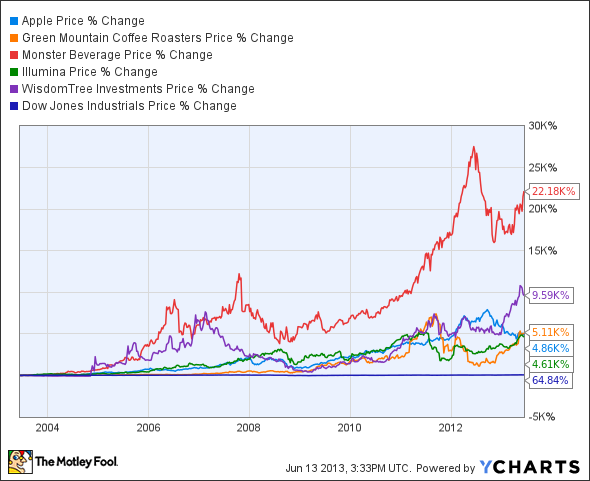

Right now, five stocks have delivered 10-year returns north of 4,500%. That's an annual return of at least 46% -- roughly tripling your investment every two years. How many of these top stocks can you name?

AAPL data by YCharts.

Let's start at the bottom of the list.

Back in 2003, Illumina (NASDAQ: ILMN ) was a micro-cap specialist in genetic testing with negative earnings and more debt than cash. The company almost went under while waiting for the genetic-testing market to mature. Now it's a hot name in a red-hot health-care market. Long-term shareholders have pocketed an outsized 4,600% return in 10 years, while the Dow Jones Industrial Average (DJINDICES: ^DJI ) gained just 65%.

How's that for market-beating performance? But wait -- it only gets better.

Everybody knows Apple (NASDAQ: AAPL ) . Under charismatic leader Steve Jobs, the Cupertino company transformed from a down-and-out wannabe computer-systems builder into a media-player giant, then a leading music-seller, and finally the smartphone-and-tablet powerhouse you see today. It's a classic rags-to-riches story that created a global powerhouse. The result: a 4,800% return.

Then there's coffee vendor Green Mountain Coffee Roasters (NASDAQ: GMCR ) , which built an empire out of brilliant acquisitions. The company bought the rights to the Keurig single-serve coffee machines, along with the rest of the Keurig company, and that $160 million investment was the main reason for Green Mountain's 5,100% 10-year climb.

The next name is still a small cap. WisdomTree is an investment firm that specializes in managing exchange-traded funds. It may only be the fifth-largest player in this field, but it's an up-and-comer with a full head of steam. It manages more than $23 billion of investor assets nowadays, up from just $1 billion in 2006. That's good for an astounding 9,600% decade-long return.

The long-term investment king should be familiar to longtime Fool readers. Energy drink giant Monster Beverage (NASDAQ: MNST ) , formerly known as Hansen Natural, crushed all comers with a 22,200% return. That's nearly 72% per year on a sustained 10-year run, though the pace slowed down considerably in the back half of this jaw-dropping jump. Monster shares have "only" tripled in the last five years, which sounds weak only when compared to the nearly 60-bagger return of the previous five years.

But you know what? That uneven performance is hardly unique to Monster. With the notable exception of Green Mountain, all of these huge gainers started out quickly and slowed down in recent years. Compare and contrast the squiggles on these two charts, detailing the front and back halves of the last decade:

AAPL data by YCharts.

AAPL data by YCharts.

As it turns out, it's far easier to beat the Dow by a ridiculous margin when you're a tiny, nimble upstart. Even Green Mountain's fantastic run is slowing down, and the stock trades well below all-time highs that were set in 2011. In a span of just nine months, the stock lost 80% of its value as the Keurig money-printing press appeared to break down. Of course, the stock has more than quadrupled again from those 2012 lows, but there's no such thing as a free lunch in the stock market. Every investment comes with a certain amount of risk -- even the strongest performers of years gone by.

So who's the next Monster Beverage or Green Mountain for the 10 years ahead? Nobody knows, but one thing is for certain: It's none of these best backward-looking stocks.

The next decade's biggest gainers will be today's no-name upstarts or beaten-down near-bankruptcy survivors. Out of this crop of long-term winners, Apple was by far the largest in 2003 with a $7.3 billion market cap. The other guys weren't even on the radar, uninvestable micro-caps one and all. Here's a snapshot of their market caps in the summer of 2003, with Apple removed for clarity:

GMCR Market Cap data by YCharts

If you want to win big, you just gotta start small.

Is Apple still a buy?

There's no doubt that Apple is at the center of technology's largest revolution ever and that longtime shareholders have been handsomely rewarded. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on reasons to buy and reasons to sell Apple, as well as what opportunities remain for the company (and your portfolio) going forward. To get instant access to his latest thoughts on Apple, simply click here now.

No comments:

Post a Comment