Over the past days hedge funds have been filing their form 13-F, which is a quarterly report of equity holdings filed by institutional investment managers with at least $100 million in equity assets under management, as required by the United States Securities and Exchange Commission (SEC). In this article, let´s concentrate in one particular hedge fund and try to see the principal holdings in its portfolio. I will look into Blackhill Capital Inc., a financial investment advisory firm headquartered in Morristown, N.J.

Recently the fund reported its equity portfolio, as at the end of last year. The total value of the portfolio amounted to $657.0 million, up from $621.2 million disclosed at the end of the previous quarter. Consequently, the fund's total return was 5.75% in the last quarter. The filing revealed that at the end of last year, the fund added 38 new positions to its equity portfolio, and sold out of two other companies. The top 10 portfolio holdings as of the end of the quarter represented 69.67%.The largest changes from previous 13-F fillings are in the health care sector (1%) followed by industrials and technological stocks (around 0.2% each).

In this article, we have selected three companies, in which the fund holds the largest stakes, in terms of market value.

The first on the list is Pfizer Inc. (PFE), in which Blackhill disclosed a $23.6 million stake with over 772,140 shares. Pfizer is a biopharmaceutical company which sells health care products worldwide. It operates in a highly competitive industry with Merck & Co. Inc. (MRK), Novartis AG (NVS) and Sanofi (SNY). It has reported fourth quarter EPS and revenues above the Zacks Consensus Estimate. It has a proven commitment to returning cash to investors, with a current dividend yield of 3% which is considered quite good to protect investors' purchasing power. The company returned about $15 billion to shareholders (dividends and share buybacks) in 2012.

Other hedge fund gurus have also been active in the company. Jim Simons (Trades, Portfolio) has bought in it in fourth quarter 2013.

The Walt Disney Company (DIS) comes in next, the fund owning over 250,860 shares, worth $19.1 million. The company reported earnings per share increased by 33.8% in the most recent quarter compared to the same quarter a year ago. As we can see in the next chart, the bank has demonstrated a pattern of positive EPS growth over the last years.

We have to mention, that the net income growth from the same quarter one year ago has outperformed compared to the Media industry average.

In Johnson & Johnson (JNJ) Blackhill disclosed ownership of over 206,560 shares, worth $18.9 million. The company reported earnings per share increased by 32.5% compared to the same quarter one year prior, and has demonstrated a pattern of positive earnings per share growth over the past two years. The company returns cash to investors: Its current dividend yield is 2.83%, which is considered quite enough to protect the purchasing power.

Final Comment

The stocks still have good upside potential despite the fact that they have already risen in the past year. The three stocks are certainly attractive for fundamental investors and make it a worthy investment for Blackhill's portfolio. In future articles we are going to calculate the intrinsic value of these stocks to determine if they are a good buy in terms of valuation.

Disclosure: Vanina Egea holds no position in any stocks mentioned.

About the author:Vanina EgeaA fundamental analyst at Lone Tree Analytics

Visit Vanina Egea's Website

| Currently 4.50/512345 Rating: 4.5/5 (4 votes) |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

body{margin:0;padding:0} MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

PFE STOCK PRICE CHART

32.46 (1y: +15%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1362722400000,28.19],[1362978000000,28.25],[1363064400000,27.94],[1363150800000,28.02],[1363237200000,28.11],[1363323600000,28.02],[1363582800000,28.04],[1363669200000,27.99],[1363755600000,28.29],[1363842000000,28.11],[1363928400000,28.38],[1364187600000,28.16],[1364274000000,28.6],[1364360400000,28.64],[1364446800000,28.86],[1364792400000,28.84],[1364878800000,29.23],[1364965200000,29.03],[1365051600000,29.16],[1365138000000,29.1],[1365397200000,29.16],[1365483600000,29.11],[1365570000000,29.92],[1365656400000,30.64],[1365742800000,30.67],[1366002000000,30.45],[1366088400000,30.94],[1366174800000,30.87],[1366261200000,30.59],[1366347600000,31.06],[1366606800000,30.93],[1366693200000,31.08],[1366779600000,30.6],[1366866000000,30.26],[1366952400000,30.09],[1367211600000,30.43],[1367298000000,29.07],[1367384400000,28.9],[1367470800000,29.27],[1367557200000,28.96],[1367816400000,28.72],[1367902800000,29.03],[1367989200000,28.73],[1368075600000,28.6],[1368162000000,28.72],[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[13736! 05200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[1379307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[1381467600000,28.72],[1381726800000,29.35],[1381813200000,29.16],[1381899600000,29.8],[1381986000000,30.26],[1382072400000,30.51],[1382331600000,30.4],[1382418000000,30.68],[1382504400000,30.6],[1382590800000,30.61],[1382677200000,30.61],[1382936400000,30.74],[1383022800000,31.25],[1383109200000,30.93],[1383195600000,30.685],[138

Bloomberg

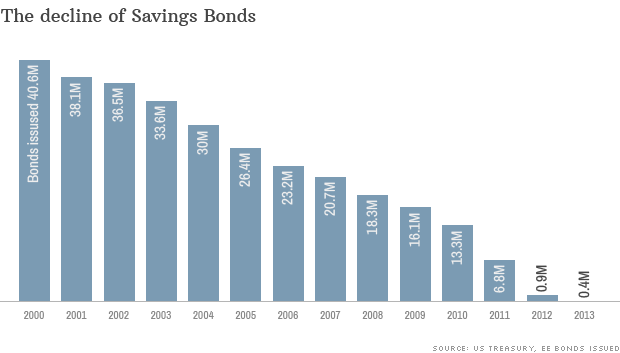

Bloomberg  NEW YORK (CNNMoney) U.S. savings bonds, a graduation gift staple for nearly a century, are on the verge of extinction.

NEW YORK (CNNMoney) U.S. savings bonds, a graduation gift staple for nearly a century, are on the verge of extinction.  Getty ImagesEven if you do reach a perfect score, there's no guarantee you'll stay at the top for long. Some people obsess over perfect grades. Others find fulfillment in bowling a perfect 300. Still others make it their life goal to earn the highly elusive perfect credit score. But while getting A's on all your midterms and even bowling 300s are fairly attainable goals, perfection in the credit world is practically unheard of. Can it really be done? And more importantly, is it a worthy goal to strive toward? Here's why the perfect credit score may not really matter in the end. Is it possible? Yes, it's possible to get a perfect credit score. However, this answer comes with a few caveats. First off, the "yes" assumes you're thinking about the 850 FICO score. While the FICO score is the most common score lenders use to determine your creditworthiness, it's not your only score. There are dozens of scoring models that can be used to determine your score, and each model calculates your score differently. So even if you achieve a perfect score with one model, your other scores may be very different. Secondly, even if someone is able to achieve a perfect score, there's no guarantee that it will stay that number or he or she will be able to reach it again. Credit scores change constantly, and every time someone pulls your score, it's calculated anew. Credit scores are also notoriously mysterious. While most people know they should pay their bills on time and avoid unnecessary hard inquiries, there is no "magic formula" out there that consumers can follow to earn a perfect score. So even the most credit-savvy consumers may not be able to repeat their success or pinpoint what exactly got them to the top. Lastly, a perfect score is extremely rare and almost impossible to attain. In 2010, the Fair Isaac Corp., the creator of FICO scores, estimated that only about 0.5 percent of consumers are able to reach the 850 mark. In fact, it's so uncommon that when people do achieve it, they sometimes get into the news. Is it worth it? Greatness is always a good goal to strive toward. However, is it worth spending ridiculous amounts of time and money stressing over a perfect credit score? In most cases, no. While it doesn't hurt to desire and try to obtain an excellent score, you don't need a perfect score to get the best rates as a consumer. As FICO spokesman Anthony Sprauve told Forbes last year, "It's important to understand that if you have a FICO score above 760, you're going to be getting the best rates and opportunities." In other words, lenders aren't looking for a perfect credit score -- they're simply looking for a score that indicates you're a responsible borrower. Most people want the 850 just so they can say they're at the top.

Getty ImagesEven if you do reach a perfect score, there's no guarantee you'll stay at the top for long. Some people obsess over perfect grades. Others find fulfillment in bowling a perfect 300. Still others make it their life goal to earn the highly elusive perfect credit score. But while getting A's on all your midterms and even bowling 300s are fairly attainable goals, perfection in the credit world is practically unheard of. Can it really be done? And more importantly, is it a worthy goal to strive toward? Here's why the perfect credit score may not really matter in the end. Is it possible? Yes, it's possible to get a perfect credit score. However, this answer comes with a few caveats. First off, the "yes" assumes you're thinking about the 850 FICO score. While the FICO score is the most common score lenders use to determine your creditworthiness, it's not your only score. There are dozens of scoring models that can be used to determine your score, and each model calculates your score differently. So even if you achieve a perfect score with one model, your other scores may be very different. Secondly, even if someone is able to achieve a perfect score, there's no guarantee that it will stay that number or he or she will be able to reach it again. Credit scores change constantly, and every time someone pulls your score, it's calculated anew. Credit scores are also notoriously mysterious. While most people know they should pay their bills on time and avoid unnecessary hard inquiries, there is no "magic formula" out there that consumers can follow to earn a perfect score. So even the most credit-savvy consumers may not be able to repeat their success or pinpoint what exactly got them to the top. Lastly, a perfect score is extremely rare and almost impossible to attain. In 2010, the Fair Isaac Corp., the creator of FICO scores, estimated that only about 0.5 percent of consumers are able to reach the 850 mark. In fact, it's so uncommon that when people do achieve it, they sometimes get into the news. Is it worth it? Greatness is always a good goal to strive toward. However, is it worth spending ridiculous amounts of time and money stressing over a perfect credit score? In most cases, no. While it doesn't hurt to desire and try to obtain an excellent score, you don't need a perfect score to get the best rates as a consumer. As FICO spokesman Anthony Sprauve told Forbes last year, "It's important to understand that if you have a FICO score above 760, you're going to be getting the best rates and opportunities." In other words, lenders aren't looking for a perfect credit score -- they're simply looking for a score that indicates you're a responsible borrower. Most people want the 850 just so they can say they're at the top.

32.46 (1y: +15%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1362722400000,28.19],[1362978000000,28.25],[1363064400000,27.94],[1363150800000,28.02],[1363237200000,28.11],[1363323600000,28.02],[1363582800000,28.04],[1363669200000,27.99],[1363755600000,28.29],[1363842000000,28.11],[1363928400000,28.38],[1364187600000,28.16],[1364274000000,28.6],[1364360400000,28.64],[1364446800000,28.86],[1364792400000,28.84],[1364878800000,29.23],[1364965200000,29.03],[1365051600000,29.16],[1365138000000,29.1],[1365397200000,29.16],[1365483600000,29.11],[1365570000000,29.92],[1365656400000,30.64],[1365742800000,30.67],[1366002000000,30.45],[1366088400000,30.94],[1366174800000,30.87],[1366261200000,30.59],[1366347600000,31.06],[1366606800000,30.93],[1366693200000,31.08],[1366779600000,30.6],[1366866000000,30.26],[1366952400000,30.09],[1367211600000,30.43],[1367298000000,29.07],[1367384400000,28.9],[1367470800000,29.27],[1367557200000,28.96],[1367816400000,28.72],[1367902800000,29.03],[1367989200000,28.73],[1368075600000,28.6],[1368162000000,28.72],[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[13736! 05200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[1379307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[1381467600000,28.72],[1381726800000,29.35],[1381813200000,29.16],[1381899600000,29.8],[1381986000000,30.26],[1382072400000,30.51],[1382331600000,30.4],[1382418000000,30.68],[1382504400000,30.6],[1382590800000,30.61],[1382677200000,30.61],[1382936400000,30.74],[1383022800000,31.25],[1383109200000,30.93],[1383195600000,30.685],[138

32.46 (1y: +15%) $(function(){var seriesOptions=[],yAxisOptions=[],name='PFE',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1362722400000,28.19],[1362978000000,28.25],[1363064400000,27.94],[1363150800000,28.02],[1363237200000,28.11],[1363323600000,28.02],[1363582800000,28.04],[1363669200000,27.99],[1363755600000,28.29],[1363842000000,28.11],[1363928400000,28.38],[1364187600000,28.16],[1364274000000,28.6],[1364360400000,28.64],[1364446800000,28.86],[1364792400000,28.84],[1364878800000,29.23],[1364965200000,29.03],[1365051600000,29.16],[1365138000000,29.1],[1365397200000,29.16],[1365483600000,29.11],[1365570000000,29.92],[1365656400000,30.64],[1365742800000,30.67],[1366002000000,30.45],[1366088400000,30.94],[1366174800000,30.87],[1366261200000,30.59],[1366347600000,31.06],[1366606800000,30.93],[1366693200000,31.08],[1366779600000,30.6],[1366866000000,30.26],[1366952400000,30.09],[1367211600000,30.43],[1367298000000,29.07],[1367384400000,28.9],[1367470800000,29.27],[1367557200000,28.96],[1367816400000,28.72],[1367902800000,29.03],[1367989200000,28.73],[1368075600000,28.6],[1368162000000,28.72],[1368421200000,29.37],[1368507600000,29.4],[1368594000000,29.56],[1368680400000,29.25],[1368766800000,28.96],[1369026000000,28.7],[1369112400000,28.78],[1369198800000,29.3],[1369285200000,29.11],[1369371600000,29.04],[1369717200000,29.01],[1369803600000,28.28],[1369890000000,28.25],[1369976400000,27.23],[1370235600000,27.75],[1370322000000,27.66],[1370408400000,27.48],[1370494800000,28.11],[1370581200000,28.26],[1370840400000,28.37],[1370926800000,28.42],[1371013200000,28.43],[1371099600000,29.08],[1371186000000,29.09],[1371445200000,29.16],[1371531600000,29.4],[1371618000000,29.1],[1371704400000,28.635],[1371790800000,28.46],[1372050000000,27.71],[1372136400000,27.99],[1372222800000,28.1],[1372309200000,28.18],[1372395600000,28.01],[1372654800000,27.78],[1372741200000,27.7],[1372827600000,27.65],[1373000400000,27.97],[1373259600000,28.13],[1373346000000,28.35],[1373432400000,28.44],[1373518800000,28.77],[13736! 05200000,28.81],[1373864400000,28.79],[1373950800000,28.68],[1374037200000,28.68],[1374123600000,28.49],[1374210000000,29.09],[1374469200000,29.35],[1374555600000,29.42],[1374642000000,29.28],[1374728400000,29.19],[1374814800000,29.37],[1375074000000,29.54],[1375160400000,29.67],[1375246800000,29.23],[1375333200000,29.11],[1375419600000,29.37],[1375678800000,29.19],[1375765200000,29.34],[1375851600000,29.26],[1375938000000,29.13],[1376024400000,29.21],[1376283600000,29.19],[1376370000000,29.27],[1376456400000,29.03],[1376542800000,28.8],[1376629200000,28.37],[1376888400000,28.46],[1376974800000,28.53],[1377061200000,28.24],[1377147600000,28.16],[1377234000000,28.34],[1377493200000,28.02],[1377579600000,27.995],[1377666000000,28.21],[1377752400000,28.1],[1377838800000,28.21],[1378184400000,28.01],[1378270800000,28.37],[1378357200000,28.27],[1378443600000,28.28],[1378702800000,28.3],[1378789200000,28.45],[1378875600000,28.67],[1378962000000,28.31],[1379048400000,28.51],[1379307600000,28.71],[1379394000000,28.64],[1379480400000,29.04],[1379566800000,28.84],[1379653200000,28.97],[1379912400000,28.8],[1379998800000,28.71],[1380085200000,28.49],[1380171600000,28.52],[1380258000000,28.88],[1380517200000,28.725],[1380603600000,28.89],[1380690000000,29.01],[1380776400000,28.77],[1380862800000,29],[1381122000000,28.62],[1381208400000,28.24],[1381294800000,28.29],[1381381200000,28.77],[1381467600000,28.72],[1381726800000,29.35],[1381813200000,29.16],[1381899600000,29.8],[1381986000000,30.26],[1382072400000,30.51],[1382331600000,30.4],[1382418000000,30.68],[1382504400000,30.6],[1382590800000,30.61],[1382677200000,30.61],[1382936400000,30.74],[1383022800000,31.25],[1383109200000,30.93],[1383195600000,30.685],[138

The guy made the ballsiest move since Jackie Robinson broke the color barrier. And he'll end up doing more for other gay athletes -- at all levels of competition -- than any organized effort south of the National Hockey League's (NHL) fantastic partnership with the You Can Play project. So to argue that I just don't want to hear about it anymore or that Gays are constantly shoving their lifestyle in our face reeks horribly of bigotry and homophobia. Do you realize that lobbyists exist who actually want to ban gay players from participating in the National Football League? Some legislators want to give businesses the "right" to ban gays from their establishments. That type of stuff goes beyond boggling my mind. It makes me want to rip my mind out of my head and heave it into the ocean. I'm all for pervading news coverage with the mind-boggling stories as well. The more we can expose the anti-gay crowd for the hateful and ignorant slugs they are, the better. We're at the precise point in history where we absolutely should want to hear as much as possible about bold acts by LGBT people and the swelling support for these actions. We don't live in a world where shutting up gets anything done, especially with respect to the existence of things that make others uncomfortable. Follow @rocco_thestreet --Written by Rocco Pendola in Santa Monica, Calif.

The guy made the ballsiest move since Jackie Robinson broke the color barrier. And he'll end up doing more for other gay athletes -- at all levels of competition -- than any organized effort south of the National Hockey League's (NHL) fantastic partnership with the You Can Play project. So to argue that I just don't want to hear about it anymore or that Gays are constantly shoving their lifestyle in our face reeks horribly of bigotry and homophobia. Do you realize that lobbyists exist who actually want to ban gay players from participating in the National Football League? Some legislators want to give businesses the "right" to ban gays from their establishments. That type of stuff goes beyond boggling my mind. It makes me want to rip my mind out of my head and heave it into the ocean. I'm all for pervading news coverage with the mind-boggling stories as well. The more we can expose the anti-gay crowd for the hateful and ignorant slugs they are, the better. We're at the precise point in history where we absolutely should want to hear as much as possible about bold acts by LGBT people and the swelling support for these actions. We don't live in a world where shutting up gets anything done, especially with respect to the existence of things that make others uncomfortable. Follow @rocco_thestreet --Written by Rocco Pendola in Santa Monica, Calif.