DELAFIELD, Wis. (Stockpickr) -- Trading stocks that trigger major breakouts can lead to massive profits. Once a stock trends to a new high, or takes out a prior overhead resistance point, then it's free to find new buyers and momentum players that can ultimately push the stock significantly higher.

One example of a successful breakout trade I flagged recently was specialty retailer Aeropostale (ARO), which I featured in Sept. 16's "5 Stocks Ready for Breakouts" at around $8.90 a share. I mentioned in that piece that shares of ARO had recently been downtrending badly from $15.73 to its 52-week low of $7.78 a share. During that trend, shares of ARO were making lower highs and lower lows, which is bearish price action. Shares of ARO were just starting to spike higher off that $7.78 low and it was quickly moving within range of triggering a major breakout trade. That trade was set to hit if ARO managed to clear its gap down day high of $9.55 a share.

Guess what happened? Shares of ARO didn't wait long to trigger that breakout, since the stock broke out above its gap down day high the following day with monster upside volume. Shares of ARO gapped up big to the upside and the stock hit an intraday high of $10.47 a share. That represents a quick gain of 20% for anyone who bought shares of ARO in anticipation of that breakout.

Breakout candidates are something that I tweet about on a daily basis. I frequently tweet out high-probability setups, breakout plays and stocks that are acting technically bullish. These are the stocks that often go on to make monster moves to the upside. What's great about breakout trading is that you focus on trend, price and volume. You don't have to concern yourself with anything else. The charts do all the talking.

Trading breakouts is not a new game on Wall Street. This strategy has been mastered by legendary traders such as William O'Neal, Stan Weinstein and Nicolas Darvas. These pros know that once a stock starts to break out above past resistance levels, and hold above those breakout prices, then it can easily trend significantly higher.

With that in mind, here's a look at five stocks that are setting up to break out and trade higher from current levels.

First Solar

One solar player that's starting to move within range of triggering a near-term breakout trade is First Solar (FSLR), which designs, manufactures and sells solar electric power modules using a proprietary thin film semiconductor technology. This stock has been in play with the bulls so far in 2013, with shares up sharply by 30%.

If you take a look at the chart for First Solar, you'll notice that this stock has been uptrending modestly over the last month, with shares moving higher from its low of $35.59 to its intraday high of $41.07 a share. During that uptrend, shares of FSLR have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of FSLR back above its 200-day moving average, and it's quickly pushing the stock within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in FSLR if it manages to break out above its 50-day at $42.04 a share and then once it clears its gap down day high from August at $42.25 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 4.67 million shares. If that breakout hits soon, then FSLR will set up re-fill some of its previous gap down zone that started near $49 a share.

Traders can look to buy FSLR off any weakness to anticipate that breakout and simply use a stop that sits right below its 200-day at $38.34 a share, or below more support at $37.50 a share. One can also buy FSLR off strength once it takes out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Vanda Pharmaceuticals

Another biotechnology player that looks poised to trigger a big breakout trade is Vanda Pharmaceuticals (VNDA), which is focused on the development and commercialization of clinical-stage drug candidates for central nervous system disorders. This stock has been on fire so far in 2013, with shares up a whopping 258%.

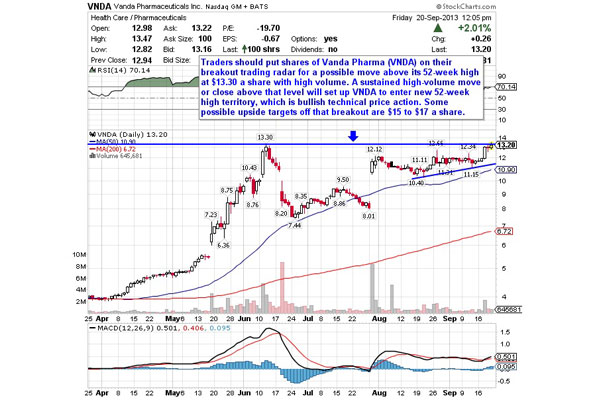

If you take a look at the chart for Vanda Pharmaceuticals, you'll notice that this stock has recently broke out above some near-term overhead resistance levels at $12.34 to $12.66 a share with solid upside volume. So far, this breakout has held and now shares of VNDA are quickly moving within range of triggering an even bigger breakout trade.

Traders should now look for long-biased trades in VNDA if it manages to break out above its 52-week high at $13.30 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action 908,467 shares. If that breakout hits soon, then VNDA will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $15 to $17 a share.

Traders can look to buy VNDA off any weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $12 a share. One could also buy VNDA off strength once it takes out $13.30 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Boyd Gaming

One gaming player that's rapidly moving within range of triggering a big breakout trade is Boyd Gaming (BYD), which owns and operates gaming entertainment facilities located in Nevada, Mississippi, Illinois, Louisiana and Indiana. This stock has been blazing a trail to the upside so far in 2013, with shares up sharply by 115%.

If you look at the chart for Boyd Gaming, you'll notice that this stock has been uptrending strong over the last month and change, with shares moving sharply higher from its low of $11.27 to its intraday high of $14.38 a share. During that move, shares of BYD have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of BYD into breakout territory above resistance at $13.79 a share, and it's quickly pushing the stock within range of another big breakout trade.

Traders should now look for long-biased trades in BYD if it manages to break out above its 52-week high at $14.50 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 2.34 million shares. If that breakout triggers soon, then BYD will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that move are $18 to $20 a share.

Traders can look to buy BYD off any weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $13 a share. One can also buy BYD off strength once it takes out $14.50 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

SunEdison

Another semiconductor player that's starting to move within range of triggering a near-term breakout trade is SunEdison (SUNE), which provides technology solutions to corporations, utilities, governments and chip manufacturers to transform lives around the world. This stock has been red hot so far in 2013, with shares up big by 150%.

If you look at the chart for SunEdison, you'll notice that this stock recently formed a double bottom chart pattern at $7.08 to $7.13 a share. Following that bottom, shares of SUNE have started to spike higher and move within range of its 50-day moving average at $8.30 a share and close to triggering a near-term breakout trade.

Traders should now look for long-biased trades in SUNE if it manages to break out above its 50-day at $8.30 a share and then once it takes out more key resistance levels at $8.35 to $8.41 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 5.81 million shares. If that breakout triggers soon, then SUNE will set up to re-fill some of its previous gap down zone from August that started at $10 a share. If this stock gets into that gap with volume, then this stock could easily re-test or take out its 52-week high at $10.47 a share.

Traders can look to buy SUNE off any weakness to anticipate that breakout and simply use a stop that sits right below those double bottom support levels at $7.13 to $7.08 a share. One can also buy SUNE off strength once it takes out that breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

TriQuint Semiconductor

My final breakout trading prospect is TriQuint Semiconductor (TQNT), which designs, develops and manufactures advanced high-performance RF solutions for the devices and networks that carry voice, video and data. This stock is a favorite target of the bulls so far in 2013, with shares up huge by 68%.

If you look at the chart for TriQuint Semiconductor, you'll notice that this stock has been uptrending strong for the last two months, with shares moving higher from its low of $7.41 to its recent high of $8.28 a share. During that uptrend, shares of TQNT have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of TQNT within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in TQNT if it manages to break out above some near-term overhead resistance levels at $8.28 a share to its 52-week high at $8.29 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 1.96 million shares. If that breakout triggers soon, then TQNT will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $11 to $12 a share.

Traders can look to buy TQNT off any weakness to anticipate that breakout and simply use a stop that sits right below its 50-day at $7.69 a share, or below more support at $7.40 a share. One could also buy TQNT off strength once it clears those breakout levels with volume and then simply use a stop that sits a conformable percentage from your entry point.

To see more breakout candidates, check out the Breakout Stocks of the Week portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

No comments:

Post a Comment