DELAFIELD, Wis. (Stockpickr) -- At Stockpickr, we track daily portfolios of stocks that are the biggest percentage gainers and the biggest percentage losers.

>>5 Stocks Insiders Love Right Now

Stocks that are making large moves like these are favorites among short-term traders because they can jump into these names and try to capture some of that massive volatility. Stocks that are making big-percentage moves either up or down are usually in play because their sector is becoming attractive or they have a major fundamental catalyst such as a recent earnings release. Sometimes stocks making big moves have been hit with an analyst upgrade or an analyst downgrade.

Regardless of the reason behind it, when a stock makes a large-percentage move, it is often just the start of a new major trend -- a trend that can lead to huge profits. If you time your trade correctly, combining technical indicators with fundamental trends, discipline and sound money management, you will be well on your way to investment success.

>>5 Big Trades for a Market Top

With that in mind, let's take a closer look at a several stocks under $10 that are making large moves to the upside.

Mueller Water Products

Mueller Water Products (MWA) is a manufacturer and marketer of a broad range of water infrastructure, flow control and piping component system products for use in water distribution networks and water treatment facilities in North America. This stock closed up 2.3% to $7.83 in Thursday's trading session.

Thursday's Range: $7.61-$7.84

52-Week Range: $3.83-$8.13

Thursday's Volume: 1.04 million

Three-Month Average Volume: 1.37 million

>>5 Cash-Rich Stocks to Triple Your Gains

From a technical perspective, MWA trended modestly higher here right above its 50-day moving average of $7.43 with decent upside volume. This stock has been uptrending strong for the last two months and change, with shares moving higher from its low of $6.02 to its recent high of $8.13. During that move, shares of MWA have been making mostly higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of MWA within range of triggering a near-term breakout trade. That trade will hit if MWA manages to take out its 52-week high at $8.13 with high volume.

Traders should now look for long-biased trades in MWA as long as it's trending above its 50-day at $7.43 or above more key near-term support levels at $7.29 to $7.16 and then once it sustains a move or close above its 52-week high at $8.13 with volume that hits near or above 1.37 million shares. If that breakout hits soon, then MWA will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $10 to $12.

Inteliquent

Inteliquent (IQNT) provides wholesale voice services for carriers and service providers. This stock closed up 2.2% to $8.25 in Thursday's trading session.

Thursday's Range: $7.92-$8.39

52-Week Range: $2.10-$11.30

Thursday's Volume: 608,000

Three-Month Average Volume: 704,432

>>4 Big Tech Stocks on Traders' Radars

From a technical perspective, IQNT trended modestly higher here right above its 50-day moving average of $7.24 with decent upside volume. This stock has been uptrending strong for the last month, with shares moving higher from its low of $5.73 to its intraday high of $8.39. During that move, shares of IQNT have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of IQNT within range of triggering a major breakout trade. That trade will hit if IQNT manages to take out some near-term overhead resistance levels at $8.54 to $9.07 with high volume.

Traders should now look for long-biased trades in IQNT as long as it's trending above its 50-day at $7.24 or above more near-term support at $7.01 and then once it sustains a move or close above those breakout levels with volume that hits near or above 704,432 shares. If that breakout hits soon, then IQNT will set up to re-test or possibly take out its next major overhead resistance levels at $10 to $12.

Cache

Cache (CACH) is a mall-based specialty retailer of lifestyle sportswear and dresses targeting style-conscious women. This stock closed up 7.1% to $4.82 in Thursday's trading session.

Thursday's Range: $4.48-$4.84

52-Week Range: $1.59-$4.99

Thursday's Volume: 117,000

Three-Month Average Volume: 71,035

>>4 Stocks in Breakout Territory on Big Volume

From a technical perspective, CACH ripped higher here right off its 50-day moving average of $4.52 with above-average volume. This move is quickly pushing shares of CACH within range of triggering a big breakout trade. That trade will hit if CACH manages to take out its 52-week high at $4.99 and some past resistance at $5 with high volume.

Traders should now look for long-biased trades in CACH as long as it's trending above some key near-term support at $4.40 and then once it sustains a move or close above those breakout levels with volume that hits near or above 71,035 shares. If that breakout triggers soon, then CACH will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $6 to $6.50.

Westell Technologies

Westell Technologies (WSTL) designs, manufactures and distributes telecommunications products to telephone companies and other telecommunications service providers. This stock closed up 6.9% to $3.09 in Thursday's trading session.

Thursday's Range: $2.89-$3.10

52-Week Range: $1.73-$3.15

Thursday's Volume: 153,000

Three-Month Average Volume: 190,163

>>3 Huge Stocks to Trade (or Not)

From a technical perspective, WSTL ripped higher here right above some near-term support at $2.82 with lighter-than-average volume. This stock has been uptrending strong for the last four months, with shares pushing higher from its low of $1.90 to its recent high of $3.15. During that uptrend, shares of WSTL have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of WSTL within range of triggering a near-term breakout trade. That trade will hit if WSTL manages to take out Thursday's high of $3.10 and then its 52-week high at $3.15 with high volume.

Traders should now look for long-biased trades in WSTL as long as it's trending above some key near-term support levels at $2.82 or its 50-day at $2.71 and then once it sustains a move or close above those breakout levels with volume that hits near or above 190,163 shares. If that breakout triggers soon, then WSTL will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $3.60 to $4.

Dolan

Dolan (DM) is a provider of necessary business information and professional services to the legal, financial and real estate sectors in the U.S. This stock closed up 6.2% to $2.20 in Thursday's trading session.

Thursday's Range: $2.05-$2.23

52-Week Range: $1.37-$5.73

Thursday's Volume: 184,000

Three-Month Average Volume: 293,875

>>5 Rocket Stocks to Buy This Week

From a technical perspective, DM jumped higher here right above some near-term support at $2 and back above its 50-day moving average at $2.08 with lighter-than-average volume. This stock has been trending sideways and consolidating for the last month, with shares moving between $1.95 on the downside and $2.35 on the upside. Shares of DM are now starting to move within range of triggering a near-term breakout trade above the upper end of its recent sideways trading chart pattern. That breakout will hit if DM manages to take out some near-term overhead resistance levels at $2.25 to $2.35 with high volume.

Traders should now look for long-biased trades in DM as long as it's trending above its 50-day at $2.08 or above more near-term support at $2 to $1.95 and then once it sustains a move or close above those breakout levels with volume that hits near or above 293,875 shares. If that breakout triggers soon, then DM will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $2.60 to $2.84. Any high-volume move above those levels will then put $3 to $3.20 into range for shares of DM.

To see more stocks that are making notable moves higher today, check out the Stocks Under $10 Moving Higher portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>4 Stocks Rising on Unusual Volume

>>5 Hated Earnings Stocks You Should Love

>>5 Stocks Under $10 Set to Soar

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

McIek/Shutterstock If you ask most people where the greatest threat to Wall Street's nearly 100-year dominance as the world's leading financial center would come from, places like London, Zurich, Tokyo or even Beijing might be suggested. But more and more, it looks as if the threat to Manhattan's financial crown will come from right here in the USA. Silicon Valley appears to have Wall Street in its sights, aggressively funding a new generation of tech startups whose goal is to disrupt the financial services industry and attack Wall Street with a strategy and an attitude they have never faced before. These new fin-tech companies are younger, more flexible and -- with deep-pocketed venture capital firms backing them -- less concerned about reaching financial profitability in the near term. Unlike most venerable Wall Street companies, they are private entities that don't have to please the stock market with share prices or quarterly earnings nor support an infrastructure top-heavy with partners, associates, directors and VPs that would make Gordon Gekko cringe. Crowdsourced Earnings Estimates Estimize is an example of this new type of company that is putting Wall Street on notice. Founded in 2011 by former quantitative hedge fund analyst Leigh Drogen, Estimize crowdsources company earnings estimates on an open and transparent platform -- the opposite of the opaque proprietary model big Wall Street firms use -- and then makes those numbers available to the public for free. According to multiple peer-reviewed research papers, the Estimize approach provides more representative data for earnings, which come from more than 4,000 analysts who contribute to their web-based platform. The company says this translates to earnings estimates that have proven 69 percent more accurate than traditional Wall Street analysts. Drogen says the last figure "shows that our philosophies are winning against the stale old philosophies regarding sharing of data within the financial community." "I want Estimize to lead the change in how the financial community shares information and points the spotlight on certain individuals based on a meritocracy." Major players in the financial research industry already recognize that change, including Bloomberg, which offers Estimize earnings estimates through its platform. Zero Commission Stock Trades In the brokerage space, Robinhood, which is backed by Marc Andreessen and Google Ventures, is bringing the stock market version of the Holy Grail to investors -- zero commission stock trades. With its mobile-only platform, Robinhood allows customers to trade any amount of shares, as often as they like, for no fee. According to co-founder Vladimir Tenev, Robinhood's model doesn't depend on commissions for profitability, which should cause traditional brokers to quake in their boots. Instead Robinhood charges other companies to build upon its platform. This means that a consumer could use a third-party mobile app like Twitter, StockTwits or Yahoo Finance and trade stocks seamlessly via Robinhood for free. What should particularly worry Wall Street is that companies like Estimize and Robinhood don't think in traditional terms on a number of issues. For example, the first 11 hires at Robinhood were not financial advisers or brokers, but programmers, because it views itself not as a financial company, but a tech company. This philosophy also informs the way they market their product -- forgoing a brick and mortar presence or Superbowl adds -- to reach their target audience. With just a website, a social media campaign and the buzz from tech media, Robinhood has had more than a quarter of a million people sign up for brokerage accounts. Follow the Job Market A key reason that tech firms are competing in the financial sector is that the 2008 crisis cut jobs on Wall Street, causing many new highly skilled college graduates to look elsewhere for employment. One example of this comes from a recent survey by Harvard's newspaper. The Crimson found that only 31 percent of graduates were planning to pursue jobs in the financial sector, down from 2007, when the number was 47 percent. The macro trend also bodes well for tech, as Moody's Analytics predicts that 450,000 new workers will be hired in the high-tech industry by 2015, compared to only 230,000 for finance. It would be premature to count Wall Street out quite yet. Financial companies have faced wars, recessions, populist politicians, regulatory reforms and Occupy Wall Street, and have come out more profitable than ever. But the emphasis on product before profit, and the speed in which they can build and adapt their products to consumer needs, may give fin-tech companies the edge they need to dethrone the wolves of Wall Street.

McIek/Shutterstock If you ask most people where the greatest threat to Wall Street's nearly 100-year dominance as the world's leading financial center would come from, places like London, Zurich, Tokyo or even Beijing might be suggested. But more and more, it looks as if the threat to Manhattan's financial crown will come from right here in the USA. Silicon Valley appears to have Wall Street in its sights, aggressively funding a new generation of tech startups whose goal is to disrupt the financial services industry and attack Wall Street with a strategy and an attitude they have never faced before. These new fin-tech companies are younger, more flexible and -- with deep-pocketed venture capital firms backing them -- less concerned about reaching financial profitability in the near term. Unlike most venerable Wall Street companies, they are private entities that don't have to please the stock market with share prices or quarterly earnings nor support an infrastructure top-heavy with partners, associates, directors and VPs that would make Gordon Gekko cringe. Crowdsourced Earnings Estimates Estimize is an example of this new type of company that is putting Wall Street on notice. Founded in 2011 by former quantitative hedge fund analyst Leigh Drogen, Estimize crowdsources company earnings estimates on an open and transparent platform -- the opposite of the opaque proprietary model big Wall Street firms use -- and then makes those numbers available to the public for free. According to multiple peer-reviewed research papers, the Estimize approach provides more representative data for earnings, which come from more than 4,000 analysts who contribute to their web-based platform. The company says this translates to earnings estimates that have proven 69 percent more accurate than traditional Wall Street analysts. Drogen says the last figure "shows that our philosophies are winning against the stale old philosophies regarding sharing of data within the financial community." "I want Estimize to lead the change in how the financial community shares information and points the spotlight on certain individuals based on a meritocracy." Major players in the financial research industry already recognize that change, including Bloomberg, which offers Estimize earnings estimates through its platform. Zero Commission Stock Trades In the brokerage space, Robinhood, which is backed by Marc Andreessen and Google Ventures, is bringing the stock market version of the Holy Grail to investors -- zero commission stock trades. With its mobile-only platform, Robinhood allows customers to trade any amount of shares, as often as they like, for no fee. According to co-founder Vladimir Tenev, Robinhood's model doesn't depend on commissions for profitability, which should cause traditional brokers to quake in their boots. Instead Robinhood charges other companies to build upon its platform. This means that a consumer could use a third-party mobile app like Twitter, StockTwits or Yahoo Finance and trade stocks seamlessly via Robinhood for free. What should particularly worry Wall Street is that companies like Estimize and Robinhood don't think in traditional terms on a number of issues. For example, the first 11 hires at Robinhood were not financial advisers or brokers, but programmers, because it views itself not as a financial company, but a tech company. This philosophy also informs the way they market their product -- forgoing a brick and mortar presence or Superbowl adds -- to reach their target audience. With just a website, a social media campaign and the buzz from tech media, Robinhood has had more than a quarter of a million people sign up for brokerage accounts. Follow the Job Market A key reason that tech firms are competing in the financial sector is that the 2008 crisis cut jobs on Wall Street, causing many new highly skilled college graduates to look elsewhere for employment. One example of this comes from a recent survey by Harvard's newspaper. The Crimson found that only 31 percent of graduates were planning to pursue jobs in the financial sector, down from 2007, when the number was 47 percent. The macro trend also bodes well for tech, as Moody's Analytics predicts that 450,000 new workers will be hired in the high-tech industry by 2015, compared to only 230,000 for finance. It would be premature to count Wall Street out quite yet. Financial companies have faced wars, recessions, populist politicians, regulatory reforms and Occupy Wall Street, and have come out more profitable than ever. But the emphasis on product before profit, and the speed in which they can build and adapt their products to consumer needs, may give fin-tech companies the edge they need to dethrone the wolves of Wall Street. The expert featured in this column, Rob DeFrancesco, may or may not own positions in any investment vehicle mentioned here. The views and opinions expressed are his or her own.

The expert featured in this column, Rob DeFrancesco, may or may not own positions in any investment vehicle mentioned here. The views and opinions expressed are his or her own.

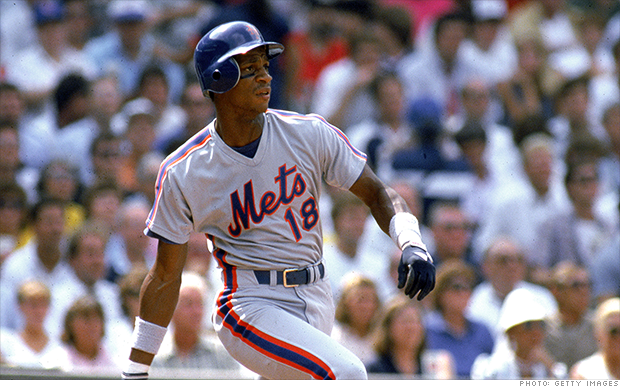

Strawberry took home four World Series titles over his 17-year Major League Baseball career. NEW YORK (CNNMoney) You can own a piece of baseball history, but it's nothing that can be put on a shelf.

Strawberry took home four World Series titles over his 17-year Major League Baseball career. NEW YORK (CNNMoney) You can own a piece of baseball history, but it's nothing that can be put on a shelf.  Whether you're battling the crowds on Black Friday or squeezing your shopping in a few days before the holidays, you have to get your mind, body and most importantly -- wallet -- ready for the challenge. Before the big day you need to create a strategy. Don't just map out the stores you want to hit, but have a list of the gifts you need to buy and an itemized budget of how much you can afford to spend for each person. After you create your gift list remember to follow these 4 money-saving tips: Check coupon and promo code sites like Retail Me Not before you buy. Get your smartphone ready with price comparison apps like RedLaser to scan a barcode and discover if you can get a better deal anywhere else. Sign up for email alerts from your favorite stores Use social media to get the scoop on recently released specials If pushing through a crowd in search of the perfect gift sounds like fun, then be sure to arm your body properly. Don't bother with heels; embrace sneakers, jeans, and a comfortable top. You don't need to impress the masses in the store; you want to dazzle your family and friends with your gift-giving skills. And don't forget to bring a snack with you for when you start to get a little cranky later in the day. For the sake of perspective, start by purchasing your less expensive gifts first. If you drop $200 on the perfect tech toy right away, a bunch of $10 items are going to seem incredibly cheap by comparison. Most of us end up spending more than usual this time of year. Responsible credit card holders can use the opportunity to get more cash back or rewards. If one card offers a rotating 5 percent cash back for online shopping this quarter, then use it for all online spend, while another may provide 2 percent back in department stores. Use sites like MagnifyMoney.com to see which cash back card provides the best value for your spending habits. Just remember -- if you can't pay your balance off on time and in full, it isn't worth the rewards. Once you start paying interest to the banks, your cash back loses its value. Those who worry about overspending at the holidays should consider leaving their credit cards at home in favor of debit cards or just cash. Shopping without a strategy will lead to frustration, returning unwanted purchases and certainly increased spending. Don't forget to include the people in your life you need to tip or buy small presents for like the doorman, children's teachers, a babysitter or mailman. Reduce your stress and impact on your wallet this holiday season by setting a budget, writing out a gift list, finding the cheapest deals, and actually put away the money you saved into a rainy day fund. Oh, and don't forget to tell Santa what you want this year, too! More from Erin Lowry

Whether you're battling the crowds on Black Friday or squeezing your shopping in a few days before the holidays, you have to get your mind, body and most importantly -- wallet -- ready for the challenge. Before the big day you need to create a strategy. Don't just map out the stores you want to hit, but have a list of the gifts you need to buy and an itemized budget of how much you can afford to spend for each person. After you create your gift list remember to follow these 4 money-saving tips: Check coupon and promo code sites like Retail Me Not before you buy. Get your smartphone ready with price comparison apps like RedLaser to scan a barcode and discover if you can get a better deal anywhere else. Sign up for email alerts from your favorite stores Use social media to get the scoop on recently released specials If pushing through a crowd in search of the perfect gift sounds like fun, then be sure to arm your body properly. Don't bother with heels; embrace sneakers, jeans, and a comfortable top. You don't need to impress the masses in the store; you want to dazzle your family and friends with your gift-giving skills. And don't forget to bring a snack with you for when you start to get a little cranky later in the day. For the sake of perspective, start by purchasing your less expensive gifts first. If you drop $200 on the perfect tech toy right away, a bunch of $10 items are going to seem incredibly cheap by comparison. Most of us end up spending more than usual this time of year. Responsible credit card holders can use the opportunity to get more cash back or rewards. If one card offers a rotating 5 percent cash back for online shopping this quarter, then use it for all online spend, while another may provide 2 percent back in department stores. Use sites like MagnifyMoney.com to see which cash back card provides the best value for your spending habits. Just remember -- if you can't pay your balance off on time and in full, it isn't worth the rewards. Once you start paying interest to the banks, your cash back loses its value. Those who worry about overspending at the holidays should consider leaving their credit cards at home in favor of debit cards or just cash. Shopping without a strategy will lead to frustration, returning unwanted purchases and certainly increased spending. Don't forget to include the people in your life you need to tip or buy small presents for like the doorman, children's teachers, a babysitter or mailman. Reduce your stress and impact on your wallet this holiday season by setting a budget, writing out a gift list, finding the cheapest deals, and actually put away the money you saved into a rainy day fund. Oh, and don't forget to tell Santa what you want this year, too! More from Erin Lowry Getty Images We hear all the time that you should not loan money to friends, but yet friends and family are the most important parts of life. So what do you do, when a family member or close friend has nowhere else to turn for their financial needs? If you feel like you can't (or don't want to) say no, there are some steps you can take to make sure the loan doesn't turn into lingering hard feelings. At the very basic level, it's important to get everyone (spouses, significant others, etc.) on board before you make a deal, consider the impact of this decision and try to look beyond the loan. 1. Lend Only What You Can Afford to Lose

Getty Images We hear all the time that you should not loan money to friends, but yet friends and family are the most important parts of life. So what do you do, when a family member or close friend has nowhere else to turn for their financial needs? If you feel like you can't (or don't want to) say no, there are some steps you can take to make sure the loan doesn't turn into lingering hard feelings. At the very basic level, it's important to get everyone (spouses, significant others, etc.) on board before you make a deal, consider the impact of this decision and try to look beyond the loan. 1. Lend Only What You Can Afford to Lose http://www.jhbuffalomeat.com For many American manufacturers, Internet sales can make or break a business. And with Cyber Monday gaining in popularity, many companies are turning attention to one-day Internet deals, promoted to potential consumers and current fans through email updates and Facebook (FB) posts. How Cyber Monday Began In 2005, shop.org debuted the term "Cyber Monday" in a news release hoping to persuade the public to shop online. E-commerce retailers had been looking for a way to highlight the spike in online spending seen the Monday after Thanksgiving. Cyber Monday allowed consumers to shop from their desk or home, with equal or better discounts to the stampedes, fights and long lines on Black Friday -- which was creeping into Thanksgiving. In 2013, comScore (SCOR) reported that Cyber Monday sales topped $1.735 billion -- an 18 percent increase from 2012. Joining the Monday Campaign For smaller manufacturers trying to make a name for themselves stateside -- often only selling online -- Cyber Monday can be a blessing. Consumers looking for an extra-special gift can find unique items not available in stores. The Jackson Hole Buffalo Meat Co. in Jackson, Wyoming, does 60 percent of its business online and will embrace Cyber Monday for the first time this year. Owner Dan Marino purchased the company, which was founded in 1947, in 1997, when the Internet started to take off. He saw an opportunity to expand by offering the highest quality all-natural raised-in-the-USA products to those outside of Wyoming. "We do custom gift packs and corporate gifts, and we ship all over the USA," he said. "I saw a great opportunity to really make the Jackson Hole Buffalo Meat Co. into a national supplier of game-type healthy meats, and make this company a household name brand." The Great Alaskan Bowl Co. in Fairbanks, Alaska, has used the Internet to sell it one-piecebowls, from sustainably harvested birch, to the rest of the United States -- and as far as India and South Africa. "We have done Cyber Monday and continue to do so," said Malen Bratcher, marketing and wholesale director. "It does increase our sales and hopefully will continue to move us in the right direction." Jacob Bromwell kitchen and household accessories has been around since 1819, and 50 percent sales are now online. "We've had an online store since 1999, and up until 2010 it was only a small part of our business," said Sean Bandawat, president. "In recent years, we've implemented many online marketing initiatives that have driven our online through the roof. That distribution channel has become extremely important to the overall financial health of the company." On Cyber Monday, it will offer 30 percent off all items.

http://www.jhbuffalomeat.com For many American manufacturers, Internet sales can make or break a business. And with Cyber Monday gaining in popularity, many companies are turning attention to one-day Internet deals, promoted to potential consumers and current fans through email updates and Facebook (FB) posts. How Cyber Monday Began In 2005, shop.org debuted the term "Cyber Monday" in a news release hoping to persuade the public to shop online. E-commerce retailers had been looking for a way to highlight the spike in online spending seen the Monday after Thanksgiving. Cyber Monday allowed consumers to shop from their desk or home, with equal or better discounts to the stampedes, fights and long lines on Black Friday -- which was creeping into Thanksgiving. In 2013, comScore (SCOR) reported that Cyber Monday sales topped $1.735 billion -- an 18 percent increase from 2012. Joining the Monday Campaign For smaller manufacturers trying to make a name for themselves stateside -- often only selling online -- Cyber Monday can be a blessing. Consumers looking for an extra-special gift can find unique items not available in stores. The Jackson Hole Buffalo Meat Co. in Jackson, Wyoming, does 60 percent of its business online and will embrace Cyber Monday for the first time this year. Owner Dan Marino purchased the company, which was founded in 1947, in 1997, when the Internet started to take off. He saw an opportunity to expand by offering the highest quality all-natural raised-in-the-USA products to those outside of Wyoming. "We do custom gift packs and corporate gifts, and we ship all over the USA," he said. "I saw a great opportunity to really make the Jackson Hole Buffalo Meat Co. into a national supplier of game-type healthy meats, and make this company a household name brand." The Great Alaskan Bowl Co. in Fairbanks, Alaska, has used the Internet to sell it one-piecebowls, from sustainably harvested birch, to the rest of the United States -- and as far as India and South Africa. "We have done Cyber Monday and continue to do so," said Malen Bratcher, marketing and wholesale director. "It does increase our sales and hopefully will continue to move us in the right direction." Jacob Bromwell kitchen and household accessories has been around since 1819, and 50 percent sales are now online. "We've had an online store since 1999, and up until 2010 it was only a small part of our business," said Sean Bandawat, president. "In recent years, we've implemented many online marketing initiatives that have driven our online through the roof. That distribution channel has become extremely important to the overall financial health of the company." On Cyber Monday, it will offer 30 percent off all items.

Lionsgate

Lionsgate

Royals catcher Salvador Perez celebrates with fans after the team won the pennant. Kansas City fans will pay more than $1,000 on average to watch the team in the World Series. NEW YORK (CNNMoney) Kansas City Royals fans, eager to watch their team play in the World Series for the first time in 29 years, are paying top dollar for the first two games of the Series.

Royals catcher Salvador Perez celebrates with fans after the team won the pennant. Kansas City fans will pay more than $1,000 on average to watch the team in the World Series. NEW YORK (CNNMoney) Kansas City Royals fans, eager to watch their team play in the World Series for the first time in 29 years, are paying top dollar for the first two games of the Series.