October 2013 is a "blue moon" of fiscal and political crises.

The world anxiously awaits Congress to pass, and the President to sign, legislation for a new Fiscal Year budget and raising the debt limit. The current shutdown originally began as a Tea Party attempt to defund Obamacare, over a temporary Continuing Resolution that only funded the U.S. government until November 2013. The Republicans in Congress are determined - come Hell or high water - to force a showdown over the Affordable Care Act, budget, deficit, and debt. President Obama and House Speaker John Boehner are star-crossed characters in a made-in-the-U.S.A. version of a Greek economic tragedy, playing out their ill-fated positions.

At a press conference last week, Speaker of the House, Rep. John Boehner (Republican - Ohio) sternly responded to a reporter who asked about winning, "THIS IS NOT A GAME!"

It is a game.

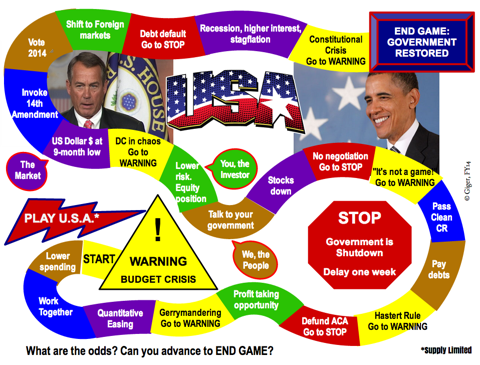

The "Play U.S.A." game (see graphic) simulates the risks and outcomes in the shutdown and debt crises. The "Play U.S.A." board is based on actual financial and political moves in real life that may lead the country on a path to ruin before government is restored. The game is not a joke.

Taking turns with a roll of a die, a player steps along the game board squares, which recalls the Candyland of your childhood. (Option: if you land on Stop, instead of pausing the game for a week, drink a shot and lose a turn.) See how long it takes you to reach "End Game - Government Restored." The objective is to win quickly, so you may stop playing.

(click to enlarge)

Takeaway for the Small investor:

The investor should play safe. Prepare for frequent market disruption and unpredictability as a result of political instability through the 2014 elections. Find profit-taking opportunities in growth stocks, if you have not already. Look ahead for ba! rgains after corrections. Allocate positions in recession-proof, dividend stocks or US-based companies with a global footprint, and short-term 3-yr. Treasury bonds. The purchase power of large cash holdings is at risk if the dollar falls. Look for value in foreign markets that will show long term strength.

My maxim as a small investor is "the future belongs to the youth." That holds true during a recovery or despite a recession. I consult my young adult children to reach mutual investment decisions, or give a little seed money to co-opt their interest as stakeholders. We buy name-brand commodities (such as beverages or drugs), entertainment, new products, and those companies in their supply chains that carve new needs and emerging domestic and global markets. I am not buying so long as the government is shutdown. Innovation is the common thread. I will look for long buying opportunities in innovative companies such as 3-D Systems (DDD), 3-M (MMM), Corning (GLW), GlaxoSmithKline (GSK), Google (GOOG), Nike (NKE), Sam Adams (SAM), Viacom (VIA), Samsung.

Come Hell or high water

The U.S. government shutdown will cause the economy to shrink about 1% per week, quoting Pacific Investment Management Co.'s Bill Gross. Even after the government shutdown is over, there will be some bounceback, but loss to local economies or services will be actual and real. At a minimum, recession is assured, and recovery will be delayed. That is the high water.

Markets have remained resilient, even faithful, despite the shutdown. "Flat is the new up," says Scarlet Fu, of Bloomberg TV, with three-quarters of U.S. and U.K. stocks still trading within 10% of their 52-week high.

It was good news that Obama nominated Janet Yellen for Federal Reserve Chairman was welcome relief to the weary market, though not unexpected. Perhaps Boehner will take the cue from the Yellen nomination and bring the government back to work. Janet Yellen is a Fed "dove," meaning she will initially continue the practice of Quantit! ative Eas! ing - the Federal Reserve buying bonds at $85 billion per month to stimulate the economy - and eventually taper QE when unemployment drops to 6.5%. Complicated by government shutdown and sequestration, a U.S. in recession won't be reaching 6.5% jobless in the near term. This will favor countries such as India, Brazil, Japan, and Indonesia, with tenuous growth, who otherwise would have seen their currency and stock stalled in favor of the US market if the Fed had gone through with the expected September QE tapering that never happened. As a footnote, the bad news on the same day as the Yellen announcement was, the announcement of the Japan Airlines contract award to EU-based EADS Airbus for 31 next-generation Airbus aircrafts, over long-time provider Boeing (NYSE:SA), seems symbolic of a US decline.

Imagine what's in store for tomorrow. New discussions began on Day #10 of the shutdown, without reaching a solution. It is now Day #11, six days from the October 17 deadline to raise the debt ceiling. Gross says the chances of debt default are "one in a million," based on his conviction that the negative consequences of debt default are catastrophic, nuclear, unfathomable, unimaginable... Bruce Ratner, executive chairman of NYC-area real estate developer Forest City Ratner Cos., estimates the chance of debt default is over 50% because Republicans don't believe or can't see the seriousness. He advises, "Be ready for chaos," with uncertainty akin to that of war time. Volatility is bad for business and ramifications are huge. Ratner says the short-term impact will not be as bad as the [2008-2010] Economic Crisis, but added with the sequester cuts, economic growth will be slowed. He says the rest of the country will lag behind the vibrant international atmosphere and intellectual capital that is driving growth in New York City.

If the U.S. does not raise the debt ceiling, spending will be limited to revenue. The President could work with the Treasury to choose the order and priority of any payment. Pa! y for int! erest on the debt, or, pay for salary, Social Security, food stamps, or death benefits to military? The first priority will be to honor payments on the debt to lenders. China holds $1.3 Trillion of US Treasury securities. To support the US trade deficit, foreign countries have been buying Treasuries. Not raising the debt ceiling will trigger a downward spiral. The US will default on its national debt. Lender countries will shift their asset allocation to reduce holding US dollars. The market could drop 50%. The U.S. dollar could freefall. Interest rates would increase, thus exacerbating the total debt we seek to reduce. Jobs would be lost. However, if Congress does not address US debt obligations, President Obama may invoke the Fourteenth Amendment and intervene to save the country.

The US is creating world chaos when the world relies on the US currency as the world's reserve currency. Repeated political fighting about government temporary CRs (which are now perennially proposed in lieu of passing a full budget), tax revenue vs. deficit spending, and the debt ceiling reflects poorly on the U.S. government. It is wearisome and confounding. Over time, governments including China, Korea, Japan, and the EU will gradually reposition themselves to reduce their risk exposure to US government dysfunction. The United States dollar will no longer be the first choice of foreign countries for currency reserve. It won't happen magically on October 17, but in due time, the US will lose the business. This is Hell.

Hell and high water are biblical. Shutdown is a disaster by flood (if a rising tide lifts all boats, a hurricane or flood might sink them), the latter is a catastrophe by fire and brimstone. Both are tragic for their victims, and inexcusably preventable by the perpetrators. We cannot politically or financially endure a blue moon every month or two - both budget and debt brinkmanship at the same time all the time - like death by a thousand cuts.

"Play U.S.A."

The moves - the squares on! the game! board - reflect the roles of characters. The characters include: "You," the Investor, who tries to protect his financial position; "We the People" who let our voices be heard; "Leadership" or solutions; "Non-starters," in particular Congress, under the influence of Tea Party hardliners; "Chaos" (self-explanatory); and "The Market" reaction to government dysfunction.

"Play U.S.A." is at once complicated or crazy, chicken or childlike. The game is for one or more people from ages 9-99, from any country, of any political persuasion. We are at the mercy of the roll of the die.

You're forced to play. You don't like it. You faintly recall something about a "Gang of Six." You remember the good old days when "fiscal cliff" meant 10% across-the-board spending cuts in the US government. More fondly, you remember bipartisan compromise back in the day of Tip and the Gipper.

Source: Come Hell Or High Water In The U.S. Shutdown And DebtDisclosure: I am long DDD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I am a furloughed government employee, and am dedicated to public service.

No comments:

Post a Comment