Management bundle of CMP provides automated processing and services to manage every aspect of the fixed and mobile communications billing function, from receipt to payment. Key capabilities of the Expense Management bundle of CMP include contract management, billing, audit, dispute, allocate, payment and optimize. The Usage Management bundle of CMP provides enterprises with visibility and control over how communications assets and services are being used in fixed and mobile environments through a combination of real-time and historical usage tracking as well as corporate communications and security policy enforcement. The Company�� capabilities of the Usage Management bundle of CMP include secure, policy management, monitor, real-time, compliance, performance and support. The Company offers Real-time Telecommunications Expense Management (rTEM) bundled or as a point solution. Its rTEM solution serves the enterprise, medium and small business and carrier deployment markets.

The Company�� rTEM solution provides businesses and ca! rriers of! all sizes the ability to monitor, report and analyze data, voice, short message service (SMS) and roaming consumption of their mobile devices in real-time. Its rTEM solution utilizes predictive algorithms designed to proactively identify and help prevent costly, unexpected overages from occurring. Its rTEM solution also provides device location monitoring services to help find lost or stolen devices, as well as device geo-fencing features to alert appropriate individuals that an asset is leaving or entering pre-defined geographic tracking areas, providing additional device security tracking. Its rTEM solution supports implementation on smartphones, tablets and machine-to-machine communication devices.

Strategic Consulting and Other Services

The Company offers a set of strategic consulting services that address all areas of CLM for fixed and mobile environments. These services can be contracted separately or in conjunction with CMP. Its strategic consulting services offerings include sourcing, strategic advisory service, bill auditing, inventory optimization, mobile optimization and policy administration. The Company assists its customers with reviewing and negotiating contracts with communications carriers. The Company provides its clients with peer comparison analysis and benchmarking. It works with its customers to identify billing errors and other issues related to usage and contract activity. The Company advises its customers on how to align their current asset and service inventories with their business objectives. The Company aids its customers in aligning their mobile policies, assets, contracts and requirements. It works with its customers to formulate policies concerning the appropriate use of communications assets and services. In addition, the Company helps its customers develop policies regarding risk mitigation, entitlements, cost management, liability models, cost allocation methodologies and positive behavioral management. The Company also offers standard imple! mentation! services, including data conversion, system configuration, process review and corporate system integration, to assist its customers in the setup and deployment of CMP.

The Company competes with Emptoris, Rivermine, MDSL, Symphony SMS, Vodafone, XIGO, AirWatch, BoxTone, Good Technology, MobileIron, Sybase, Zenprise, CSC, Orange, Ariba and PAETEC.

Advisors' Opinion:- [By James K. Glassman]

52-Week High: $23.05

52-Week Low: $11.99

Annual Revenue: $140 million

Projected 2013 Earnings Growth: 33.3%

Terry Tillman, who analyzes software stocks for the Raymond James investment firm, chose SuccessFactors for 2012. Now he's enthusiastic about Tangoe (symbol: TNGO), which makes software that helps manage the telecom services that large and midsize companies use. Revenues in the July–September quarter were up 39% from the same period in 2011. When you consider Tangoe's fast growth, its P/E of 20, based on 2013 earnings estimates, seems attractive. But I'm mainly drawn by the firm's similarity to SuccessFactors. Two in a row? - [By James K. Glassman]

Terry Tillman, who analyzes software stocks for the Raymond James investment firm, chose SuccessFactors for 2012. Now he's enthusiastic about Tangoe (symbol: TNGO), which makes software that helps manage the telecom services that large and midsize companies use. Revenues in the July–September quarter were up 39% from the same period in 2011. When you consider Tangoe's fast growth, its P/E of 20, based on 2013 earnings estimates, seems attractive. But I'm mainly drawn by the firm's similarity to SuccessFactors. Two in a row?

Best High Tech Stocks To Buy For 2014: Marin Software Inc (MRIN.N)

Marin Software Incorporated, incorporated on March 16, 2006, provides cloud-based digital advertising management platform to advertisers and agencies. The Company�� Revenue Acquisition Management platform is a software-as-a-service (SaaS), analytics, workflow, and optimization solution for marketing professionals, enabling them to manage their digital advertising spend across search, display, social and mobile advertising channels. Its platform integrates with publishers, such as Baidu, Bing, Facebook, Google, Yahoo! and Yahoo! Japan, as well as Web analytics and ad-serving solutions, and key enterprise applications to enable marketers to measure the return on investment of their marketing programs.

The Company�� software platform serves as a system-of-record for advertising performance, revenue and conversion data and allows advertisers to correlate advertising spend to subsequent revenue outcomes or business events. It enables its customers to simulta neously run large-scale digital advertising campaigns across multiple publishers and channels, making it easy for marketers to create, publish, modify and optimize campaigns in real time.

5 Best Tech Stocks To Invest In Right Now: Alcatel Lucent SA (ALU)

Alcatel Lucent, incorporated on June 18, 1898, is engaged in mobile, fixed, Internet Protocol (IP) and Optics technologies, applications and services. The Company is a partner of service providers, enterprises, industries and governments worldwide. Alcatel-Lucent includes Bell Labs centres of research in communications technology. Its operations are in more than 130 countries. The Company operates in three business segments: networks, applications, and services. On December 31, 2010, the Company completed the sale of its Vacuum pump solutions and instruments business to Pfeiffer Vacuum Technology AG. In September 2010, the Company acquired OpenPlug, a mobile software and applications development tools vendor. In June 29, 2010, the Company acquired ProgrammableWeb.

During 2010, the Company launched the Digital Media Store, a multicontent digital storefront that allows service providers to deliver content to end-users. Launched during 2010, Optism is a permission-based mobile marketing solution. During 2010, it launched Alcatel-Lucent�� Mobile Wallet Service (MWS), which allows the mobile operator to leverage its secure network to deliver a mobile payment capability through a mobile handset. During 2010, it also launched Alcatel-Lucent�� Application Exposure Suite to facilitate the development of new services by third-party application developers and content providers.

Networks Segment

The Networks segment supplies a portfolio of products and offerings used by fixed, wireless and converged service providers, as well as enterprises and governments for their business communications. The Company�� IP portfolio consists of four product families that deliver multiple services, including broadband triple play for residential customers; Ethernet and IP Virtual Private Network (VPN) services for Enterprise customers, and wireless second-generation (2G), third-generation (3G) and long term evolution (LTE) broadband services for mobile operators. The main product fami! lies include Internet Protocol/Multiprotocol Label Switching (IP/MPLS) service routers, Carrier Ethernet service switche, Multi-service wide-area-network (or MS WAN) switches and Content Delivery Network (CDN) appliances.

Internet Protocol/Multiprotocol Label Switching (IP/MPLS) service routers direct traffic within and between carriers��national and international networks to enable delivery of a range of IP-based services (including Internet access, Internet Protocol TV (IPTV), Voice over IP (VoIP), mobile phone and data, and managed Enterprise VPN services) on a single common network infrastructure with superior performance, with application intelligence, and with scalability (such as the simultaneous support of many diverse types of traffic and customers); Carrier Ethernet service switches. Carrier Ethernet service switches enable carriers to deliver residential, business and wireless services, and these products are mainly used in metropolitan area networks; Multi-service wide-area-network (MS WAN) switches. Multi-service wide-area-network (MS WAN) switches enable fixed line and wireless carriers to transition their existing networks to support newer technologies and services, and Content Delivery Network (CDN) appliances. Content Delivery Network (CDN) appliances distribute and cache (store) Web and video content.

The Company�� Internet Protocol/Multiprotocol Label Switching (IP/MPLS) and Carrier Ethernet products are designed to facilitate the development and availability of applications for the more participatory and interactive Web 2.0 business and consumer services. Its service routers are particularly well suited to deliver complex services to business, residential and mobile end-users. Its IP/MPLS service routers and Carrier Ethernet service switches are often used in conjunction with its DSL and Gigabit Passive Optical Network (GPON) access products to deliver these newer triple-play services, or with its wireless access products to deliver LTE solutions, or w! ith its D! ense Wave Division Multiplexing (DWDM) and optical switching products to deliver converged backbone transformation solutions for optimizing IP transport. Its Optics division designs and markets equipment for the long distance transportation of data over fiber optic connections via land (terrestrial) and under sea (submarine), as well as for short distances in metropolitan and regional areas.

The Company�� transport portfolio also includes the microwave wireless transmission equipment. Its terrestrial optical products offer a portfolio designed to seamlessly support service growth from the metro to the network core. With its products, carriers manage voice, data and video traffic patterns based on different applications or platforms and can introduce a range of managed data services, including multiple service quality capabilities, variable service rates and traffic congestion management. These products allow carriers to leverage their existing network infrastructure to offer these new services. Its submarine cable networks can connect continents (using optical amplification required over long distances), a mainland and an island, several islands together, or many points along a coast. It offers a portfolio of point-to-point microwave radio products meeting both European telecommunications standards (ETSI) and American standards-based (ANSI) requirements.

The Company�� Wireless All Around message developed during 2010 is a combination of wireless and IP products. The version of CDMA technology, known as 1X EV-DO Revision A, enables operators to offer two-way, real-time, high-speed data applications, such as VoIP, mobile video, push-to-talk and push-to-multimedia. The introduction of High Speed Packet Access (HSPA) and HSPA+ (the latest evolutions of W-CDMA technology) on networks and devices has led to increases in data speeds available to broadband devices. The Company develops mobile radio products for the second generation (2G) Global System for Mobile communications (GS! M) standa! rd, including General Packet Radio Service / Enhanced Data Rates for GSM Evolution (GPRS/EDGE) technology upgrades to that standard.

LTE offers service providers a compelling evolution path from all existing networks (GSM, W-CDMA, CDMA or WiMAX) by simplifying the radio access network and converging on a common IP base. RFS designs and sells cable, antenna, tower systems and their related electronic components, providing an end-to-end suite of radio frequency products. RFS serves original equipment manufacturers (OEMs), distributors, system integrators, network operators and installers in the broadcast, wireless communications, microwave and defense sectors. Specific applications for RFS products include cellular sites, in-tunnel and in-building radio coverage, microwave links, television and radio. The Company offers products that extend from legacy switching systems to IP multimedia subsystem (IMS) solutions for fixed, mobile, and converged operators. It has deployed its next-generation network (NGN) products in more than 170 fixed NGN networks, and it has provided the core network for more than 66 full IMS fixed and mobile networks. Its fixed access solutions allow carriers to offer triple-play services over a single access line. Its carrier customers are offering both residential and business customers multiple services, such as a number of broadcast channels, video on demand, high definition television (HDTV), VoIP, high speed Internet, and business access services.

Applications Segment

The Applications segment develops software-based applications and solutions that contribute to the personal communications for users. The Applications group is divided into two businesses: Enterprise Applications and Network Applications. The Enterprise Applications business includes its IP-based communications and collaboration applications for enterprises, including the Genesys contact center business. The Network Applications business develops applications used by service pr! oviders t! o deliver a range of services to their customers, and also includes Motive, which provides software for service providers to remotely manage their customers��at-home networks, networked devices and broadband and mobile data services. During the year ended December 31, 2010, its Applications segment accounted 12% of its total revenue.

The Applications segment is investing resources in next generation collaboration and communications systems offered by its Enterprise Applications division; customer contact, customer engagement and service management areas addressed by its Genesys and Motive businesses; carrier applications, such as communication and messaging, next-generation telephony, digital media and multi-screen delivery of content and personalized advertising, device agnostic location based address book services, and technologies, such as Long Term Evolution (LTE), IP multimedia subsystem (IMS), and Application Enablement.

Services Segment

The Services segment is focused in helping the service provider and customers realize the potential of media, information technology (IT) and telecommunications services and technologies. These services address the lifecycle of its customers��networks and operations, and encompass business consulting, systems design and integration, maintenance and managed services. The service offerings are organized around four areas: network and system integration, managed and outsourcing solutions, multi-vendor maintenance, and product-attached services.

The Company competes with Avaya, Cisco Systems, Ericsson, Fujitsu, Huawei, ZTE and Nokia Siemens Networks.

5 Best Tech Stocks To Invest In Right Now: Aruba Networks Inc.(ARUN)

Aruba Networks, Inc. provides next-generation network access solutions for the mobile enterprises worldwide. Its products include ArubaOS, an operating system software for wired, wireless, and remote access products for integrating user-based security, application-aware radio-frequency services, and wireless LAN access to deliver mobile networking solutions; software modules for ArubaOS; mobility controllers for managing wired and wireless access; access points, which serve as on-ramps that aggregate user traffic onto the enterprise network and direct this traffic to mobility controllers; and mobility access switches that provide secure network access for wired users and devices. The company also offers remote networking products comprising remote access points for securing always-on network access to corporate enterprise networks from remote locations; Aruba Instant; and Virtual Intranet Access client software that provides secure network connectivity for Windows laptops and MacBooks. In addition, it offers outdoor wireless mesh routers to secure Wi-Fi access and backhaul links for transporting voice, video, and data traffic wirelessly. Further, the company provides management and security software products, such as AirWave network management for managing mobile and wired users on multisite networks; and Amigopod access management, which manages secure wireless LAN access for visitors, contractors, employees, and their mobile devices, as well as offers cloud-based content security services for branch offices and teleworkers. It markets its products to construction, general enterprise, education, finance, government, healthcare, hospitality, manufacturing, media, retail, technology, telecom, transportation, and utility industries through its sales force, value-added resellers, value-added distributors, and original equipment manufacturers. The company was incorporated in 2002 and is headquartered in Sunnyvale, California.

Advisors' Opinion:- [By Toby]

The company is set to benefit from the rapid proliferation of wi-fi devices and WLAN adoption across the globe. As enterprises move to 802.11n WLANs, there is a need to upgrade the infrastructure of the WLAN significantly, which is unlike the change from 11b to 11g, creating a significant opportunity for Aruba to gain market share.

"We think that ARUN is the largest WLAN pure-play and the mind-share leader in the market, which we believe is a result of ARUN's superior Security-based differentiation," the analysts said.

Apart benefiting from secular trends, the company also holds a significant advantage over larger, more-diversified networking companies in that an expansion of WLAN and network rightsizing does not cannibalize existing revenue streams from physical wired edge ports.

Getty Images Should you quit now or work another year? This is the question that plagues many soon-to-be retirees. In fact, there's even a term for those suffering from this condition: The work one more year syndrome. Some people who have adequate resources are afraid to retire, fearing that their nest egg won't last through a 30-year retirement. Here are some suggestions for people who have enough money to retire, but feel compelled to stay in the workforce for another year: Have a clear understanding of the 4 percent rule, and create a plan based on accurate knowledge. Retirees generally understand that a sustainable withdrawal percentage is 4 percent annually, but not everyone knows all the intricacies behind this rule of thumb. In order for you to gain more confidence that your portfolio will survive, you need to have a clear understanding of the original study by William Bengen (pdf) and how future changes will affect your assumptions. You should know the asset allocation used, the assumptions made and how the numbers are calculated so you can think for yourself whenever a new published study challenges the numbers. Build reasonable cushions into the plan. Another year of work means a bigger nest egg, but there are also other ways to increase your chances of retirement success. You could develop a detailed budget and identify areas where you could cut spending if market performance doesn't go your way. Your personal inflation rate is also somewhat controllable, and it could be smaller than standard inflation. There are many ways to conservatively plan for retirement, and working longer is just one of them.

Getty Images Should you quit now or work another year? This is the question that plagues many soon-to-be retirees. In fact, there's even a term for those suffering from this condition: The work one more year syndrome. Some people who have adequate resources are afraid to retire, fearing that their nest egg won't last through a 30-year retirement. Here are some suggestions for people who have enough money to retire, but feel compelled to stay in the workforce for another year: Have a clear understanding of the 4 percent rule, and create a plan based on accurate knowledge. Retirees generally understand that a sustainable withdrawal percentage is 4 percent annually, but not everyone knows all the intricacies behind this rule of thumb. In order for you to gain more confidence that your portfolio will survive, you need to have a clear understanding of the original study by William Bengen (pdf) and how future changes will affect your assumptions. You should know the asset allocation used, the assumptions made and how the numbers are calculated so you can think for yourself whenever a new published study challenges the numbers. Build reasonable cushions into the plan. Another year of work means a bigger nest egg, but there are also other ways to increase your chances of retirement success. You could develop a detailed budget and identify areas where you could cut spending if market performance doesn't go your way. Your personal inflation rate is also somewhat controllable, and it could be smaller than standard inflation. There are many ways to conservatively plan for retirement, and working longer is just one of them.