WHY BUY GOLD? Gold is underbelieved, but it is finally gaining serious investor attention.

Deep problems are developing in the

One thing you can count on is that as long as the Fed continues to push interest rates below the true rate of inflation and balloons the money supply, gold will be attractive as an inflation hedge. While demand for precious metals is increasing on a global scale, supply is being severely curtailed due to played-out reserves and South African production being shut down for a lack of power. South African mines will not be up to full production again for several more years, and they account for a full 20% of the world's gold supply.

At the root of it all - underlining gold's continued advance to $1,600 is the declining value of the U.S. dollar. Essentially, when you see some high school kid get a multi-million dollar contract to play basketball, you know that your dollars are becoming worthless. As the U.S. dollar falls, gold will rise; and the dollar is about to be taken out and shot ... again.

With your one-year subscription, you will receive a copy of our now classic booklet "Timing Gold With Simplicity." You will learn why gold will run at least to $1,600 - easily doubling its 1980 high - and why the commodity bull market still has seven years to run. You will discover why the commodity boom will not be stalled by a

The Fed's response to the recession is providing the fuel for the commodity bull market, as well as the inflation that goes along with it. As long as the Fed holds interest rates below the true rate of inflation, inflation will continue to rise and the dollar will continue to fall. This will encourage foreign governments like

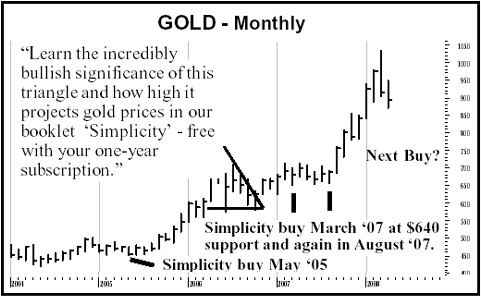

In your special gold report "Timing Gold With Simplicity," you will learn why crude oil selling at $100 a barrel virtually guarantees $1,600/ounce gold. You will also learn to use and keep a powerful indicator called "Simplicity" that will tell you when to sell as well as when to buy precious metal mining stocks for 2010. This simple, but effective, indicator last issued a buy for gold stocks last summer. Subscribers will be alerted when it triggers its next sell. In 30 seconds a day, you can easily keep this powerful model on your own.

What to buy now? We are constantly reviewing which precious metal stocks offer the best risk-to-reward potential. We discuss each of them, along with specific buy prices, in the Professional Timing newsletters.

My current favorite is Yamana (AUY-NYSE). ProTiming subscribers bought Yamana in April 2005 when we initially recommended it at $2.90. It was a little "up-and-comer" when it was first included on our list of junior mining companies. Yamana has since progressed from an upstart to a medium-size producer, turning out about 400,000 ounces of gold each year - and significant copper as well. Yamana will see even better times in the future, and we have elevated them to our master list of core investment recommendations.

If you do nothing but discard this missive, put a few dollars into Yamana (AUY-NYSE-$12.50). Don't chase it. Timing is of vital importance to long term investors. Our approach is intentionally conservative, and part of that conservatism is managing risk by paying attention to what we pay for our long term investments and when we make those commitments. I tell subscribers exactly what they should pay for each best stock for 2010 I recommend.

We bill our list of select junior mining companies as "The Option Alternative" because these companies, although speculative, beat buying call options 100 to 1. Two of our earlier picks (including Yamana) have already grown up, and the more mature miners and medium producers like Yamana will continue to do very well as gold moves toward $1,600. However, our juniors hold exceptional promise as they are all potential Yamanas.

My favorite junior is a little company we originally purchased at C$1.20. It is still in buying range and has the potential to become our next Yamana. Most of the juniors on our list sell for less than $5.00.

"Recent Hulbert Financial Digest highly rated your letter for gold stocks and bond trading. Congratulations!!!" G.K. 3/24/07

We are not at the bottom of the gold market, but we are nowhere near the top either, and the public has not even started to climb aboard yet. The low-hanging fruit is difficult to find in the metals, but we are guiding our readers to select new, mega-potential opportunities with each issue.

The most exciting event I see ahead is the buying opportunity that the current correction in precious metals is leading to. We are closing in on the next Simplicity buy signal, and it may well mark the best buying opportunity in precious metals that we have seen for several years.

Why not give yourself Professional Timing today? You will receive monthly and mid-monthly letters plus access to twice weekly online updates. Discover why gold is set to reach $1,600 within the next 18 months. You will learn about specific gold stocks that are poised to double, or more - ones that will provide you with a hedge against further erosion of the U.S. dollar and will help you build your estate.

With your subscription to Professional Timing Service, you will have access to a free special report: "Timing Gold With Simplicity." You will learn why gold will run at least to $1,600 easily doubling its 1980 high and why the commodity bull market has at least seven more years to run. Subscribe now and find out where the best opportunities lie in precious metals before the next big move begins.

Here is a little secret for you that the pros are not willing to discuss. It is this: next to precious metals, crude oil is as close to a slam dunk investment as you will ever find in the markets. However, with oil reserves dwindling - and in some cases declining alarmingly - investors have to be wary of how they invest in the rising price of crude oil. Did you know, there is only one major oil producer worth owning?

Crude oil is heading to $160/barrel, and you need to invest for that now ... but investing for $160 crude is not straightforward. What good is investing in a producer if they run out of oil, no matter how high the price of crude is?

There is only one major oil producer you should own, and it is discussed in our latest report "Slam Dunk Investing For $160 Oil." This report will teach you how to avoid the pitfalls of investing in the wrong companies, and it's included with your one-year subscription. For example, the majority of the Canadian trusts will not keep up as crude hits $160. There are exceptions, and you will learn how to select those that will continue to perform after the Canadian trust tax takes effect in 2011.

On the other hand, you will discover plenty of companies that will benefit from higher priced oil, without the need to produce it. Our two most recent recommendations are up an average of 27.6% already. We bought them only three months ago, and they are just getting started. Some of the energy companies on our list pay handsome dividends. One, a Norwegian company, pays a regular dividend of about 4.6% as well as frequent extra dividends. Over the last 12 months, they paid out a total of 15.8% based on today's price, and the best stock has appreciated 75.3% since we purchased it a little over a year ago.

What sort of opportunity is that, you say? It is an opportunity to save yourself from horrible losses. If you need liquidity, put it in 3-month T-bills - yes, at 1.30%. Furthermore, don't take your money market fund for granted - especially if it pays much over the current T-bill rate. You need to be conservative with your cash. It will only take one defaulted money market fund to create a run that will make the run on the banks in the 1930's look innocent.

Where to put your fixed income money? I like the safety of T-bills and other government securities like TIPS. Subscribe today, and I will also send you "Buying Treasuries In The World's Most Secure Investment Account." Subscribers tell us that this easy-to-follow guide alone is worth the price of their subscription.

It is too late to buy long term bonds, but it's not a bad time to sell them. You shouldn't have long term money invested in bonds, but you can certainly trade them if you like. As a subscriber, you will have access to all of our bond trading signals.

This is a negative opportunity also, but it's no less important than the advice to stay out of bonds. With the exception of a few select, hard asset related issues (which you will quickly learn to identify), it is time to take profits in stocks.

The hot stock market for 2010 is vulnerable to further selling as the sub prime and real estate mortgage problems push the economy into a recession and investors to safer waters. The most recent flight out of stocks began last October, and there are more panics coming. The ultimate flight to safety into tangible assets - with gold and crude oil taking the lead - has already begun.

Subscribe today, and you will receive another Special Report report "A Handbook For The Perplexed."This report will introduce you to several simple, but invaluable, tools you can employ to better navigate the markets on your own. Among these tools, you will learn how to use a simple ratio to identify the correct asset class that you should be invested in. It will take you less than one minute a month.

Being invested in the right asset class accounts for 85% of investment success, and we are currently recommending stocks and specific mutual funds that you can hold and profit from, even in a bear market. Our special report "Timing Gold With Simplicity," which you will receive with your subscription, includes three gold stocks poised to explode on the up side. There have been big movers like Yamana, but my current recommendations are still cheap and undiscovered. The most recent is a long-established mining company. It's incredibly cheap, and it's beginning development on the largest gold deposit in the world.

"I looked into and actually took trial memberships in a couple of other newsletters, but I must say, yours really is the best. After a few months of this, I'm a believer in your newsletter service." KM 12/21/07

With the exception of a few select resource-advantaged issues (which we will point out), it is time to take profits in stocks and other financial assets. The stock market's prospects are downright ugly.

Isn't it time you gave yourself Professional Timing?

Investing Is About Tomorrow – Not Today.

Every portfolio should have a stake in gold ... and energy. The first step is to anchor your portfolio with precious metal issues. The second step is to take advantage of the slam dunk opportunities in selected energy investments.

Why don't you take this opportunity to give yourself Professional Timing?

"My hat is off to you. I don't believe there is another analyst existing that has a handle on gold bullion and the stocks like you do. You have achieved all the downside buy targets that I hold (8 gold stocks), and the action of the bullion is just about perfect."

--M.D. 4/13/04

"I like several letters that I take, but what is unique about yours is that you tell us not only what to expect in the future, but what to do right now."

--D.B. 5/28/05

"Recent Hulbert Digest (January '07 Performance Rating) highly rated your letter for gold stocks and bond trading. Congratulations!!!" G.K 3/24/07

What you will receive with your subscription to Professional Timing Service:

* Monthly newsletter and mid-monthly updates.

* E-mailed mid-weekly updates on Tuesday and Thursday.

* Exclusive access to our "Special Reports" folder that includes all of our current studies.

* Signals telling you when to be in and out of gold funds, including the Rydex Precious Metal Fund.

* Objective signals on trading the U.S. Dollar Index, bonds, and the Nasdaq.

* Income-producing energy investments that put the dollar to work for you rather than against you

* Sane and sensible information that will assist you in managing your financial future.

Every subscriber will have access absolutely free to "Timing Gold With Simplicity". I want to show you how to put this simple indicator to work for yourself – you can become your own advisor.

Each monthly letter includes our updated list of what stocks to buy now and what price you should pay for them.

Subscribe today and you can immediately gain access to all of the ProTiming Special Reports including "Buying Treasuries In The World's Most Secure Investment Account," "A Handbook for the Perplexed," as well as "Slam Dunk Investing for $160 Oil." You will discover how to exploit the rising energy prices for generous income and capital gains. "Timing Gold with Simplicity" will give you a firm grip on the gold market. As well as discovering our projections for gold and silver through the balance of this year, you will find out how to keep a simple indicator, taking less than 30 seconds a day, to time your purchases and sales of gold shares.

No comments:

Post a Comment