BALTIMORE (Stockpickr) -- When everyone's opening presents this Christmas, it's no fun to get coal in your stocking. Likewise, when the market's sitting on new all-time highs this December, it's no fun to see "toxic" names drag your portfolio through the mud.

For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution.

So without further ado, let's take a look at five toxic stocks you should be unloading.

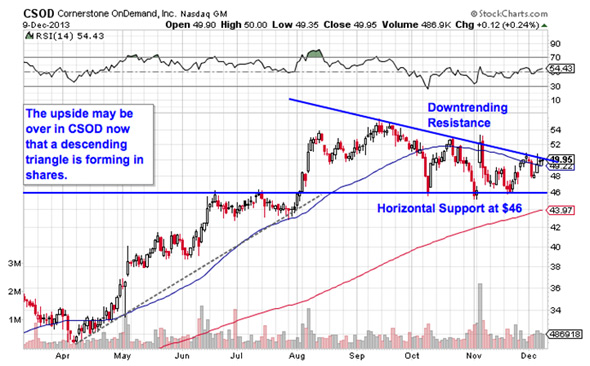

Cornerstone OnDemand

First up is Cornerstone OnDemand (CSOD), a $2.57 billion software stock that's been on a tear in 2013. Since the first trading session of the year, CSOD has rallied more than 69%. But the upside could be over thanks to a bearish setup that's been forming in shares.

CSOD is currently forming a descending triangle pattern, a bearish setup that's formed by a horizontal support level below shares at $46 and downtrending resistance to the upside. Basically, as CSOD bounces in between those two technical price levels, it's getting squeezed closer and closer to a breakdown below $46. When that happens, we've got a sell signal.

$46 gets some extra strength as a support level because it acted as resistance for shares on the way up back in the summer. The fact that buyers assigned some extra significance to $46 makes it a level that's worth watching on the way down. The 50-day moving average has been a good proxy for resistance on the way down. If you decide to bet against CSOD from here, that's where you'll want to keep a protective stop.

PNC Financial Services Group

Don't be fooled by the 30% premium on shares that $40 billion bank PNC Financial Services Group (PNC) commands today; the stock is starting to look "toppy" in the long-term here.

PNC is currently forming a double top, a bearish reversal pattern that's formed by two swing highs that top out around the same price level. The sell signal comes on a break below the trough that separates the two tops. For PNC, that support level comes into play at $70.50. If shares slip below that $70.50 level, we've got a sell signal.

Whenever you're looking at any technical price pattern, it's critical to think in terms of buyers and sellers. Triangles and double tops are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That support level at $20.75 is a price where there had been an excess of demand of shares; in other words, it's a place where buyers were more eager to step in and buy shares at a lower price than sellers were to sell. That's what makes a breakdown below $20.75 so significant. The move would indicate that sellers are finally strong enough to absorb all of the excess demand above that price level. Wait for that trigger before you sell.

There's an abundance of gaps on Pearson's chart. Those gaps, called suspension gaps, are the result of off-hours trading on the London Stock Exchange. The gaps can be ignored from a technical standpoint.

CVR Refining

Meanwhile, it doesn't take an expert technical analyst to figure out what's going on in shares of $3.3 billion refinery stock CVR Refining (CVRR). This stock is showing traders about as simple a setup as it gets: a downtrending channel. With shares testing resistance this month, it's time to unload CVRR.

CVRR's price channel has provided traders with a high-probability range for shares since the middle of the year. Despite the last four attempts at pushing through trendline resistance, shares have been swatted down on each attempt. A move all the way down to support looks likely at this point.

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.

Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment